Undoubtedly, 2020 was one of the most difficult years in memory for the seniors housing and care industry. In the wake of COVID-19, many healthcare real estate investment trusts (REITs) disposed of assets, particularly on the lower end of the acuity spectrum. Along the way, REITs and owner/operators had to be flexible in devising financial arrangements to tide the industry over. As the vaccine rollout commenced and conditions improved, the pace of M&A deal-making increased, due to continued low interest rates, stimulus funds and the long-term strength of the industry. Looking forward, the buyer’s market should continue, and even though interest rates are rising, we expect the uptick in deal activity to continue throughout 2021.

Optimizing Portfolios and Operations

The change in strategy required of REITs in 2020 is perhaps best demonstrated by Healthpeak’s decision to shift their core focus to continuing care retirement communities (CCRCs), life sciences, and medical office buildings while disposing of $4 billion in seniors housing assets. Likewise, Ventas announced a plan to dispose nearly $1 billion of low cap rate seniors housing properties. Additionally, in early March of 2021, Welltower announced their lease termination on their entire Genesis skilled nursing portfolio, totaling 51 facilities and $880 million. As seen by these and other major deal headlines, REITs have been focused on optimizing their portfolios across all acuity levels, with sell-offs more pronounced for independent and assisted living due to occupancy woes.

For those assets that REITs kept or acquired, an increased focus on the wellness of residents became essential. Communities homed in on asset management, rolled out programs to combat COVID-19 and set up vaccination clinics. In late 2020 and into 2021, communities made important progress as they got residents and staff vaccinated. Along the way, owners were flexible with tenants evolving needs, as contractual rent collections continued to improve during the fourth quarter of 2020. Relief also came to operators as REITs restructured a number of major leases during 2020, such as Ventas’ Brookdale and Holiday Retirement master lease restructuring. In addition, LTC Properties notified their triple net lease (NNN) tenants that rent escalators in 2021 were decreased by 50% in order to provide partial relief during the pandemic.

As REITs examine their portfolios and determine which assets to shed and which to focus on improving, one defining trait of the seniors housing and care industry keeps emerging: it is a care-based real estate type, as opposed to residential or hospitality. Those operators who understand the importance of that distinction fared better in the past 12 months than those who treated seniors housing and care like an extension of multifamily.

M&A Landscape

Senior care M&A transactions slowed in 2020 due to the COVID-19 pandemic. Some investors have taken a step back on acquisitions as they quantify the impacts of the pandemic, governmental relief programs and the political environment. The pandemic significantly affected transaction activity across the National Investment Center’s (NIC’s) 31 primary markets, as volume declined by 75% in the second quarter and by 67% in the third quarter as compared to 2019. The second quarter of 2020 was the first quarter in seven years to have recorded fewer than 60 deals, highlighting the impact of COVID-19 on the capital markets. However, the fourth quarter came back strong for M&A with 120 transactions, breaking the all-time quarterly record.

The pandemic has been particularly challenging for seniors housing heavy REITs, as seen in the capital markets where many saw large declines in stock price while those in the skilled nursing space saw more muted declines, or even gains. In this wave of market turbulence, there remains ample opportunity for sellers. Clearly, however, it is a buyer’s market, with options across the acuity spectrum ranging from broken and nonstrategic facilities to stable performing facilities, as well as portfolios.

Looking forward, savvy investors may find opportunities to build scale, consolidate, and install qualified operators that proved their ability during the pandemic. As smaller owner/operators exit due to COVID, further depressed prices could continue through 2021, creating plenty of opportunities for buyers. Distressed operations, paired with the large volume of properties put up for sale with a potentially smaller pool of buyers, will continue to put downward pressure on pricing metrics across the senior care industry. To demonstrate the wide variety of strategic initiatives being pursued as well as the recent uptick in overall activity, we selected several recent M&A deals that are particularly noteworthy:

- Sep. 2020 – $700+ million AEW Capital Management and Merrill Gardens JV: Welltower made headlines with the announcement of the sale of 11 communities (California, Washington and Nevada) for $702 million to a joint venture (JV) between AEW and Merrill Gardens. While this transaction was in process prior to the pandemic, the deal was structured at ~5% cap rate on pre-pandemic cash flow (last 12 months (LTM) March 2020). Given the pandemic’s impact, the implied cap rate was sub-4% on annualized 2020 performance.

- Oct. 2020 – $200 million Northbridge portfolio: Welltower also sold a portfolio of six communities in Boston operated by Northbridge Seniors Housing in a RIDEA structure to a JV between Taurus Investment Holdings and Northbridge Asset Management for $200 million ($395,000 per unit), at a 4.9% cap rate on LTM March 2020. Welltower will retain a 20% interest and Northbridge Seniors Housing will continue to operate; unlike the prior deal, this one was sourced during the pandemic.

- Nov. 2020 – $78.1 million Virginia portfolio – Omega Healthcare REIT acquired a SNF and assisted living (AL) portfolio with 876 beds for $78.1 million ($87,000 per bed) in Virginia. Omega simultaneously added the assets to an existing operator’s triple-net master lease with initial annual contractual cash rent of $7.4 million.

- Nov. 2020 – Eagle Arc’s acquisition of 20-SNF portfolio: Private REIT Eagle Arc Partners acquired 20 SNFs, the majority of which are located in Florida, along with properties in Georgia and Mississippi. The price of the sale was not disclosed.

- Jan. 2021 – $350 million Blue Moon Capital Partners-Aegis Living JV: Healthpeak sold a 10-facility, 702-unit portfolio to existing operator Aegis Living and its private equity JV partner Blue Moon for $350 million (or nearly $500,000 per unit). The portfolio included AL and memory care facilities in urban markets in Washington and California, driving high barriers to entry.

- Jan 2021 – $230MM White Oak Healthcare REIT-Discovery Senior Living JV: Healthpeak also sold a 16-facility, 1,801-unit (758 IL, 978 AL, 60 SNF) portfolio (operated by Capital Senior Living, Atria Senior Living, and Life Care Sciences) predominantly located in Texas for $230 million ($128,000 per unit) to a JV between White Oak and Discovery. The portfolio vintage averaged 21 years. Healthpeak provided $150 million in seller financing.

- Jan 2021 – $510 million Brookdale portfolio: Omega Healthcare REIT acquired a 24-facility, 2,552-unit seniors housing portfolio from Healthpeak in 10 states that was leased to Brookdale for $510 million ($200,000 unit). The transaction included the assumption of an in-place master lease, which represented a lease yield of 8.5%.

- Feb 2021 – Harbor Retirement portfolio: Healthpeak sold an eight-facility, 790-unit NNN portfolio operated by Harbor Retirement Associates for $132 million ($167,000 per unit) to Welltower. The Southeastern U.S. portfolio (predominantly Florida) included occupancy of 80.7% and EBITDARM lease coverage of just 0.92x.

- Mar. 2021 – $126.1 million acquisition of CCRC portfolio: CareTrust REIT acquired a four-property CCRC portfolio located in southern California for $126.1 million. Two of the four properties were added to a master lease with a current CareTrust operator, while the other two were leased to a new operator.

- Mar. 2021 – $15.9 million acquisition of Santa Barbara SNF: CareTrust REIT acquired Buena Vista Care Center, a 150-bed SNF in Santa Barbara, for $15.9 million ($106,000 per bed). The facility will continue to be operated by California-based Covenant Care, Inc. under a long-term lease that CareTrust assumed in the off-market transaction. The acquisition was funded using CareTrust’s $600 million unsecured revolving credit facility.

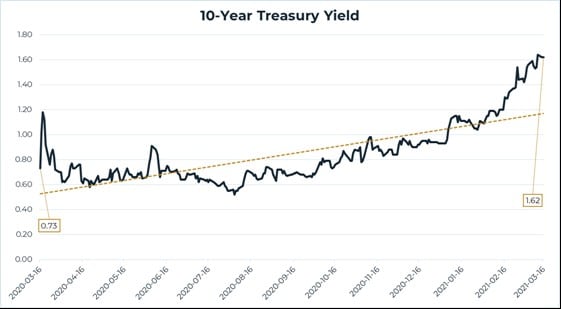

10-Year Treasury Yield

While the Fed announced it is committed to keeping rates low for the next few years to help the economy regain its footing, the 10-year treasury yield has increased rather significantly in early 2021.

The increase could potentially cause REITs to take a patient approach to their acquisition pipeline in 2021 as borrowing costs could increase. However, the long-term strength of the seniors housing and care industry and still historically low interest rates should prevent any major slowdown in activity.

Although 2020 was a challenging year, the recent pick-up in M&A activity, progress on the COVID-19 vaccination front, and overall optimism being expressed by REIT executives are pointing towards an active 2021. In spite of the largest investor category’s focus on rebalancing their portfolios, REITs continue to be interested in the right opportunity. These span the spectrum of “blue chip” stabilized corporate investments to challenged assets requiring operator replacement.