This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

FREDDIE MAC OPTIGO®

Tax-Exempt Bond Securitization

For tax-exempt bondholders (Sponsors) in the multifamily affordable housing market, we provide liquidity via the efficiencies of our securitization platform. Through our Tax-Exempt Bond Securitization (TEBS) program, the Sponsor transfers portfolios of unrated bonds to Freddie Mac in exchange for certain rated M-class certificates.

SECURITIZATION FOR TAX-EXEMPT BONDHOLDERS

-

ELIGIBLE PROPERTY TYPES

Multifamily properties; all assets will be underwritten by Freddie Mac.

-

PRODUCT DESCRIPTION

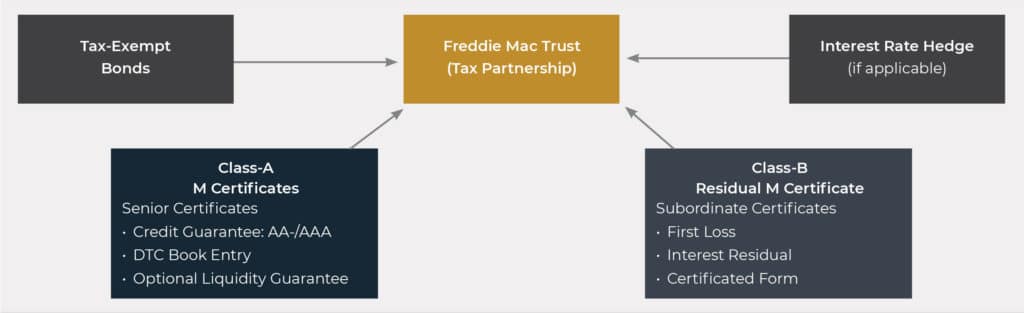

The TEBS structure is a proprietary execution offered by Freddie Mac through which a Sponsor transfers privately placed tax-exempt multifamily housing revenue bonds (and possibly related taxable bonds or loans) to Freddie Mac in exchange for:

- Freddie Mac senior Class-A M Certificates that are generally sold to investors, and;

- Subordinate Class-B M Certificates that are generally retained by the Sponsor.

Freddie Mac’s Class-A M Certificates are fully guaranteed tax-exempt or taxable securities supported by pools of unenhanced tax-exempt multifamily housing revenue bonds or related taxable bonds or loans. In the event that the senior Class-A M Certificates bear interest at a variable rate, Freddie Mac may also provide a liquidity facility in the form of a guarantee of the purchase price of the senior Class-A certificates if tendered for purchase by an investor.

-

AMOUNT

Generally, ≥ $100 million.

-

BENEFITS TO SPONSOR

- Balance Sheet Management: reduce concentration of Multifamily assets.

- Capital Management: risk capped at Class-B M Certificate amount (if retained by Sponsor).

- Profitability: enhanced yields through retention of Class-B M Certificates.

- Monetization: Class-A M Certificates sold to investors for cash.

-

SUBORDINATION LEVEL (Size of B Piece)

On average 15% of total pool size, but can vary based on collateral quality and Sponsor needs.

-

MINIMUM DEBT COVERAGE RATIO/MAXIMUM LOAN-TO- VALUE RATIO (of each asset)

1.05x / 95% per Freddie Mac underwriting.

-

DOCUMENTATION/DUE DILIGENCE REQUIRED DURING FREDDIE MAC UNDERWRITING

(Complete list of documentation available in TEBS Underwriting Checklist, provided upon request)

- Appraisal or market study for each property.

- Current rent roll of each property.

- Current and historical financial statements of each property.

- Sponsor organizational documents.

- Ground lease information (if applicable).

- HAP contracts and amendments (if applicable).

- LURA or Regulatory Agreement.

- Evidence of tax credits awarded or tax credit application.

- As-built surveys.

- Title policy.

- Bond amortization schedules.

- Insurance review.

- Seismic reports (if applicable).

- Terms of subordinate debt (if applicable).

-

UPFRONT FEES

(Approximately 50 bps for a $100 million transaction)

- Underwriting fees.

- Legal fees.

- Execution fees.

- Tax opinion fee.

- Modeling fee.

- Rating agency fee.

- Liquidity facility fee (if applicable).

-

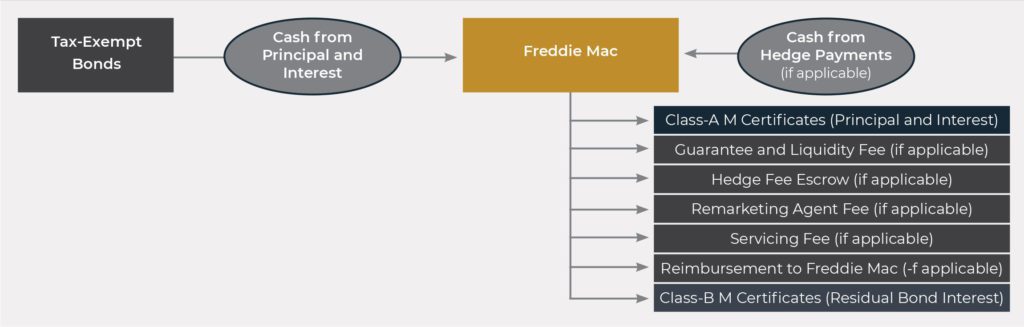

ONGOING FEES

(Based on underlying collateral and subordination level)

- Freddie Mac guarantee fee.

- Servicing fee.

- Remarketing agent fee (if Class-A M Certificates are variable-rate certificates).

- Liquidity facility fee (if Class-A M Certificates are variable-rate certificates).

-

LIQUIDITY FACILITY OPTIONS

In the event that the senior Class-A M Certificates bear interest at a variable rate, Freddie Mac may also provide a liquidity facility.

-

HEDGING

If the Class-A M Certificates are variable-rate certificates, the Sponsor must purchase an interest rate hedge acceptable to Freddie Mac from an approved Freddie Mac counterparty.

How TEBS Works

- Sponsor delivers bonds to Freddie Mac, which are registered in the name of Freddie Mac.

- Freddie Mac delivers rated Class-A and unrated Class-B M Certificates to the Sponsor.

- Class-A M Certificates are marketed and sold to investors; Freddie Mac guarantees the payment of scheduled principal on the bonds and all interest on the Class-A M Certificates.

- Class-B M Certificates are issued to and held by Sponsor. Monthly interest payments on the Class-B M Certificates are made on a subordinate “if available” basis only after all Class-A M Certificate interest and ongoing fees have been paid in full, and after Freddie Mac has been reimbursed for all amounts then due under the Reimbursement Agreement.

Note: The most common structure has been detailed above. The Class A and Class B Certificates can be retained by the Sponsor or both sold to investors.

In its prequalifying review, Lument will attempt to estimate both the loan amount and the fees and costs associated with the transaction. Actual loan amounts and actual fees and expenses may vary from the prequalifying estimates. A prequalifying estimate is not a commitment to make a loan.