FREDDIE MAC OPTIGO®

Early Rate-Lock

Eliminates interest rate risk early in the mortgage approval process. Provides peace of mind for borrowers that are concerned about market volatility.

WHAT IS AN EARLY RATE-LOCK?

- Borrowers can lock the interest rate for a fixed-rate mortgage or the spread for a floating-rate mortgage, establish the mortgage amount and set other key provisions of a proposed mortgage within two to five days after our preliminary underwriting review and long before the Seller submits the full underwriting package.

- After rate-lock and full underwriting, some aspects of the transaction can be modified if necessary.

BENEFITS

- Fast and efficient: The limited amount of information that the borrower needs to submit in the preliminary underwriting package enables our underwriter to review the package more quickly and move mortgages quickly through the process.

- Additional factors can further speed decisions, including:

– Repeat borrowers that have completed other deals within the last 12 months.

– Our familiarity with the property’s market. - Cost savings: Savings can be significant when interest rates and/or spreads are rising.

- Flexibility: At full underwriting, after rate-lock:

– Borrower can increase the loan amount by up to 5 percent provided positive net operating income (NOI) growth is demonstrated.

– There is no breakage fee for decreases in the loan amount that are within 5 percent of the preliminary underwriting amount due to decreases in NOI, appraised values that are lower than the underwritten value, etc.

-

ELIGIBLE PRODUCTS

- Conventional cash loans, including supplemental loans and refinances.

- Targeted Affordable Housing cash transactions.

-

HOW EARLY RATE-LOCK WORKS

-

PRELIMINARY QUOTE

- Seller submits the Loan Submission Template (LST) and requests quote.

- Freddie Mac Production reviews the submission and obtains the pricing quote.

- Seller reviews and accepts quote, and requests early rate-lock.

-

PRELIMINARY UNDERWRITING PACKAGE

- Seller provides all documents for an early rate-lock execution detailed in the Seller/Servicer Guide (Guide), Exhibit 1: Underwriting Checklists.

- For properties with special circumstances or special features, Seller also submits the applicable documents listed in the Addendum to Part A.

-

RATE-LOCK

- After Freddie Mac preliminary underwriting and due diligence are complete and the loan has been approved for rate-lock, Freddie Mac provides the Seller with the maximum mortgage amount, term, amortization, net spread, servicing fee, prepayment terms and non-standard provisions.

- Freddie Mac provides the early rate-lock application (ERLA) to Seller; Seller signs and returns all applicable portions of the application.

- Once the ERLA is executed, Seller calls the Freddie Mac regional office during the time period set forth in the ERLA to lock the terms contained in the ERLA.

-

AFTER RATE-LOCK

- By 2:00 pm ET on the business day following interest rate lock, Seller must retain a good faith deposit equal to 2 percent of proposed loan amount.

(Note: On the refinance of an existing Freddie Mac portfolio loan, borrowers may post a demand note in lieu of a good faith deposit and provide the non-refundable application fee in cash.) - Seller must execute Exhibit A of the ERLA to indicate acceptance of terms and return to Freddie Mac within two business days.

- Within the specified time frame, Seller must deliver the full underwriting package to Freddie Mac, including all documents detailed in the Guide, Exhibit 1: Underwriting Checklists, as well as any applicable documentation noted in Addendum to Part B.

- By 2:00 pm ET on the business day following interest rate lock, Seller must retain a good faith deposit equal to 2 percent of proposed loan amount.

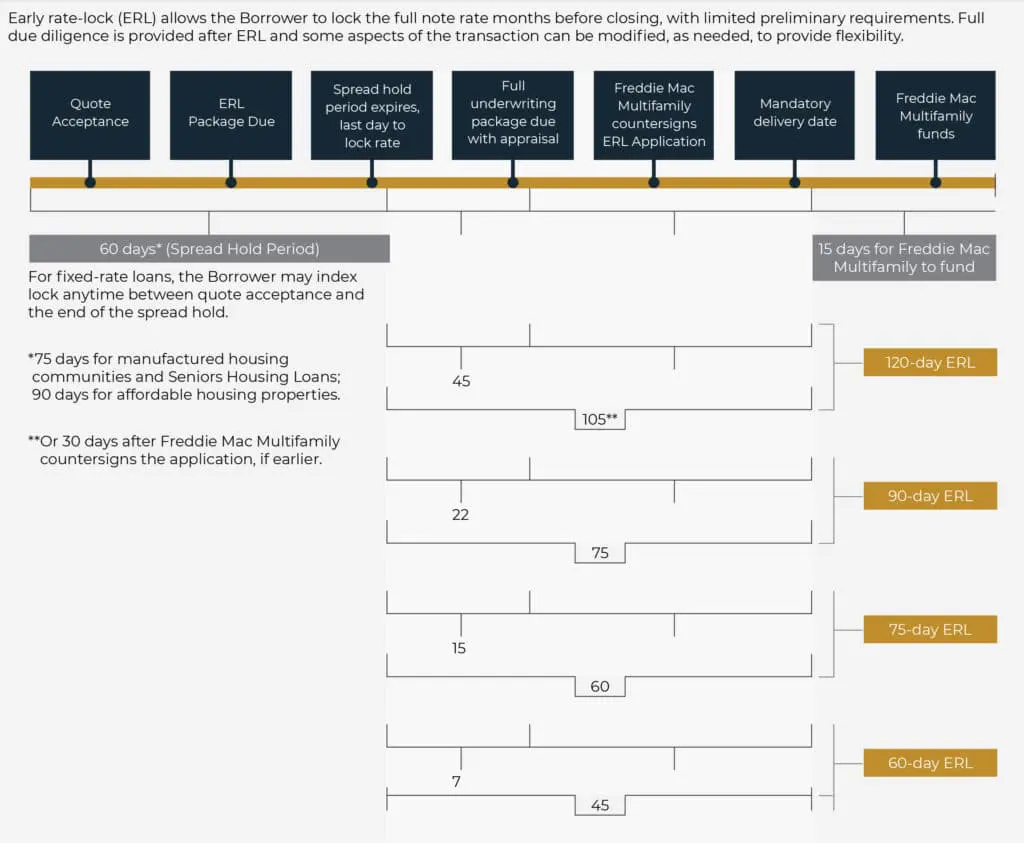

Early rate-lock (ERL) allows the Borrower to lock the full note rate months before closing, with limited preliminary requirements. Full due diligence is provided after ERL and some aspects of the transaction can be modified, as needed, to provide flexibility.

In its prequalifying review, Lument will attempt to estimate both the loan amount and the fees and costs associated with the transaction. Actual loan amounts and actual fees and expenses may vary from the prequalifying estimates. A prequalifying estimate is not a commitment to make a loan.