Shut it down

Mr. Worldwide is well known for shutting clubs down, but not necessarily governments. Pitbull, as he is colloquially known as, nevertheless clearly foreshadowed today’s political landscape when he sang “Now watch me shut this thing down” back in 2009.

When it comes to U.S. government shutdowns, precedent leads us to believe that politicians will saber rattle for days (maybe even weeks). But in the end, a budget deal is highly probable, and market disruption will likely be muted. Indeed, Pitbull later exclaims in the same prescient song, “can’t nothing hold me down”— which may be a nod to a funding accord of some kind.

The central issue prompting this latest government shutdown is healthcare funding. Democrats won’t pass a short-term continuing resolution bill unless Republicans agree to both extend subsidies provided through the Affordable Care Act (a.k.a. Obamacare) that expire at the end of the year and reverse the cuts to Medicaid in President Trump’s “Big Beautiful Bill.” For their part, Republicans seem to be holding their line, prioritizing broader spending cuts.

The economic ramifications are a bit murky, but the outlook is negative. Economists predict that 800,000 workers could be furloughed, although President Trump has also threatened to permanently fire some federal employees. The 16-day shutdown in 2013 led to a slowdown in private-sector job growth by about 120,000 jobs, according to an estimate from the Council of Economic Advisers. The dampening effect was largely due to businesses that had to cut staff because they couldn’t obtain necessary government permits due to closed offices. The most recent shutdown occurred in late 2018 and early 2019, during Trump’s first term. Private-sector job losses were estimated at 120,000 then as well.

According to the Morning Brew, below is a small sample of government services that will—and won’t—be affected:

- Airports: open. Air-traffic controllers and Transportation Security Administration (TSA) employees must show up to work even though their pay is furloughed. However, expect delays.

- U.S. Postal Service: open. Mail delivery will continue (so you will still receive bills and Halloween cards).

- Law enforcement: open. Agencies like the Federal Bureau of Investigation (FBI), Immigration and Customs Enforcement (ICE), and the Drug Enforcement Administration (DEA) will continue operating.

- National parks: mostly closed. Some may stay open without visitor services.

- Museums: mostly closed. These typically close within a few days of a shutdown (but at least everything inside can now come to life during daylight hours a la “Night at the Museum”).

So far, Congress seems rigidly divided along party lines. The longest government shutdown, which occurred during Trump’s first term, lasted 35 days. From a timing perspective, “House lawmakers aren’t expected to return to Washington until [this] week and any compromise funding proposal would need their approval,” the Wall Street Journal reported.

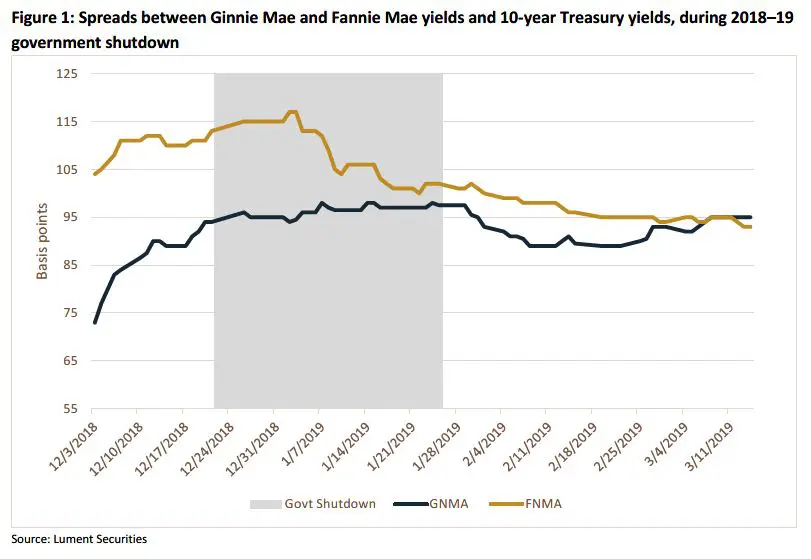

As for our sector, we expect delays at the U.S. Department of Housing and Urban Development (HUD) due to worker furloughs. But from a market perspective, we don’t expect much change. Prior to the 2018–2019 shutdown, we experienced investor spread widening leading up to the final hour. Yet that calendar year-end timing was probably the ultimate culprit for the weakness. Ginnie Mae spreads widened by about 20 basis points (bps), while Fannie Mae spreads followed by about 10 bps (Figure 1).

After the first day of the year, Fannie spreads snapped back, likely due to new-year mandates to put money to work, along with relief from end-of-month/quarter/year-end pressures. This particular period was also accompanied by late-stage monetary policy tightening. This forced a yield-curve inversion, which tends to push mortgaged backed securities (MBS) spreads wider.

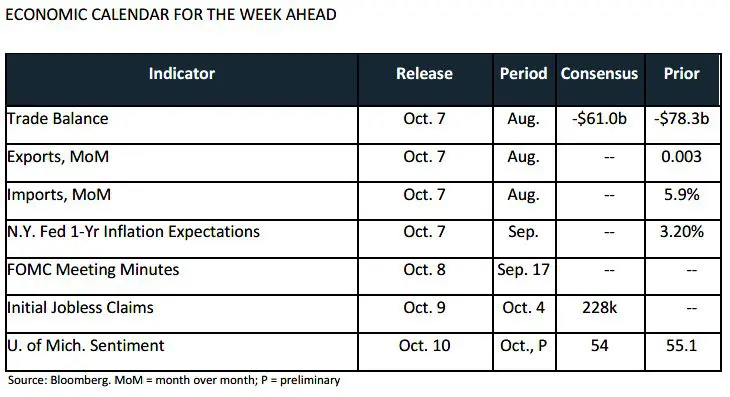

The shutdown of federal agencies leaves us with less economic data than we would prefer in these fast-changing times. But fortunately, we aren’t completely without options. For example, the ADP Employment Report is a private service; therefore, it will continue to report, so we will consider it the new golden source of employment data until the government’s weekly jobless claims and nonfarm payroll reports (NFP) return. The ADP report for September suggested that private-sector payrolls dropped in three of the last four months (-23,000 June, +104,000 July, -3,000 August, -32,000 September). August was revised down sharply last week— now showing -3,000, compared to the initial read of +54,000. While this data should be taken with a grain of salt, given the impact of the re-benchmarking, the prevailing trend is a downshift in hiring across most sectors.

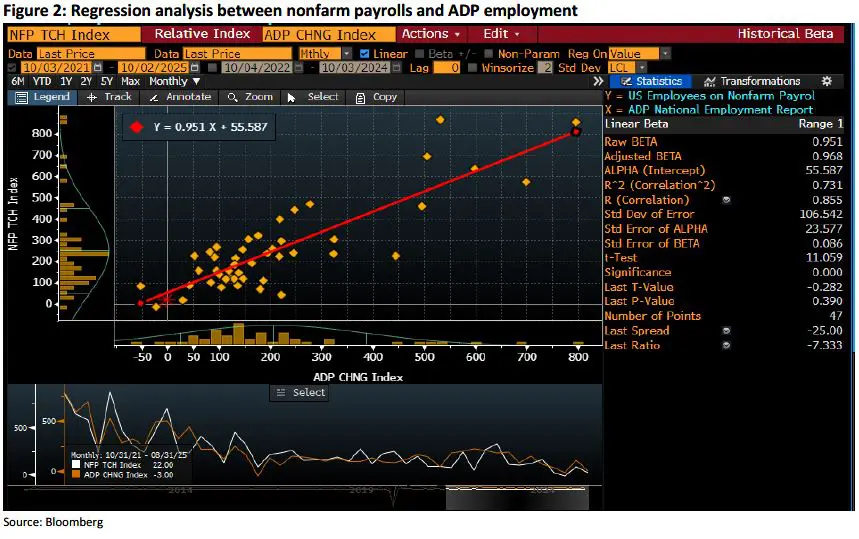

When running a regression analysis on the monthly changes in each index over recent years, ADP employment data is also highly correlated with the Department of Labor’s NFP reports. Using ADP to forecast NFP, we came up with an October projection of +24,000 in private-sector payrolls.

Figure 2 shows that the two indices tend to move together—via the correlation coefficient of 0.855, which indicates a strongly positive linear relationship. Still, the coefficient of determination indicates that only around 73% of the variance in NFP can be explained by ADP.

While the mile marker would be convenient, the macro narrative isn’t changing much—and it likely wouldn’t change much if the actual September NFP figure were within striking distance of the projected figure. Stated differently, the market is well attuned to a slowing labor scenario.

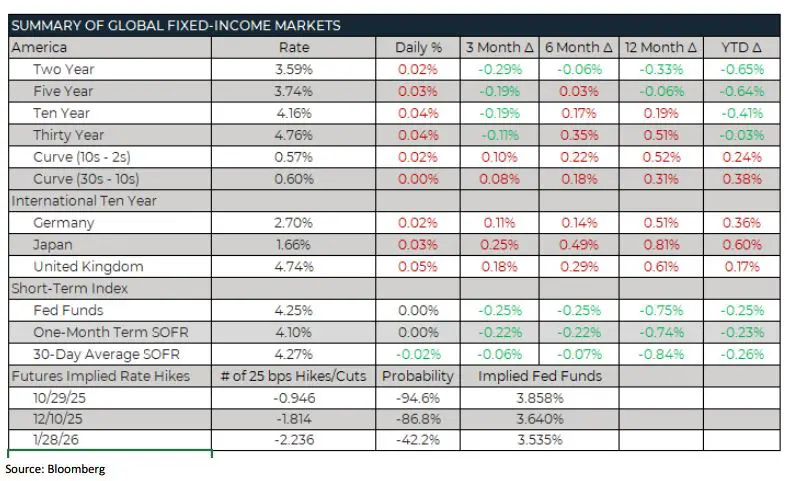

Federal Reserve officials remain steadfast in their commitment to data dependency. Even with a nonexistent data set, they can likely maintain the status quo in the near term, given inflationary data that remains above target and a lack of emergencies elsewhere. In a world without data, it would take anecdotal evidence like mass firings—not by government, but from pro-cyclical job sectors—to reach headlines and shake Fed hawks off their perch to acquiesce to easier monetary policy.

While the mile marker would be convenient, the macro narrative isn’t changing much—and it likely wouldn’t change much if the actual September NFP figure were within striking distance of the projected figure. Stated differently, the market is well attuned to a slowing labor scenario.

Federal Reserve officials remain steadfast in their commitment to data dependency. Even with a nonexistent data set, they can likely maintain the status quo in the near term, given inflationary data that remains above target and a lack of emergencies elsewhere. In a world without data, it would take anecdotal evidence like mass firings—not by government, but from pro-cyclical job sectors—to reach headlines and shake Fed hawks off their perch to acquiesce to easier monetary policy.

FROM THE DESK

Agency CMBS — Ginnie Mae spreads were mostly flat week-over-week while DUS spreads tightened marginally. Full term interest only (IO) structures and size over $20 million continue to trade extremely well, along with buydowns. We are hearing that the September REMIC cycle is somewhat weaker, although the tone remains optimistic.

Municipals — AAA tax-exempt yields were higher on the short end of the yield curve and lower on the long end of the yield curve, week over week. The short end of the yield curve continues to see pressure— investors are turning their attention toward longer maturities to lock in higher interest rates in expectation of a flattening yield curve and lower rates. New-issuance volume for September was just north of $44 billion, a 10.5% decrease from September 2024. A heavy new-issuance supply in the first half of 2025, holiday-shortened weeks and Fed-meeting weeks all played into a decrease in September 2025 volume. Municipal bond funds reverted to inflows, with $1.1 billion entering (YTD inflows of $18.08 billion), while high-yield funds saw inflows of $478 million.

The information contained herein, including any expression of opinion, has been obtained from, or is based upon, resources believed to be reliable, but is not guaranteed as to accuracy or completeness. This is not intended to be an offer to buy or sell or a solicitation of an offer to buy or sell securities, if any referred to herein. Lument Securities, LLC may from time to time have a position in one or more of any securities mentioned herein. Lument Securities, LLC or one of its affiliates may from time to time perform investment banking or other business for any company mentioned.