In recent years, rising insurance premiums have become an annual stress trigger for multifamily operators. The problem is even more acute in the affordable housing space due to the limited ability to adjust rents to accommodate for increased costs. While insurance is a pain point for regular operations, it can become a deal killer for acquisitions or refinancings if you aren’t prudent.

What led to this problem, and what can developers and borrowers do in response?

The drivers of higher insurance costs

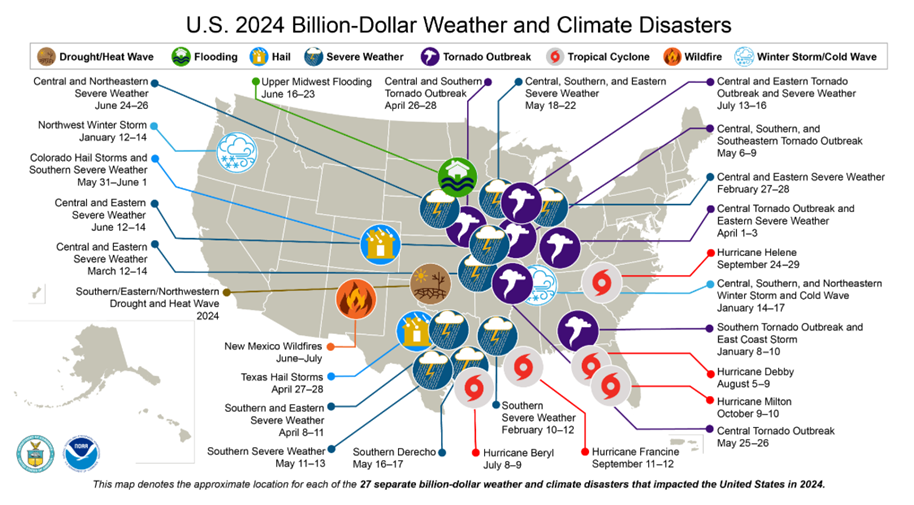

Insurance premiums started rising four years ago as carriers dealt with the effects of extreme weather events and natural disasters, particularly in California, Florida, and other coastal states. There were 27 individual weather and climate disasters with at least $1 billion in damages in 2024 – the yearly total of $182.7 billion in damages made 2024 the fourth costliest since records began in 1980, according to the NOAA. It’s worth noting that the property damages related to the January wildfires in Los Angeles are expected to fall between $28 billion and $54 billion, putting a significant strain on the California FAIR Plan, and the fallout will result in higher premiums for at-risk areas across the U.S.

In addition to being impacted by the general climate change trend, affordable housing communities encounter higher insurance costs due to the nature of the asset class. For example, affordable developers typically seek less expensive land—or whatever land in a municipality might be available—to reduce costs. These plots are often in areas more prone to flooding. A recent study by Urban Land, for instance, found that 70% of new LIHTC developments in Texas were in FEMA-designated flood-prone areas. Developments also tend to be in infill locations in densely populated neighborhoods, where liabilities are higher and fires pose a greater risk than in more disbursed suburban areas.

Instead of raising premiums, some insurers have opted to decline coverage for affordable housing altogether, often without explanation. Keep in mind, there is no legal or regulatory obligation for insurers to underwrite coverage or to provide explanations for denying coverage. At the same time, general liability policies are moving to exclude coverage for certain risks like assault and battery, animal attacks, and firearms. These exclusions could require the borrower to obtain expensive stand-alone policies to cover these risks.

A brightening picture

Fortunately for the developers and owners of affordable housing, green shoots are appearing that signal a slowdown or even a decrease in insurance premiums. In their annual State of Multifamily Risk Survey & Report, NMHC members recently reported the first decline in insurance premium costs since 2017 after 27 consecutive quarters of rising rates. While a rising 10-year U.S. Treasury puts pressure on loan pricing and LIHTC yield targets, it also means that insurers are earning more on their bond investments and becoming a little less reliant on premium hikes to maintain financial stability. Some large national carriers are also willing to keep premiums steady or even decrease them to win market share.

However, the days when obtaining insurance coverage for affordable housing was a routine formality are long past. Despite costs moving in the right direction, there are concerns about tariff-induced inflation reversing the trend. It’s important to remember that increased replacement costs also factor into the increase in premiums, and those costs appear poised to increase further. While today’s environment remains challenging and requires thoughtful preparation, the following suggestions can help take the headache out of insurance.

Today’s affordable housing insurance to-do list:

- Start early. Obtaining insurance coverage can’t wait until the last minute and is no longer an afterthought. Planning for coverage and checking with insurance brokers should happen early in your refinancing or purchasing process.

- Talk to more brokers. Since insurance is more difficult to come by, it makes sense to use a bigger pool of brokers to expand the range of possible sources of underwriting.

- Don’t count on waivers. This point underscores the importance of starting early. Many developers who could not obtain insurance in a timely fashion in the past were able to receive a coverage waiver. Today, obtaining such waivers is more challenging, and the Agencies insist on coverage before considering taking on a mortgage.

- Reduce risk. As difficult as it may be to find the resources, developers should make a concerted effort to reduce risk whenever possible. Keeping up with capital improvements, using resilient construction materials, and not foregoing maintenance are all important. Upgrading plumbing, electrical systems, and roofs can significantly lower risk. In a recent Houston rehab deal, for example, we saw that a $750,000 roof replacement across 200+ units cut annual insurance costs by approximately $140,000—an 18.7% reduction in total premiums.

Having a solid security system that includes closed-circuit camera coverage, adequate lighting, and locks kept in good working order also helps. Requiring tenants to carry renters’ liability insurance is also desirable. Consulting with your providers about ways to reduce risk can meaningfully impact premiums. - Higher deductibles. Opting for higher deductibles can lower premium costs, but developers should carefully weigh the savings against the potential for higher out-of-pocket expenses in the event of a claim. An experienced broker can help find the right balance.

- Source gap funding. To cover rising insurance costs, developers can explore gap funding from equity partners, local governments, or specialized programs, as well as potential state tax credits or subsidies for affordable housing to either reduce first mortgage debt or pay for capital improvements that will reduce the risk of loss.

There is no getting around the fact that higher insurance premiums put a strain on the economics of operating affordable housing properties. But despite the current challenges, demand for affordable housing remains strong, and insurers still want your business. Finding the route to a successful deal can still be done—it just requires more planning, preparation, and legwork.