In 2020, both the seniors housing and skilled nursing sectors faced unprecedented demand side challenges stemming from the ongoing COVID-19 pandemic. Many owner/operators were forced to halt admissions to their communities or otherwise severely limit admissions activities at various points during the year. As a result, many communities experienced large occupancy declines. However, many of the same owner/operators successfully employed strategies to mitigate the economic effects of the pandemic. Despite the challenges, many investors took a long-term view and uncovered attractive opportunities within the sector. Below, we look at recent market data to shed light on the past 12 months, identify trends, and provide a big picture analysis of what the industry looks like as 2021 unfolds.

Seniors Housing Occupancy Falls

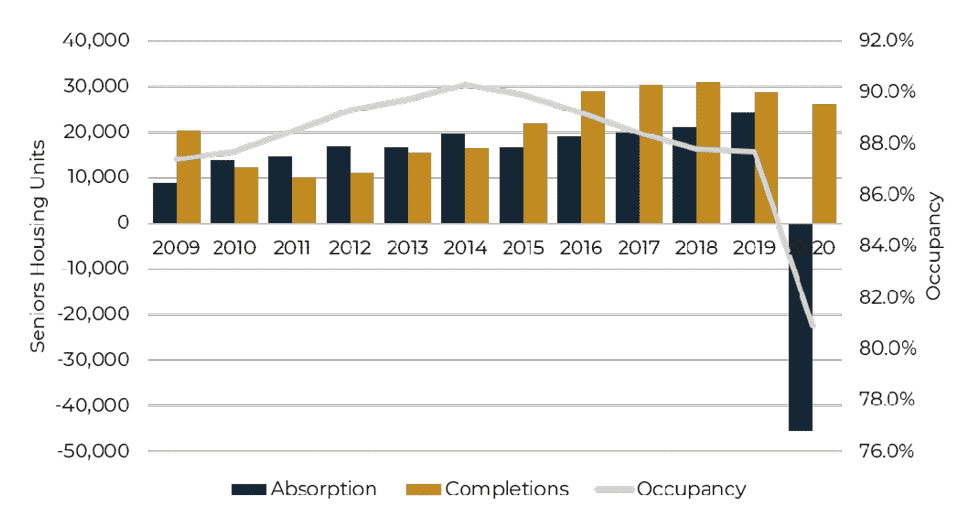

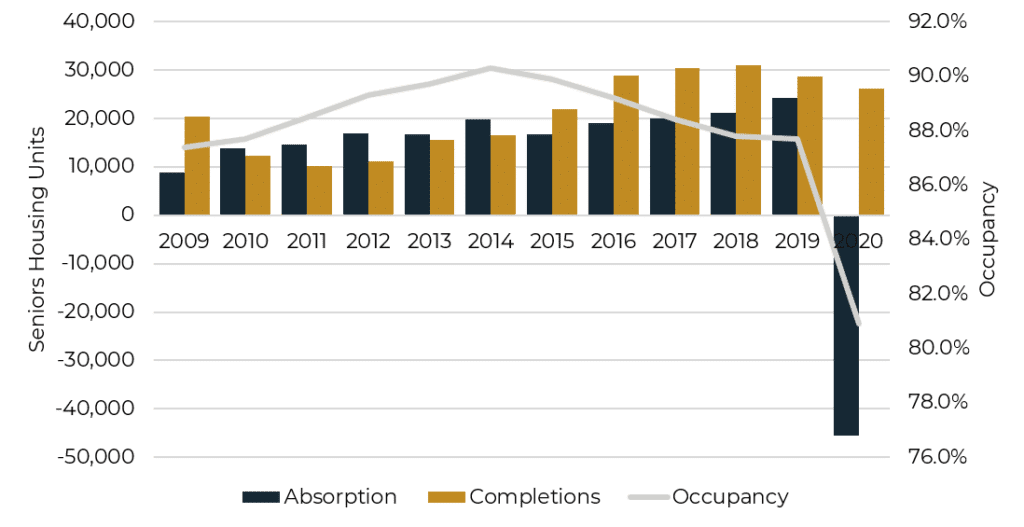

The seniors housing sector saw occupancy fall to record low levels in 2020. According to the National Investment Center for the Seniors Housing & Care Industry (NIC), the occupancy rate within NIC’s primary and secondary markets fell from 87.7% at the end of 2019 to 80.9% in the fourth quarter of 2020 (Figure 1). Fueling the occupancy rate fall was a decline in absorption (the change in occupied units) of over 45,000 units in 2020.

(source: NIC MAP)

The drop in occupancy has been corroborated by industry participants as well. Brookdale Senior Living reported that its occupancy rate fell from 83.2% in 1Q20 to 72.7% in 4Q20. Welltower reported its SHOP (senior housing operating portfolio) occupancy fell from 85.6% in February 2020 to 76.2% in December 2020. Welltower noted in the filing that occupancy remains pressured by a decline in move-in activity resulting from the continued increase in COVID-19 cases and implementation of shelter-in-place orders.

Heading into 2021, expect the headwinds facing the demand side of the sector to slow down but persist for several more quarters. Many residents and employees of seniors housing communities are among the first to receive the COVID-19 vaccine and the continued rollout will likely buoy demand for seniors housing communities. However, occupancy rates were still falling into 4Q20 and into December of 2020, which is evidence they have not yet found bottom. Expect the seniors housing occupancy rate to find bottom in 2021 and begin to set the next stage of growth.

Average Monthly Rent and REVPOR Hold Steady

Despite the onset of the pandemic, average monthly rent (AMR), rent growth, revenue per occupied room (REVPOR) and REVPOR growth all performed well in 2020. NIC MAP data shows that AMR was $4,196 in 4Q20, up from $4,124 in 4Q19. In addition, year-over-year rent growth was positive in 4Q20 at 1.5% but down from 3.0% in 4Q19. Further, both BKD and Ventas reported stable REVPOR. Welltower noted on their 3Q20 earnings call they are seeing evidence of select discounting on room rates in some markets but, in general, rates continue to be fairly resilient in the face of occupancy declines. AMR and REVPOR will be key metrics to watch in 2021. The use of discounts and concessions will likely be more prevalent in 2021 than in 2020, and this may weigh on AMR and REVPOR growth.

Occupancy Declines but Skilled Mix Improved Across Skilled Nursing Sector

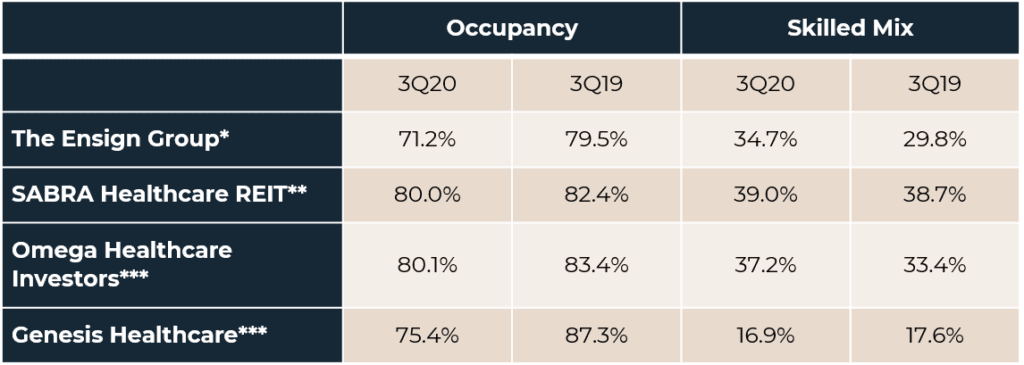

The skilled nursing sector also experienced occupancy losses stemming from the COVID-19 pandemic. Data from AHCA/NCAL shows that SNF occupancy has fallen from 80.2% at the end of 2019 to 67.7% as of January 31, 2021. Despite occupancy losses, the publicly traded owners and operators reported mixed results in 2020. The Ensign Group reported same store occupancy across 152 properties of 71.2% in 3Q20, down from 79.5% in 3Q19 (Figure 2). However, it also reported dramatic increases in skilled mix and skilled revenue.

*Same Store, ** Triple Net Portfolio, *** Operating Beds

Omega Healthcare Investors, the largest owner of SNFs in the U.S., reported 3Q20 occupancy of 80.1% compared to 3Q19 occupancy of 83.4%, but its skilled mix improved from 33.4% to 37.2% during the same period. SABRA Healthcare REIT also reported an increase in skilled mix across its SNF portfolio in 3Q20. Genesis Healthcare was adversely impacted by the COVID-19 pandemic. GEN reported declining occupancy and skilled mix across its portfolio of almost 400 nursing centers in 3Q20.

As 2021 unfolds, expect SNF admissions to rebound as hospital discharge planners have limited options for many post-acute patients. This could help to increase skilled mix many SNFs and lead to improved operating fundamentals.

Mitigation and Lack of Widespread Distress

Despite deteriorating operating fundamentals in 2020, there were just a few public instances of distress across the seniors housing and long term care sectors. Genesis Healthcare announced in their 3Q20 10Q that it had completed a going concern assessment. Capital Senior Living reported in its 3Q20 10Q that it was transferring 18 communities back to its lender (Fannie Mae). Correspondingly, Fannie Mae reported in its 3Q20 Financial Supplement that 10.85% of its $17.3 billion seniors housing business was considered seriously delinquent. This was a marked change from a year ago when Fannie Mae reported that none of its seniors housing portfolio was considered seriously delinquent.

A big reason for the lack of widespread distress was the government stimulus. Many SNFs applied for relief under the CARES Act at the onset of the pandemic which helped them to financially survive during the early months of the pandemic. The CARES Act also suspended Medicare sequestration and allowed operators to defer FICA and Medicare tax withholding for their employees. In late summer, seniors housing operators were allowed to apply for relief under the CARES Act. It is likely operators will be in line for additional relief funding under the incoming Biden administration.

Financing Pulls Back in 2020

Fannie Mae and the U.S. Department of Housing and Urban Development (HUD) loan volume for the seniors housing and long term care sectors was mixed in 2020. Fannie Mae reported 2020 loan volume of $0.9 billion, down roughly 70% from $3.1 billion in 2019. For HUD, production was stable, as its 232-program issued firm commitments of $4.1 billion in fiscal year (FY) 2020 compared to $4.2 billion in FY 2019.

The Healthcare REITs also pulled back with regard to investment volumes in 2020. The three largest Healthcare REITs by market cap, Welltower, Ventas and HealthPeak Properties, all reported lower 2020 (YTD through 3Q) investment volumes compared to 2019. Welltower reported YTD through 3Q20 acquisition volume of $935 million, down from $3.36 billion for the same period in 2019. Ventas reported YTD through 3Q20 acquisition volume of $1.18 billion compared to YTD 3Q19 volume of $3.76 billion. HealthPeak reported YTD 3Q20 acquisition volume of $1.35 billion compared to $1.93 billion through YTD 3Q20. Interestingly, the big three healthcare REITs did not close any SHOP or triple net lease (NNN) seniors housing or long-term care acquisitions in 2020 through 3Q20. In addition, Peak announced in 3Q20 that it was selling approximately $4.5 billion of seniors housing properties and focusing their investments on continuing care retirement communities (CCRCs), life science and medical offices. On the SNF side, Omega Healthcare reported YTD 3Q20 acquisition volume of $162 million compared to $796 million through YTD 3Q20, a significant drop-off.

Pricing Remains Strong in 2020

In the face of lower acquisition volumes, lower loan volumes and deteriorating operating fundamentals, pricing for seniors housing and long term care assets remains as strong as ever. The active acquirers in 2020 were no doubt focusing on the longer-term tail winds at the sector’s back rather than short-term ups and downs. Welltower announced it sold an 11 property SHO portfolio located on the west coast for $702 million, representing a 5.1% cap rate. Welltower mentioned the portfolio was 96% occupied in March 2020.

On the skilled nursing front, active investors are focusing on longer-term trends and the fact that SNFs are mission critical in the world of hospital discharges and post-acute care. Care Trust REIT acquired less in 2020 compared to 2019 but initial yields for SNF assets remain in the high 8% range to low 9% range. Omega mentioned they acquired a SNF for a 9.5% initial yield. National Health Investors reported that it is providing over $25 million for the development of an Ignite Medical Resort. The money is being provided in the form of a development lease at a 9.5% yield.

With lower volumes, there are many investors likely waiting out the short-term challenges and seeking an adjustment in pricing. If that materializes in 2021, look for investment volumes to increase dramatically. Looking forward, we will be sure to stay on top of emerging trends and will work to help you take advantage of market opportunities, as well as navigate potential risks.

Mike Hargrave is a principal at Revista. He may be reached at mah@hargraveanalytics.com.

Orin Parvin is a director and deputy chief underwriter of FHA seniors at Lument. He may be reached at orin.parvin@lument.com.