Lument recently collaborated with Senior Housing News on its 2022 Senior Housing Outlook Report, an educational glimpse into the minds of seniors housing and care leaders nationwide. Despite what continues to be a massively challenging environment, respondents indicated they are decidedly optimistic about 2022 and beyond. Reasons for optimism include rising occupancy, new COVID treatments and vaccines that have helped turn the tide against case counts, and the fact that many operators are now more adept at moving in residents amid the pandemic.

Positively Confident

The survey, conducted online between November 12, 2021 and December 9, 2021, asked 351 seniors housing and care professionals about their views on the investment landscape, staffing and operating challenges, and occupancy recovery. Respondents, who largely identified as seniors housing or skilled nursing owners/operators at the executive level, appear confident that the industry’s recovery will continue to accelerate, as 87% are either somewhat positive or very positive about the 2022 outlook.

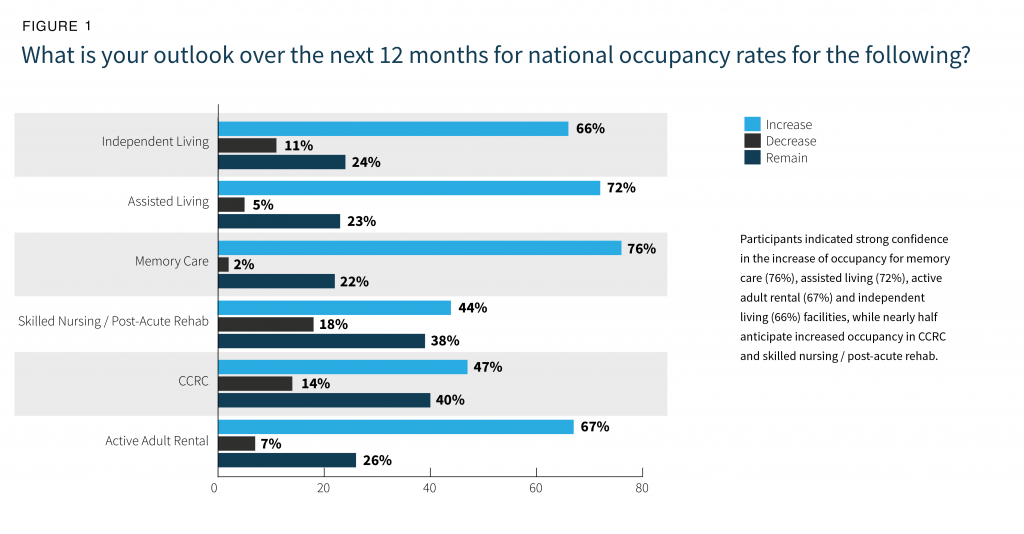

That optimism extends to occupancy levels, as 78% of respondents indicated strong confidence that occupancy rates would return to pre-COVID levels between the second half of 2022 and the end of 2023. Breaking it down by asset class (Figure 1), participants were most confident about memory care (MC) and assisted living (AL) increasing, followed by active adult and independent living (IL). Respondents were less optimistic about skilled nursing facilities (SNFs) and continuing care retirement communities (CCRCs), although nearly half still predicted increased occupancy in the coming year.

As occupancy rises, so too will valuations, at least according to 44% of survey respondents. Another 42% predict valuations will remain stable, signifying a clear majority do not see valuations falling in the coming months.

Healthy expectations also extend to new construction starts, as 60% of respondents see an increase in 2022, up from 44% in 2021. This may be seen as surprising given the presence of overbuilt markets and recent price increases for labor and supplies, but clearly respondents believe well-capitalized, experienced operators will continue to successfully pursue new development projects.

Active Market

Survey respondents predict an active market ahead, with plenty of available capital. Bank/finance companies are the top source of financing that respondents are looking to in 2022, with 48% selecting that option, up from 36% in 2021. The increase is likely a reflection of the fact that banks are flush with deposits, in no small part due to stimulus funds, and are eager to lend. The second most selected answer was private equity (32%), institutional (11%), and agency (9%).

As valuations continue to stabilize and rise, the merger and acquisition (M&A) market should heat up, as 55% of respondents stated they are planning to buy assets in 2022. As to who will be the biggest buyer, respondents ranked private equity first (36%), followed by regional operators (19%), and public real estate investment trusts (REITs) and private REITs both at 17%.

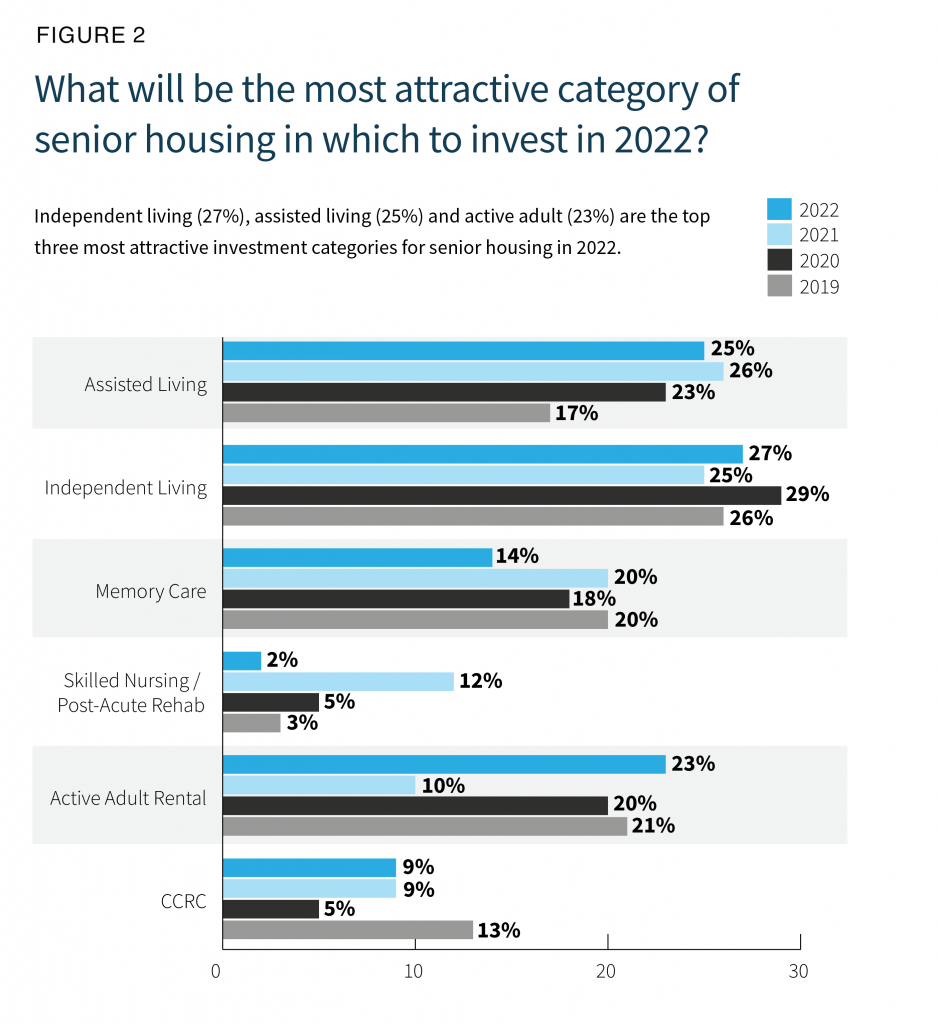

In terms of the most attractive category in which to invest, IL (27%), AL (25%), and active adult (23%) topped the list, with skilled nursing at the bottom (2%) (Figure 2). These results are largely consistent with responses from recent years, especially for AL and IL, which have remained steady the last three surveys. Clearly the further up the acuity scale you go, the more challenges you face—a reality reflected in the results.

Staffing Woes Continue

When it comes to staffing, however, the outlook is more pessimistic, as 37% of respondents predict industrywide staffing pressures would not improve anytime soon, with 33% predicting 2023 and 24% predicting the second half of 2022. In addition, the majority of respondents (64%) said that staffing is their greatest non-COVID challenge, a 36-percentage point increase from last year’s survey. Staffing challenges can have a cascading effect, as shortages can hinder care for current residents as well as the ability to accommodate new residents, and clearly is an issue taking its toll on operators.

The seniors housing and care industry has no shortage of challenges, yet cautious optimism prevails as occupancy steadily rises and demographics remain poised to drive demand. Although every outlook and forecast has its uncertainties, having an informed understanding of prevailing sentiments can help those in the industry prepare for whatever the future holds.

Download the eBook with complete 2022 Outlook Survey results here.