The proposed flat 25 basis point MIP rate lowers borrowing costs, simplifies execution, and boosts FHA competitiveness for market-rate and mixed-income apartment financing.

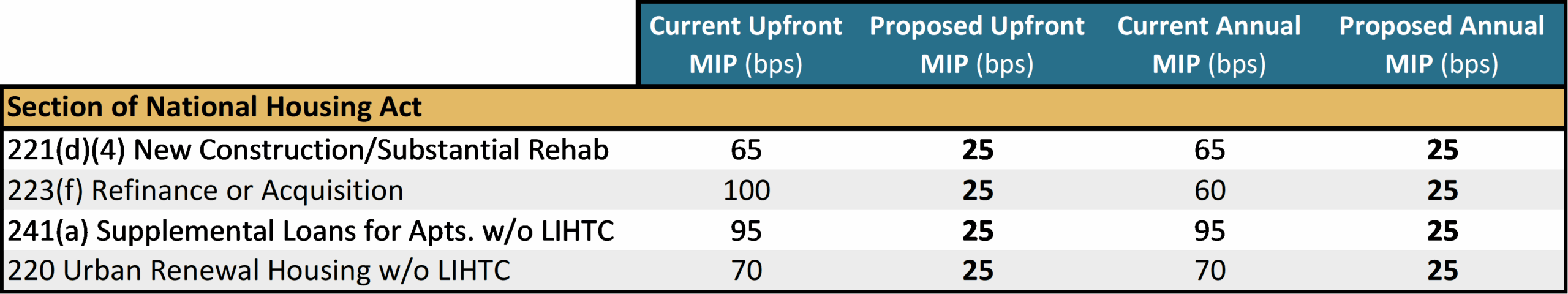

In a move to streamline the FHA multifamily loan process and reduce borrowing costs for apartment developers and owners, HUD Secretary Scott Turner announced that the Federal Housing Administration (FHA) is proposing a flat 25 basis point mortgage insurance premium (MIP) for all multifamily loan programs. The proposal, released today for a 30-day public comment period, would effectively eliminate existing MIP categories, including the Green MIP, in favor of a universal 25 basis point MIP. We summarize the HUD’s press release and FHA notice below.

The Green MIP program, introduced in 2016, provided reduced premiums for projects that achieved specified green building certifications and met ongoing energy performance reporting requirements. While the program offered meaningful incentives for energy-efficient developments, it also introduced added complexity, costs, and compliance obligations that posed challenges for some borrowers— particularly those with market-rate or mixed-income projects that did not fully meet HUD’s affordability or green compliance definitions. In some cases, it was more cost-effective to pursue alternative financing than to undertake the improvements required for the Green MIP program.

“By leveling MIPs and cutting cost-inflating regulations, we’re unlocking competitive financing and driving down costs across the board to spur development,” Secretary Turner said in a press release.

Currently, MIPs for FHA-insured multifamily loans vary significantly based on affordability levels and program type. The proposed flat 25 basis point rate could reduce upfront premiums by as much as 75 basis points for market-rate deals. While the savings are more modest for affordable housing, the standardization brings clarity and reduces transactional friction.

Importantly, these adjustments simplify the financing process for market-rate and mixed-income affordable housing, as well as affordable housing that doesn’t meet HUD’s definition of Broadly Affordable — for example, those with limited remaining regulatory term or restricted rents that do not meet HUD thresholds. By eliminating additional green certification costs and requirements, developers now gain direct access to favorable pricing without having to retrofit or recertify to meet green standards.

“This change eliminates the need for costly and time-consuming reports that were needed for green transactions and reduces borrowing costs at a time when many other costs have been increasing,” said Paul Weissman, senior managing director and head of affordable housing at Lument. “A flat 25 basis point MIP supports the development and preservation of a wide variety of high-quality rental housing with simpler processing, lower costs, and increased proceeds.”

Reach out to Lument’s team of financing experts to learn more.