FREDDIE MAC OPTIGO®

Index Lock

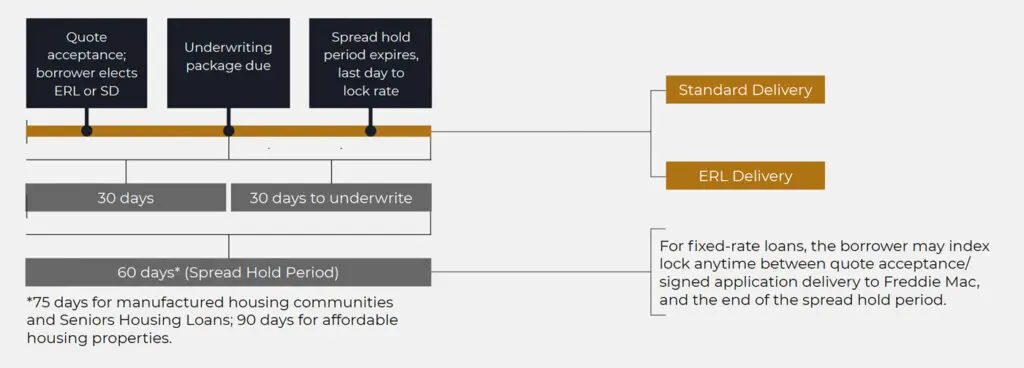

Our Index Lock option allows borrowers to lock the Treasury index (subject to the quoted Treasury Floor) for fixed-rate loans any time after a signed application with the Optigo® lender has been delivered to Freddie Mac—providing an enhanced level of risk mitigation against interest rate volatility. The spread will also not be subject to market grid movements during the Index Lock period. If one or more of the assumptions in the quote sheet changes such as changes in the terms of the loan, property, borrower, or certain loan document modifications—the quote will be adjusted based on the pricing grid in effect as of the date of the quote.

BENEFITS

Allows borrowers to mitigate market risk and reduce loan coupon volatility by locking the Treasury index with less documentation and faster execution than our traditional lock process.

-

ELIGIBILITY

Index Lock is available to borrowers that have had a loan purchased by Freddie Mac within the last 24 months. First-time Freddie Mac borrowers may be eligible if certain conditions are met. Freddie Mac evaluates Index Lock eligibility for each loan on a case-by-case basis, with consideration for the loan’s credit quality.

Parameters of the Index Lock include:- Index lock periods:

- The lock period for most conventional loans is 60 days after quote expiration.

- The lock period for Seniors Housing and Manufactured Housing Community loans is 75 days after quote expiration.

- The lock period for Targeted Affordable Housing loans is 90 days after quote expiration.

- 2% good faith deposit retained by the Optigo lender.

- 10% proceeds reduction without triggering breakage; final proceeds greater than 110% of the Index-Locked UPB will be locked at the blended rate using the Treasury index at final spread lock.

- Not a commitment or credit approval.

- Applies to property or properties identified in the quote; not transferable to other properties.

Index Lock

-

WHAT IS BEING LOCKED?

Treasury yield only; The spread is not subject to market grid movements, but may adjust based on quoted terms and conditions as well as further changes to loan terms, property, borrower, loan document modifications, etc. The spread is locked at full rate-lock.

-

ELIGIBLE BORROWERS

- Borrowers in good standing that have had a loan purchased by Freddie Mac within the last 24 months.

- First-time borrowers may be eligible if certain conditions are met.

-

ELIGIBLE LOANS

- Loans to be securitized.

- Acquisition or refinance loans.

- Fixed-rate loans.

-

WHICH LOAN TERMS ARE DETERMINED PRIOR TO LOCK?

Term of the loan, loan structure (interest-only period, prepayment structure, etc.), and loan amount (loan amount is subject to change).

-

EST. TIME FOR CREDIT APPROVAL

1 to 2 business days.

-

GOOD FAITH DEPOSIT (GFD)

2%.

-

DURATION OF LOCK

- 60 days after quote expiration date for most Conventional loans.

- 75 days after quote expiration for Seniors Housing and Manufactured Housing Loans.

- 90 days after quote expiration for TAH loans.

-

EXPOSURE TO SPONSOR UPON BREACH/BREAKAGE

Fixed-rate: Standard breakage formula, subject to a 0.5% minimum and 3.0% maximum (“3% Cap”) of the rate-locked mortgage amount. Note if there has been fraud or intentional misrepresentation/omission, the 3% Cap will not apply (breakage is uncapped).

Early Rate-Lock (ERL)

-

WHAT IS BEING LOCKED?

Interest rate for a fixed-rate loan or the gross spread for a floating-rate loan.

-

ELIGIBLE BORROWERS

Standard underwriting requirements.

-

ELIGIBLE LOANS

- Loans to be securitized or held in portfolio.

- Acquisition or refinance loans.

- Fixed- or floating-rate loans.

-

WHICH LOAN TERMS ARE DETERMINED PRIOR TO LOCK?

Most material loan terms (loan amount is subject to change).

-

EST. TIME FOR CREDIT APPROVAL

2 to 5 business days.

-

GOOD FAITH DEPOSIT (GFD)

2% (retained by Optigo lender), adjusted for longer-term ERLs.

-

DURATION OF LOCK

Varying durations, typically ranging from 60 days to 120 days until Freddie Mac purchase.

-

EXPOSURE TO SPONSOR UPON BREACH/BREAKAGE

- Fixed-rate: Standard breakage formula, subject to a 0.5% minimum and 3.0% maximum of the rate-locked mortgage amount.

- Floating-rate: 1.0%

Standard Delivery

-

WHAT IS BEING LOCKED?

Interest rate for a fixed-rate loan or the gross spread for a floating-rate loan.

-

ELIGIBLE BORROWERS

Standard underwriting requirements.

-

ELIGIBLE LOANS

- Loans to be securitized or held in portfolio.

- Acquisition or refinance loans.

- Fixed- or floating-rate loans.

-

WHICH LOAN TERMS ARE DETERMINED PRIOR TO LOCK?

All loan terms.

-

EST. TIME FOR CREDIT APPROVAL

2 to 3 weeks.

-

GOOD FAITH DEPOSIT (GFD)

Not required.

-

DURATION OF LOCK

Typically 45 days until Freddie Mac purchase.

-

EXPOSURE TO SPONSOR UPON BREACH/BREAKAGE

- Fixed-rate: Standard breakage formula, subject to a 0.5% minimum and 3.0% maximum of the rate-locked mortgage amount.

- Floating-rate: 1.0%

1If the quoted Treasury floor, if applicable, is triggered at the time of index lock, the spread will be increased by a corresponding amount.

This option for fixed-rate loans enables the borrower to lock the most volatile part of the coupon (the Treasury Index) anytime after a signed application has been delivered to Freddie Mac, with little documentation. Following an Index Lock, the borrower may complete the early rate-lock (ERL) process to quickly lock the spread or follow the Standard Delivery (SD) path to lock the spread at the

completion of full underwriting..