Complicated — After last week’s conflicting inflationary data and subsequent political commentary from the likes of Treasury Secretary Scott Bessent and St. Louis Fed President Alberto Musalem, dovish rate-cut hopefuls may well have repeated singer Avril Lavigne’s lyrics: “Why’d you have to go and make things so complicated?”

Both the Consumer Price Index (CPI) and Producer Price Index (PPI) releases came about with the backdrop of uncertainty caused by President Trump’s firing of Erika McEntarfer as commissioner of the Bureau of Labor Statistics, for allegedly mishandling or misreporting data. (Because such allegations have yet to be proven, Lavigne enthusiasts might also be heard repeating her lyrics: “Chill out, what ya yellin’ for?”) Trump has since nominated E.J. Antoni, former chief economist at the Heritage Foundation, to replace McEntarfer. With concerns about the politicization of government statistics rising, we outline below how last week’s CPI, PPI, and political commentary impacted investor expectations for a September rate cut.

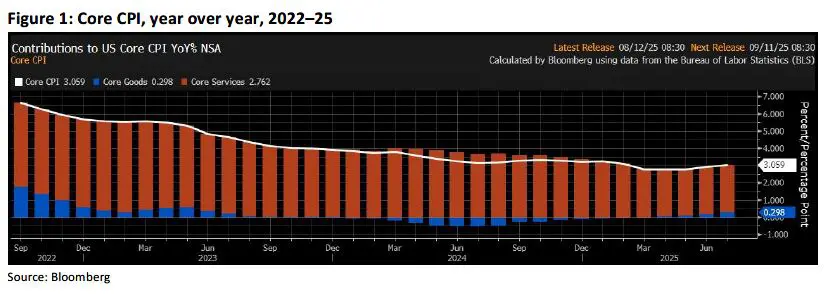

The CPI rose modestly in July (Figure 1). Year over year, the figure increased 2.7%, unchanged from June. The core figure increased 3.1% year over year, up slightly from 2.9% in June. These numbers were largely in line with expectations, with the largest increases for TVs and furniture, while toys and sporting goods lost momentum after larger increases in June. At first glance, it thus seemed that the tariff impact was less evident in July than in June—core goods, excluding vehicles, were up 0.22% in July, after increasing 0.55% in June. Following the CPI release, treasuries rallied and Fed rate-cut bets were boosted.

Complicating the inflation narrative and Fed rate-cut odds, however, was Thursday’s PPI print, which came in hotter than expected: Producer prices increased by the most in three years on services (Figure 2). PPI rose by 3.3% year over year, blowing June’s 2.3% increase out of the water. Core PPI printed even higher at 3.7%, up from 2.6% in June.

Thursday’s data also showed a 0.8% increase in the price of processed goods for intermediate demand, the largest increase since January (largely due to diesel fuel costs). Unlike Tuesday’s light CPI data, Thursday’s hot PPI print pared rate odds slightly. As Ben Ayers, senior economist at Nationwide, said Thursday, “While businesses have assumed the majority of tariff cost increases so far, margins are being increasingly squeezed by higher costs for imported goods. We expect a strong pass through of levies into consumer prices in coming months, with inflation likely to climb modestly over the second half of 2025.”

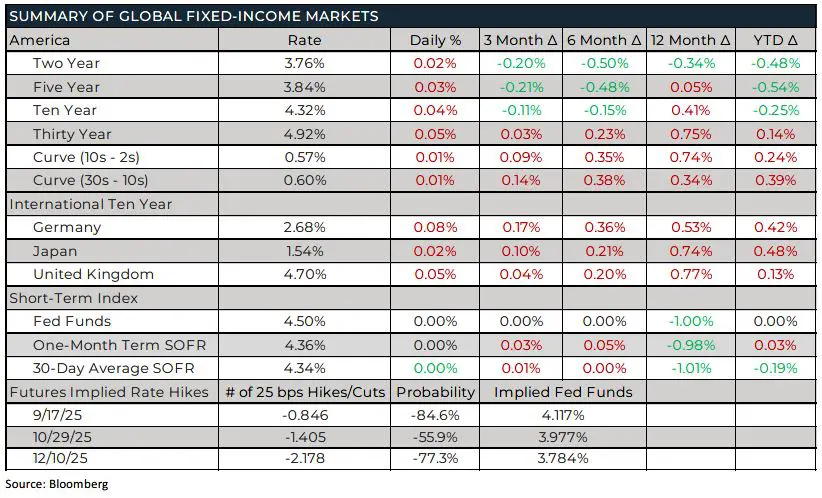

Secretary Bessent muddies the waters — Earlier last week, Bessent ruffled feathers in a TV appearance on Bloomberg TV, when he called for the Fed to cut rates: “I think we could go into a series of rate cuts here, starting with a 50 basis point rate cut in September. If you look at any model, it suggests that we should probably be 150, 175 basis points lower.” Bessent went on to say that “the reason Jay Powell gets the nickname ‘Too Late’ is because he wants to go into a series of rate hikes. He’s not Alan Greenspan, who was very forward thinking. They try to be more data-driven, which I think is a mistake … we’re going back into an economy like we had in the Nineties.”

Following Bessent’s appearance on Bloomberg, commentators like economist Julia Coronado retorted: “It’s really not the role of the Treasury secretary to opine” on the optimal level of benchmark interest rates. She added that Bessent’s comments are “direct public pressure on what [Bessent] wants the Fed to do.” Bessent responded to the backlash by saying: “I believe that there is room, if one believes in the neutral rate, for a series of rate cuts. I’m not calling for one. I didn’t call for one. I just said that a model of a neutral rate is approximately 150 basis points lower.”

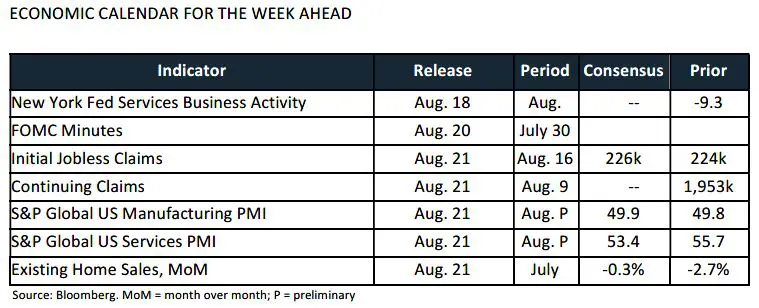

The Federal Open Market Committee (FOMC) opted to hold rates steady at the 4.25–4.50% range at the recent July meeting. Following the PPI print last Thursday, interest rate futures also showed that investors are now betting that the Fed will cut rates by less than 150 basis points (bps) by the end of 2026. The PPI print also lessened expectations of a 25-bps cut at the upcoming September meeting.

Fed officials react to inflation data — As is common following the release of inflation data, several Fed officials discussed the CPI and PPI reports. Musalem, for example, responded to a question about where he sees the Fed going at the September meeting. “For me, it’s too early to say exactly what policy I will be able to support,” he said. When pressed whether a 50-bps reduction was in the cards, Musalem said that such a move would be “unsupported by the current state of the economy and the outlook for the economy.” In discussing the dual mandate, he added: “I’m weighing both things. When we see tension between our two mandated goals, we need to follow a balanced approach.”

San Francisco Fed President Mary Daly also defended the FOMC’s choice to hold rates steady at the July meeting, but believes it is nevertheless time for a 25-bps cut. “Policy is likely to be too restrictive for where the economy is headed. So for me, that calls for recalibration,” she said. When asked if a 50-bps cut is on the table, Daly responded: “I’m worried it would send off an urgency signal that I don’t feel about the strength of the labor market … I don’t see the need to catch up.” Daly forecasted two cuts for this year back in June and said she still sees that as a reasonable prediction.

Later this week, the Federal Reserve Bank of Kansas City hosts its annual meeting at the Jackson Hole Economic Symposium. Many of the current Fed governors will be in attendance and will surely offer commentary on current market conditions.

FROM THE DESK

Agency CMBS — DUS Agency spreads ended the week one to two bps wider than the previous week for belly of the curve standard YM structures despite the light supply. The slight widening was attributed to investor concern over heavy issuance in the fall; however, DUS paper is very well supported by deep demand from every type of account. As is typical for August, it was a relatively quiet week with approximately $1 billion coming to market. Overall, investors absorbed about $1.42 billion between FNMAs and Freddie PC originations.

Municipals — AAA tax-exempt yields were relatively flat throughout the yield curve, week over week. The municipal bond market continues to see elevated primary new issuance. After July saw a record $59 billion issued, the first half of August has already seen over $30 billion come to market. In the housing space, we saw spreads remain consistent over the last few weeks—although the market as a whole has seen heavy issuance, the housing sector has only seen a few deals come to market each week. After experiencing three consecutive weeks of strong inflows, municipal bond funds saw $108 million exit (YTD inflows of $10.25 billion), while high-yield funds saw outflows of $18 million.

The information contained herein, including any expression of opinion, has been obtained from, or is based upon, resources believed to be reliable, but is not guaranteed as to accuracy or completeness. This is not intended to be an offer to buy or sell or a solicitation of an offer to buy or sell securities, if any referred to herein. Lument Securities, LLC may from time to time have a position in one or more of any securities mentioned herein. Lument Securities, LLC or one of its affiliates may from time to time perform investment banking or other business for any company mentioned.