Bad blood — News of Taylor Swift’s upcoming nuptials to Travis Kelce flooded headlines and excited the singer’s many fans last week. But it is one of Swift’s less romantic songs, “Bad Blood,” that best describes the new legal battle between President Trump and Fed Governor Lisa Cook. After Trump moved to fire Cook from her seat on the Federal Reserve Board of Governors and Cook responded with a lawsuit, Swift’s lyrics hit the mark: “Now we got problems, and I don’t think we can solve them.”

On August 20, Trump called for Cook’s resignation from the Federal Reserve after Federal Housing Finance Agency Director Bill Pulte alleged that Cook lied on loan applications for two properties in 2021—one in Michigan and one in Georgia. According to Pulte, Cook declared both properties as her primary residence to secure more favorable loan terms.

In a letter posted to social media following Pulte’s allegation, Trump wrote: “The American people must be able to have full confidence in the honesty of the members entrusted with setting policy and overseeing the Federal Reserve. In light of your deceitful and possibly criminal conduct in a financial matter, they cannot and I do not have such confidence in your integrity.” Trump added that it was “inconceivable” that Cook was unaware that she filed both properties as a primary residence. In her initial public comments last week, Cook replied: “I have no intention of being bullied to step down from my position because of some questions raised in a tweet.” Tensions escalated last Thursday, when Cook hired a legal team and filed a lawsuit in a D.C. federal court: “This case challenges President Trump’s unprecedented and illegal attempt to remove Governor Cook from her position which, if allowed to occur, would be the first of its kind in the Board’s history.” Cook asserts that Trump’s attempt at removing her is a political tactic, with the sole aim of attaining a majority of Trump-nominated governors on the board: “The mortgage allegations against [Cook] are pretextual, in order to effectuate her prompt removal and vacate a seat for President Trump to fill and forward his agenda to undermine the independence of the Federal Reserve.” Cook’s defense went on to state that should there be any discrepancies in any of Cook’s former mortgage applications, they are merely “clerical errors.”

Later on Thursday, Pulte filed a criminal referral against Cook. In it, Pulte alleges that Cook also fraudulently claimed a Massachusetts residence as a second home—and that eight months later, Cook declared the residence to be an investment property that made $15,000 to $50,000 in rental income. Pulte urged the Justice Department to investigate whether Cook made “further potential criminal violations as well as material representations … to acquire and maintain her position as [Fed] governor.”

Cook was nominated for her current role in January 2022 by President Biden to a term set to expire in 2038 (governors serve 14-year terms). During her confirmation process, Cook faced intense scrutiny from Republican lawmakers and conservative media commentators, who argued that Cook lacked adequate experience in interest-rate policy.

Previously, Cook earned a PhD in economics from the University of California, Berkely, served as an economics and international-relations professor at Michigan State University, was a staff economist in President Obama’s White House, and served as an adviser to Biden’s presidential transition team. Later, Cook was narrowly confirmed to the Board of Governors in a 51-50 vote in the Senate that was decided by Vice President Harris.

The current controversy centers, in part, on the legality of Trump’s actions. Critics argue that Trump’s move to fire a Fed governor is not only unprecedented, but illegal. In his defense, Trump cites the Federal Reserve Act of 1913, which states that a president may fire a governor “for cause,” which is typically interpreted by legal experts to mean grave misconduct committed while in office.

Questions about the independence of the Fed have been a growing theme of Trump’s time in office. While Trump berated Chair Jerome Powell publicly for months throughout 2025, the value of having a Fed that operates independently of the whims of politicians is still widely recognized. For this reason, markets are paying close attention to Cook’s lawsuit.

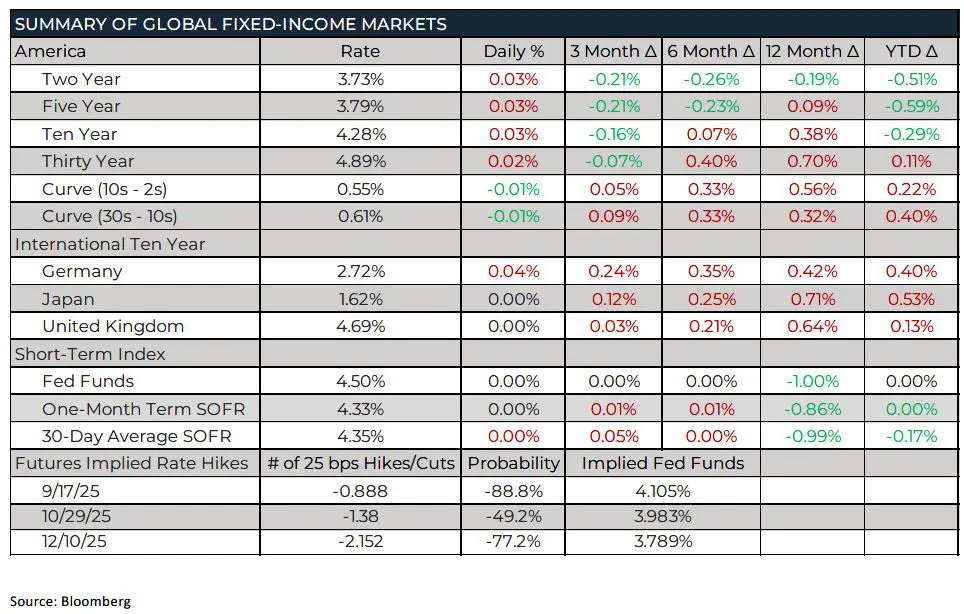

As David Roberts, head of fixed income at Nedgroup Investments, put it, “The combination of weaker U.S. payroll growth and the White House baiting of the Fed, both institutional and personal, is starting to create real issues for investors in U.S. Treasuries.”

Should Trump succeed in replacing Cook with a more dovish, like-minded governor and rates get cut aggressively, “cheaper money now would likely stoke a boom, a weaker U.S. dollar, and materially higher inflation,” added Roberts. Meanwhile, macro strategist Edward Harrison wrote: “If efforts to gain political control of the Fed gain more traction, we should expect a larger reaction both in premiums and inflation expectations.”

Though the specifics of the current controversy are unprecedented, there is a precedent for presidents appointing a majority of Fed governors during a given period. For example, President Biden appointed four of the seven sitting Fed governors during his term, while Trump did the same in his first term. The number of appointments for Presidents Obama (seven), Bush (eight), Clinton (six), Reagan (eight), and Carter (six) during their time in office was similarly high. Perhaps more importantly, Fed Governors, like Supreme Court Justices, tend to act not as mere rubber stamps for the presidents who appoint them. Trump’s appointees to the Fed Board to date, for instance, have had strong resumes—which is mostly likely why markets have met the latest headlines with a yawn.

While Trump continues to demand lower rates—last month, for example, he wrote “let people buy and refinance their homes!” after the Fed kept rates steady—premature easing could, ironically, raise Americans’ longer-term borrowing costs if inflation expectations subsequently become unanchored. To see why, consumers and investors need only look across the Atlantic.

Since mid-2024, the European Central Bank (ECB) has cut its benchmark borrowing rate by 225 basis points to 2.15% today. Yet rates on longer-term bonds are higher in Germany, France, and Italy now than before the ECB began cutting. (Some investors point to high deficits in these countries as one culprit behind higher rates. But the U.S. is no model student in this area either.)

The bottom line: History shows that central banks with higher levels of autonomy do a much better job of keeping inflation low and otherwise promoting economic stability and prosperity. Because the independence of the Fed is a crucial pillar of the success of the American economy, this landmark case will affect future policy for years to come. Investor attention will therefore remain keenly attuned to the developing lawsuit between Governor Cook and President Trump.

FROM THE DESK

Agency CMBS — New-issue Fannie DUS volume was around $1.14 billion last week. Week over week, DUS spreads were one to three bps wider. Demand remained strong for block-size and discount paper. There were minimal changes, week over week, in the project loan space. While buydowns remained in vogue, we began to hear of investor-spread widening at lower coupon stratospheres. The general tone in our markets remained positive.

Municipals — AAA tax-exempt yields were flat throughout the yield curve, week over week. The market saw back-to-back weeks of primary new issuance under $10 billion—a welcome reprieve from the $14 to $16 billion weekly supply in June and July. Spreads on short-term, cash-collateralized deals remained consistent last week too, even with the decrease in deals coming to market. Given the Labor Day holiday, we expect issuance to remain relatively low this week as well. Municipal bond funds had a second consecutive week of inflows, with $591 million entering (YTD inflows of $13.14 billion).

The information contained herein, including any expression of opinion, has been obtained from, or is based upon, resources believed to be reliable, but is not guaranteed as to accuracy or completeness. This is not intended to be an offer to buy or sell or a solicitation of an offer to buy or sell securities, if any referred to herein. Lument Securities, LLC may from time to time have a position in one or more of any securities mentioned herein. Lument Securities, LLC or one of its affiliates may from time to time perform investment banking or other business for any company mentioned.