Save you a seat — Adriana Kugler’s final day as a governor on the Federal Reserve Board was last Friday. Her term was set to expire on January 31, 2026, but she will return instead to Georgetown University as a professor this fall, according to the Fed’s website.

We find ourselves in anything but ordinary times. Kugler’s departure has, in turn, made Alex Warren’s 2024 song “Save You a Seat” seem especially prescient. Stephen Miran, chair of President Trump’s Council of Economic Advisers, secured the remainder of Kugler’s spot on the Federal Open Market Committee (FOMC) last Thursday, while Christopher Waller seemingly got the nod to be appointed as the next Fed chair. Below, we offer short profiles of each man.

Donald Trump chose Council of Economic Advisers Chairman Stephen Miran to serve as a Federal Reserve governor for the remainder of Kugler’s term. “He [Miran] has been with me from the beginning of my Second Term, and his expertise in the World of Economics is unparalleled — He will do an outstanding job,” Trump wrote on social media, after nominating Miran. Miran will need to be confirmed by the Senate, but “[i]n the meantime, we will continue to search for a permanent replacement [for Kugler’s seat],” Trump added. The Senate is on its annual August recess and will return to Washington in early September. From there, confirmation could take several weeks if the nomination is prioritized by Republican leaders.

Miran earned a Ph.D. in economics from Harvard University and has echoed Trump’s call for lower interest rates. Miran has also been a Fed critic and has proposed some unorthodox changes to the Federal Reserve in recent years. In a March 2024 paper, for example, Miran and Dan Katz, now chief of staff at the Treasury Department, laid out a 24-page plan for reforming the Fed that blamed policy errors at the central bank on “groupthink.” The paper also criticized the central bank for having expanded into political areas that, they argue, are beyond the Fed’s remit.

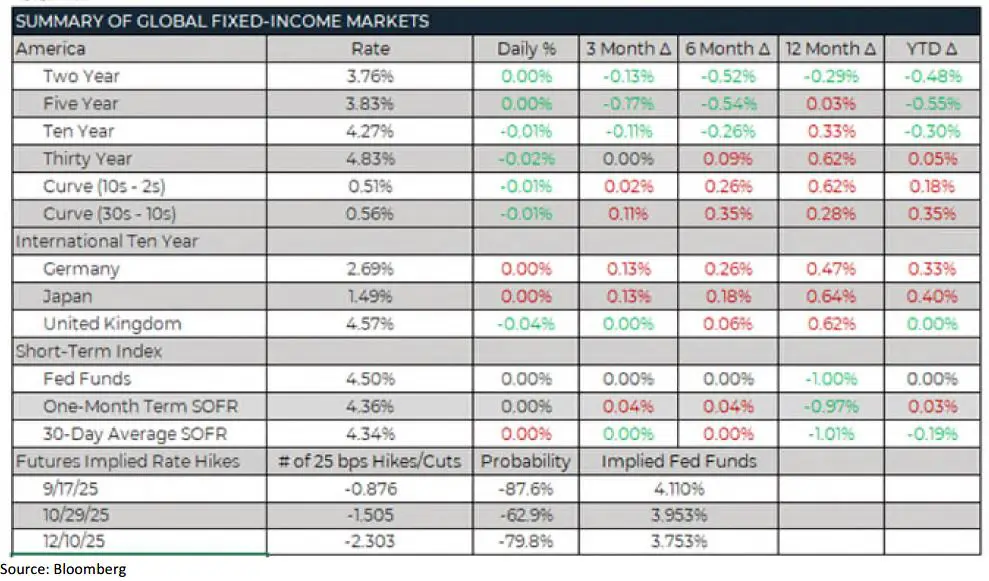

Joe Gilbert, a portfolio manager at Integrity Asset Management, said Miran was “not an expected pick, but it is within the framework that the market was looking for… Miran would provide another voice to conceivably support easier Fed policy.” Indeed, Miran’s nomination reinforces the belief that the Fed will ease interest rates for the balance of the year—it is unlikely the Fed will hold rates steady with three dissents on its board. We have, in other words, officially entered an easing cycle for markets.

As noted in previous Talking Points, the FOMC makes policy decisions based on consensus, so this nomination, which still has weeks before official approval, likely won’t change much. It does add a more dovish member to the committee in the short term, but it seems the economic landscape is largely accounted for during upcoming months. “Overall, he’s just one member and he’s not going to go in and bring structural change or lead to larger rate cuts,” said David Beckworth, senior research fellow at the Mercatus Center at George Mason University. “And I really don’t think he can do much in just a few months.”

The second soon-to-be open seat, that of Chair Powell, will be much more impactful on markets. As it stands, current Fed Governor Christopher Waller appears to be the likely pick for the job. Waller earned his Ph.D. in economics from Washington State University in 1985. Before his nomination to the FOMC in 2020, Waller served as research director and executive vice president at the St. Louis Fed. In 2020, senators voted 48-47 to support Waller’s nomination to the Fed board.

While Waller’s potential nomination appears to have substantial support from Trump and others—due, in part, to his dovish outlook—not all members of the FOMC appear to support his dovishness. For example, Waller was one of only two dissenters at the most recent FOMC meeting, meaning the majority of his colleagues have some disagreements in regard to policy. Bloomberg, meanwhile, reported that Trump advisers are impressed with Waller’s willingness to move on policy based on forecasting, rather than current data, as well as his deep knowledge of the Fed system. Waller’s recent dissent was also well timed: Just days after the meeting, the Bureau of Labor Statistics reported that employment declined by significantly more than previously reported.

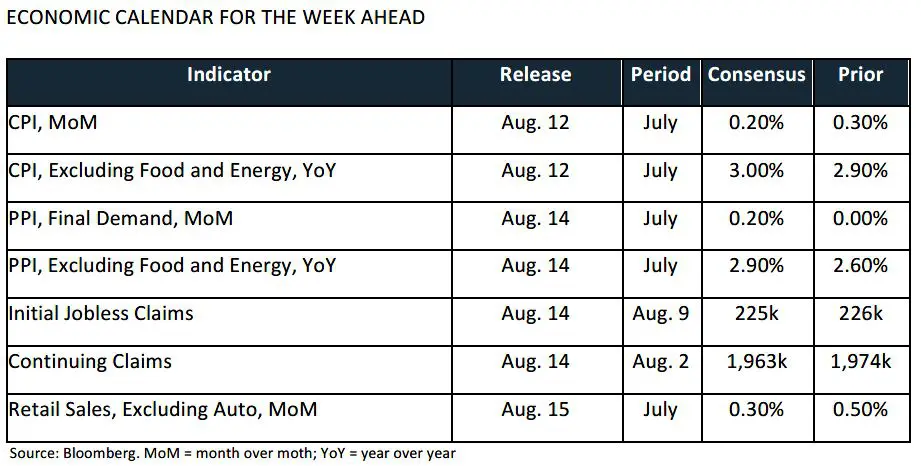

Time will tell if the FOMC decides to cut rates at the September meeting. Certainly, the release of Consumer Price Index (CPI) and Producer Price Index (PPI) data this week will factor into that decision. Atlanta Fed President Raphael Bostic said he still views one rate cut as likely this year; Bostic also reiterated that there are reasons to be “somewhat skeptical” that the inflationary effects from tariffs will be only temporary.

“This has not been a one-time thing, where you wake up on one day and everybody knows what all the tariffs are,” Bostic said last week. Instead, the frequent evolution of tariffs is extending the time frame that the prospect of higher prices is on consumers’ minds, which risks further lifting inflation expectations. “I think more and more that we will still be seeing strategic adjustments into 2026,” Bostic added. He also argued that the Trump administration’s primary aim in imposing tariffs is to fundamentally reshape U.S. supply chains. The resulting structural changes raise the risk of a persistent inflationary impact too, Bostic noted.

For example, Apple CEO Tim Cook and Trump announced last week that the tech giant committed to drop another $100 billion on domestic manufacturing and research. In total, that brings Apple’s pledged U.S. spending to $600 billion over the next four years. Cook promised the other $500 billion in February, after Trump imposed tariffs on China, Apple’s longtime key manufacturer.

Then, instead of Apple shifting its supply chain to the U.S.—a Trump goal that Apple called a non-starter— the company moved much of its manufacturing operations to India. Thanks to that move, India has overtaken China as the top smartphone exporter to the U.S. for the first time, reported Canalys, a research firm. Yesterday’s announcement of fresh funds from Apple might therefore “soften the White House’s ire” over its India pivot, according to Bloomberg Intelligence.

The labor market has remained steadfast as the pillar holding up the economy—and holding up potential rate cuts. That may be on a course correction, though. Regarding last Friday’s weak jobs report, Bostic called it a surprise and said the revisions reflected turbulence in the economy: “The numbers today and the revisions … suggest that maybe the economy and the labor market is weakening more broadly. That does also suggest that the risks to the employment side of the mandate are maybe coming more into balance with those in inflation, and that’s something that I’ll really have to look at as I think about the appropriate path for policy.”

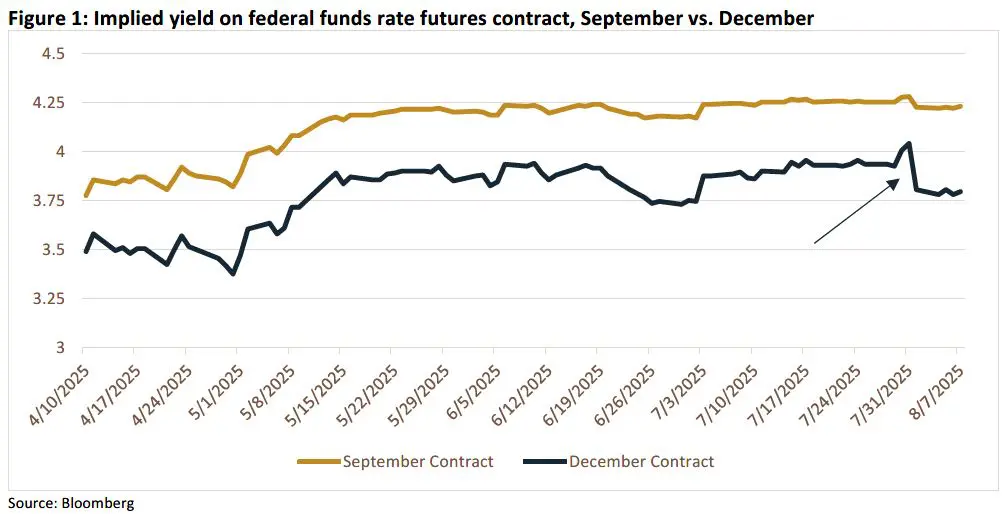

The current upper bound on the federal funds rate futures contract is 4.50%. And, as Figure 1 illustrates, the revised employment number was clearly the catalyst for the market to price in an additional cut by the end of the year.

FROM THE DESK

Agency CMBS — Fannie Mae DUS and Ginnie Mae project loans both tightened from a spread perspective, week over week. DUS traded well, with the strongest appetite mostly coming from large ($50+ million) deals and FTIO. Buydowns continued to trade well too, though with a comparatively tighter spread.

Ginnie Mae volume was overwhelming, approaching $1 billion in new origination. Investor appetite was strong across the board for both PLs and CLs and even across a variety of coupon areas. Buydown options are the flavor of the week from the borrower perspective; the lower coupons have been well received in order to balance out some of the vintage loans that are in inventory.

Municipals — AAA tax-exempt yields were lower throughout the yield curve, week over week. The municipal bond market saw a pickup of primary new issuance, with over $15 billion pricing last week. With August principal and interest payments due back to investors at almost $60 billion, investors were able to absorb the large issuance calendar last week. If issuance continues to remain at this level as the month-end approaches, expect deals to compete with each other to get investors’ attention. Municipal bond funds saw their third straight week of inflows, with $1.7 billion entering (YTD inflows of $10.36 billion), while high-yield funds saw outflows of $224 million.

The information contained herein, including any expression of opinion, has been obtained from, or is based upon, resources believed to be reliable, but is not guaranteed as to accuracy or completeness. This is not intended to be an offer to buy or sell or a solicitation of an offer to buy or sell securities, if any referred to herein. Lument Securities, LLC may from time to time have a position in one or more of any securities mentioned herein. Lument Securities, LLC or one of its affiliates may from time to time perform investment banking or other business for any company mentioned.