The final countdown

The government struck a deal to get back to work last week. The bustling streets of Washington, D.C. will regain the American flag lapel pin donned by politicians. More importantly, workers will receive back pay. SNAP benefits for one in eight Americans will return to normal. And airport screeners and air traffic controllers will return in force, which will alleviate some pressure on security lines and flight disruptions. The Josh Abbott Band celebrated this reversion in “Back to Normal,” when they sang: “Making the world slow down until we reach the end [of the shutdown, presumably]. Yeah, but until then, I’m getting back to normal again.”

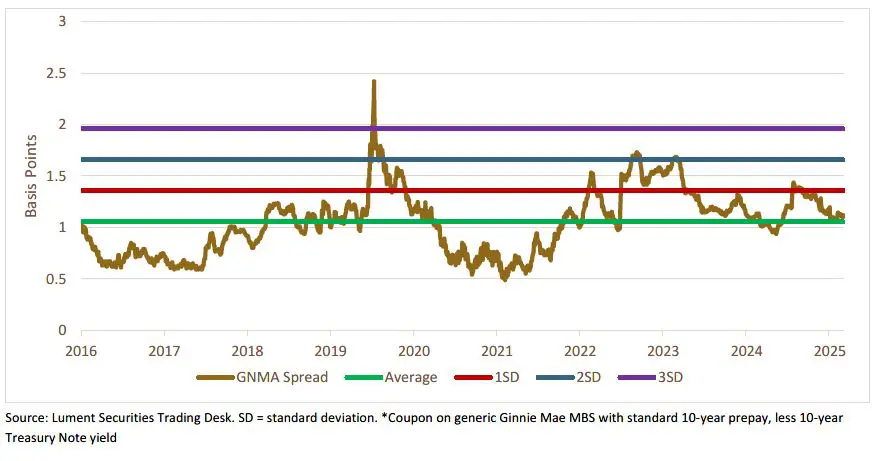

Alas, the release of critical economic data will still be delayed and will likely contain distortions for weeks or months to come. The shutdown, meanwhile, clearly delayed issuance of new loan commitments from the U.S. Department of Housing and Urban Development (HUD). But from our market perspective, spreads on standard Fannie Mae and Ginnie Mae fixed-rate, permanent-loan products have quietly returned to long-run averages following a near three-year period of elevation (Figure 1).

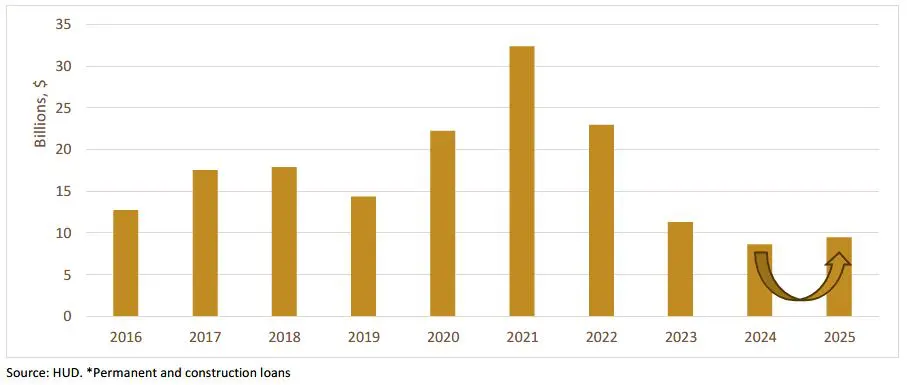

Spreads widened from the 2021 to 2023 period, following a huge wave of supply along with trouble in the banking sector, which stressed end investor appetite for tranched Ginnie Mae REMIC bonds. The spread widening wasn’t an idiosyncratic event, however, as other fixed-income asset classes, like corporate bonds and conduit CMBS, also endured pressure. Fortunately (for spreads), the rising rate environment that followed the lows of the pandemic created an atmosphere ripe for lower Federal Housing Administration (FHA) loan volume (Figure 2).

Recent years have been plagued by significantly lower annual origination volumes, but the market seems to be turning the corner. FHA volume is set to break its three-year consecutive decline this year. Thankfully, lower annual supply has not only helped to keep investor spreads from widening, but has actually prompted spreads to compress back to long-term averages.

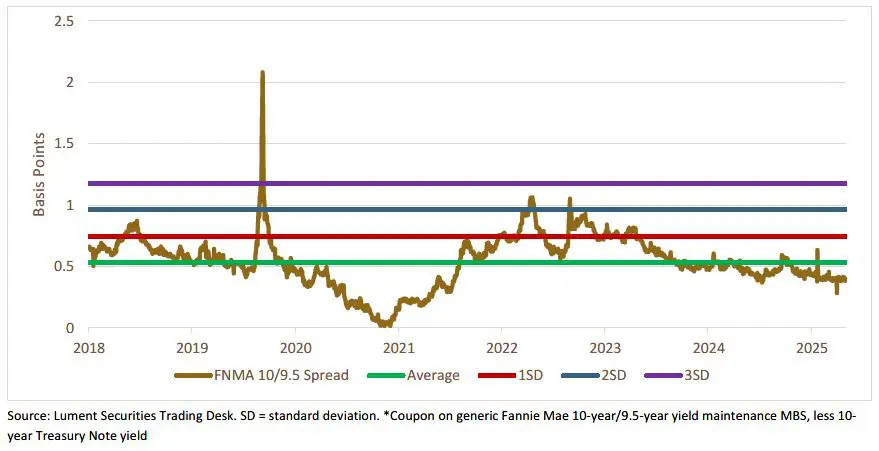

The Fannie Mae DUS loan program fared better the last couple of years. This is partly due to the increased liquidity, yield maintenance, hedgeability, and distance from the stigma that tarnished its Ginnie Mae counterpart following the regional banking crisis. Fannie Mae spreads still widened, again commensurate with the broad market weakness, but the softness was less pronounced (Figure 3).

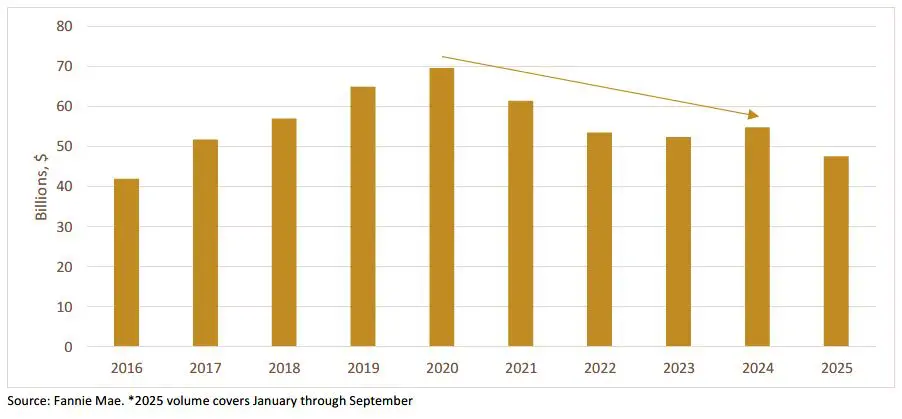

Fannie Mae DUS loan volumes were less affected, too. While Ginnie Mae new issuance declined by about 75%—from a peak of $32 billion in 2021 to $8 billion in 2024—Fannie Mae origination dropped only 25%, from a 2020 peak to a 2023 trough (Figure 4); the drop in Fannie origination is even smaller if 2021 production is used as the base. While Ginnie Mae seems poised for a rebound year, Fannie Mae is less certain. Fannie Mae has maintained a $70 billion volume target for years and has been short of that since 2020. Still, Fannie Mae is expected to finish 2025 strong and hit its $70 billion target by the end of the year.

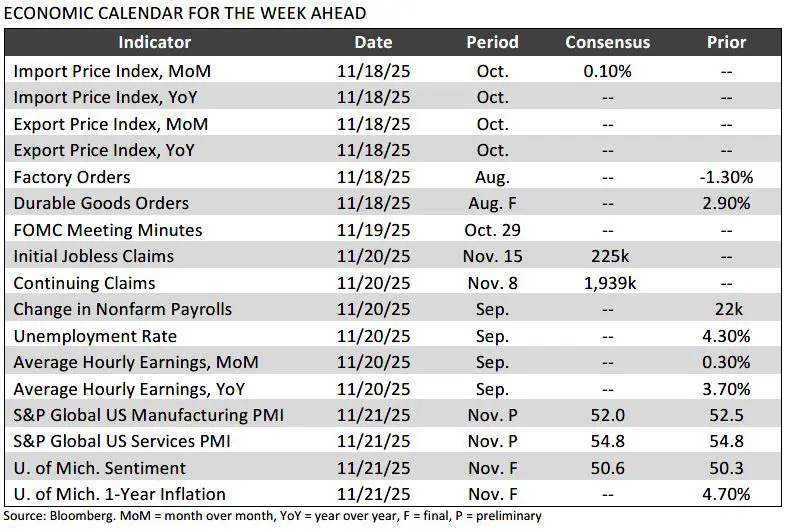

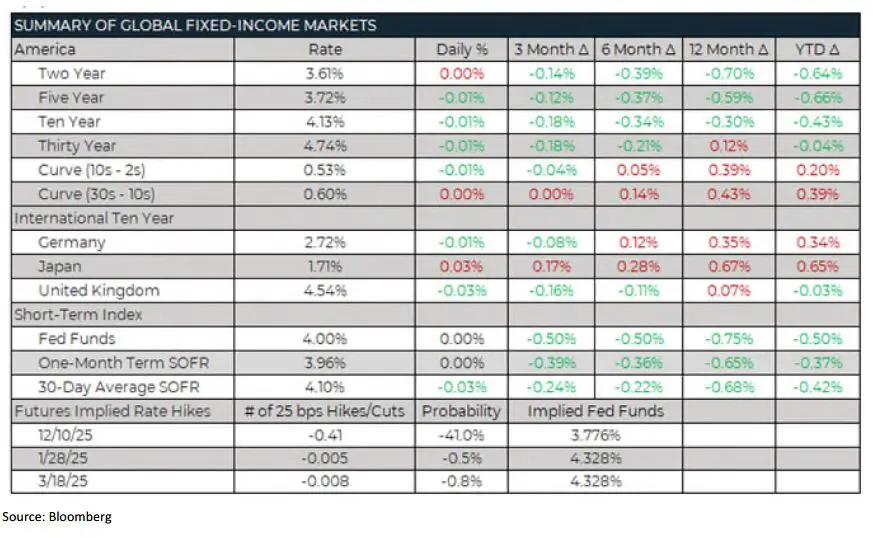

Now that the federal government shutdown is behind us (at least until January 30), we can get back to analyzing economic fundamentals. The data will likely take some time to purify, but the market can agree that having government data is better than the alternative, which we endured for 43 days.

On the other hand, private data did provide a useful crutch during the shutdown and may become more important due to the increased gridlock in Washington. Either way, we are returning to normal—with economic data coming back, investor spreads coming back, and a Federal Reserve coming back to its familiar stance of “data dependency.”

FROM THE DESK

Agency CMBS — Our markets continued to function well. Fannie Mae DUS volume was $735 million for the week and generic spreads tightened by around three basis points (bps) in the popular five to 10-year tenors. Ginnie Mae volume was light, as borrowers were reluctant to lock in uncertain loan-closing timeframes during the shutdown. We expect rate locks will pick up over the next two to three weeks. However, Ginnie volume will remain light for the remainder of 2025 because HUD employees lost six weeks to process loan applications. Week over week, Ginnie Mae spreads were flat to one bp wider.

Municipals — AAA tax-exempt yields were relatively flat throughout the yield curve, week over week. The new-issue calendar was light last week due to the federal holiday. Deals that did price came at comparable spreads to the prior week. With Thanksgiving approaching, issuers will look to price their deals next week— last week, the new-issuance calendar was $16 billion. Municipal bond funds had a sixth-straight week of inflows with $405 million entering (YTD inflows of $23.25 billion), of which high-yield funds received $81 million.

The information contained herein, including any expression of opinion, has been obtained from, or is based upon, resources believed to be reliable, but is not guaranteed as to accuracy or completeness. This is not intended to be an offer to buy or sell or a solicitation of an offer to buy or sell securities, if any referred to herein. Lument Securities, LLC may from time to time have a position in one or more of any securities mentioned herein. Lument Securities, LLC or one of its affiliates may from time to time perform investment banking or other business for any company mentioned.