Hello

Grammy-winning superstar Adele was presumably frustrated with the missing economic calendar, when she sang: “Hello, it’s me. I was wondering if after all these [weeks] you’d like to meet to go over everything.” No doubt she was referring to economic data coming from government departments, which has been absent for three weeks. It will be a race between when the market will return to its daily dose of data or Adele’s Tottenham Hotspurs can reach number one in the Premier League. As authors of a weekly economic/markets-based publication, we hope the former wins. But either way, we digress and wish her well.

It’s a particularly difficult time for Federal Reserve officials to go without data. Previous economic statistics were pulling officials in opposite directions, with a cooling labor market amid inflationary pressures above the central bank’s 2% target. The dearth of economic data today leaves the market in a place of minimal conviction, with just rhetoric, anecdotes, and Fedspeak to go on for the most part. It is clear that monetary policy will be shifting to a more natural stance in the form of lower rates—Federal Open Market Committee (FOMC) officials seem to all now agree on that point—but at what pace will the central bank get there?

Clearly, Fed Governor newcomer Stephen Miran represents the most dovish faction at the Fed, preferring to lower rates more aggressively, while a large majority of remaining officials seem keen to take a more cautious approach. Fed Governor Christopher Waller echoed this point last week when he said, “You don’t want to make a mistake. So the way to avoid that is to go cautiously or carefully and do 25 [basis point cuts], wait and see what happens, and then you can get a better idea of what to do.”

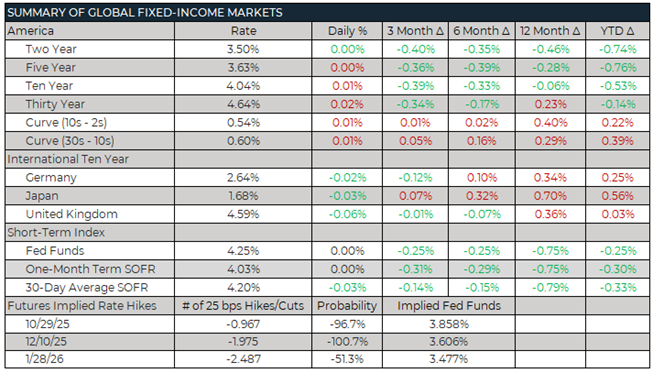

The market seems primed for the later approach, perhaps guided by Fed Chair Jerome Powell’s comments last week signaling another quarter-point reduction later this month. Investors see a nearly 100% chance of a reduction at the conclusion of the next FOMC on October 29, according to federal funds rate futures contracts.

Powell also said that he and his colleagues are looking to alternative, private-sector data sources to help evaluate the state of the economy. But he still emphasized the importance of government data, which he called the “gold standard.” “We don’t expect that we’d be able to replace the data we’re not getting,” Powell said. “We’ll start to miss that data, and particularly the October data. If this goes on for a while, they won’t be collecting it, and it could become more challenging.”

In an otherwise empty economic calendar, economic highlights from the Fed’s Beige Book can become more meaningful. The Beige Book, which earned its name from the literal color of the literature handed to officials, is a collection of anecdotes of economic activity from the 12 regional Fed banks.

To highlight the difficulty at the Fed, three districts reported slight to modest growth in economic activity, five reported no change, and four noted softening. Across most districts, more employers reported reductions to headcount through layoffs and attrition; employers cited weaker demand, lingering economic uncertainty, and investment in artificial intelligence. Those who did seek to hire largely reported an easier time finding workers, though some sectors faced hiring challenges. “Labor supply in the hospitality, agriculture, construction, and manufacturing sectors was reportedly strained in several districts due to recent changes to immigration policies,” according to the report.

There are several takeaways here. First, outside of an exogenous shock like a financial crisis or pandemic, economies tend to trend in some fashion. (Economic data has been proven to be highly autoregressive.) So we could “forecast” missed economic data—with reasonable accuracy—by using the trend of past prints. Second, it has proven more fruitful to take the Fed at its word in recent months in lieu of overanalyzing data. While market pundits/investors/presidents argued about whether the FOMC should cut rates throughout most of 2025, Fed officials said repeatedly that they were going to remain patient and data-dependent.

Even without data, the tea leaves suggested that “patient” was more akin to holding rates steady. We can therefore be somewhat confident that when Powell hints at just a 25 bps cut this month, he means it.

Still, tea leaves really aren’t necessary—market participants have had about 35 opportunities over the prior two weeks to listen to senior Fed officials talk at public events (prior to the Fed’s self-imposed blackout period that commenced last Friday). After such a deluge of Fed speak, it appears that every official, save Miran, seems to be amenable to one or two additional 25 bps cuts in 2025. And fed funds futures indicate that investors listened: Expectations for rate cuts at the October and December FOMC meetings are 100%. Yet the same gauge shows less confidence in the Fed’s desire to cut further in 2026, given the chances of January and March cuts at near 55%.

With these probabilities, the market is expecting the Fed will keep cutting at each meeting until reaching whatever level the FOMC believes to be neutral. Or the FOMC will pause at 3.50% after the December cut to reassess 2025 economic data.

FROM THE DESK

Agency CMBS — Agency volume came in healthy last week, despite the holiday-shortened calendar. New-issue Fannie Mae DUS volume was around $1.19 billion and Freddie Mac participation certificate volume was near $900 million, beating the combined year-to-date weekly average by more than $500 million. Our generic Fannie Mae spreads held in well—at flat to 2 bps tighter—on 5-year through 12-year tenors, week over week. Ginnie Mae volume was light last week, mainly due to loan-closing concerns brought on by the federal government shutdown. Ginnie Mae spreads were flat to 2 bps wider for the week.

Municipals — AAA tax-exempt yields were again higher on the short end of the yield curve and lower on the mid to long end of the curve, week over week. October is typically a challenging month in the municipal bond market, as primary new issuance usually increases and reinvestment capital due back to investors decreases. However, the new-issue calendar was light last week—especially in the housing sector, where only a handful of deals priced. We expect the calendar to increase significantly for the last two weeks of the month. Municipal bond funds had a third straight week of inflows, with collections of $678 million last week (YTD inflows of $19.73 billion). High-yield funds received $15 million of those inflows.

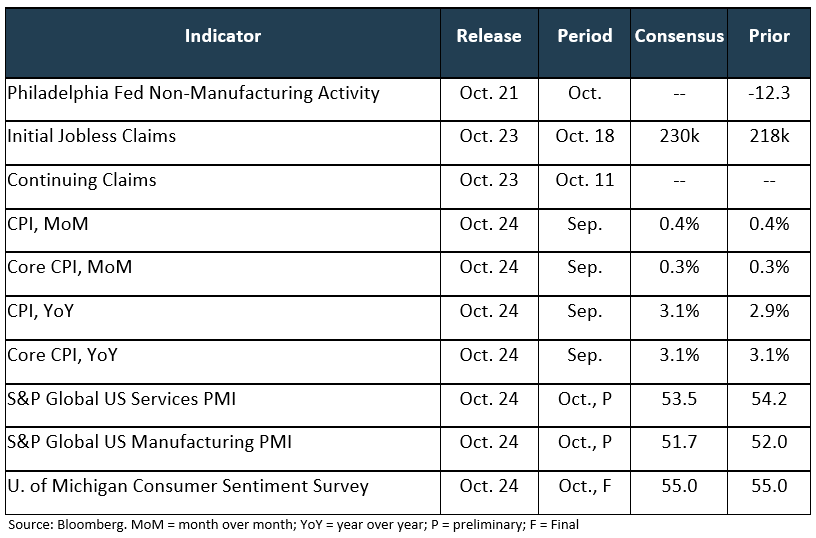

ECONOMIC CALENDAR FOR THE WEEK AHEAD

The information contained herein, including any expression of opinion, has been obtained from, or is based upon, resources believed to be reliable, but is not guaranteed as to accuracy or completeness. This is not intended to be an offer to buy or sell or a solicitation of an offer to buy or sell securities, if any referred to herein. Lument Securities, LLC may from time to time have a position in one or more of any securities mentioned herein. Lument Securities, LLC or one of its affiliates may from time to time perform investment banking or other business for any company mentioned.