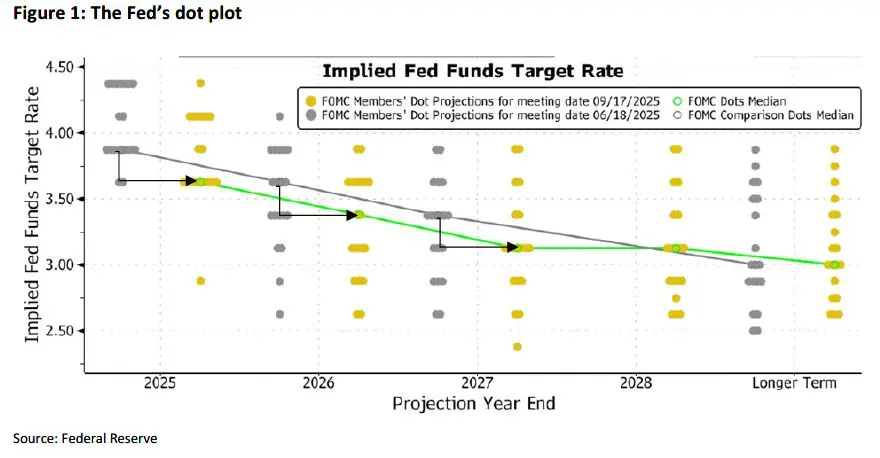

Still waiting — Last week, the Federal Open Market Committee (FOMC) delivered the consensus prediction of a 25 basis points (bps) rate cut. The Treasury market rallied immediately following the release of the FOMC’s dovish statement and “dot plot” (Figure 1). However, the rally was completely reversed after Fed Chair Jerome Powel’s hawkish press conference: The market, in particular, dialed in to Powell’s advice to “think of today’s move as a risk-management cut.”

Still, the idea that the cut was primarily about “risk management” is somewhat at odds with the forecasts of other FOMC policymakers. As Figure 1 shows, they predicted an additional 50 bps of cuts this year (25 bps in both October and December), as well as additional cuts in 2026 and 2027.

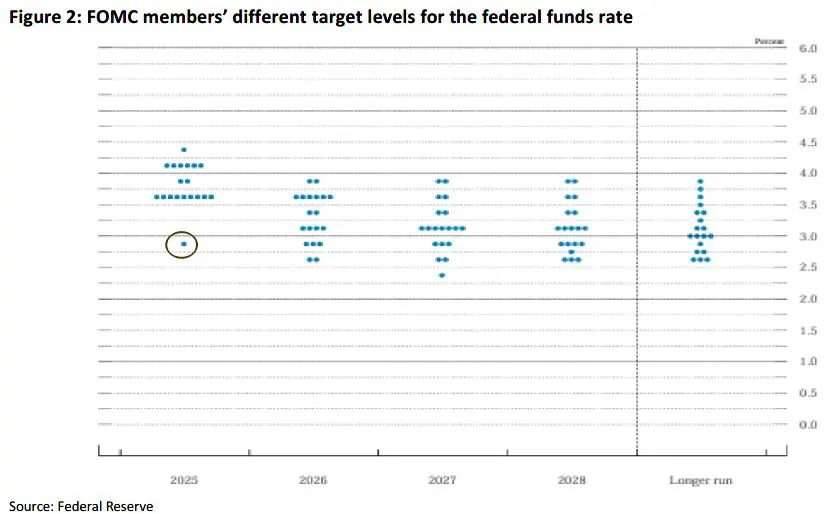

The optics of the latest FOMC meeting were also peculiar. The FOMC has been under intense pressure from President Trump for not decreasing rates sooner or more aggressively. While the FOMC delivered the first cut of Trump’s second term, it was not a unanimous decision. Voting newcomer—and now perceived Trump ally—Stephen Miran was the lone dissenter, arguing in favor of more aggressive cuts for the rest of 2025 (Miran’s favored dot is circled in Figure 2).

Appearing on CNBC, Miran was asked about his dissenting vote for a 50 bps cut, when the rest of the committee voted on a 25 bps cut. “I don’t see any material inflation from tariffs,” Miran responded. “The second thing I’d say is there’s no discernable trend difference between core goods inflation in the United States versus that in other countries.” According to Miran, border policy in recent years has caused an increase in the cost of shelter. But Trump’s deportation policies will nevertheless have “significant disinflationary effects.” Miran added that he will further explain the economic projections supporting his dissent in a speech today.

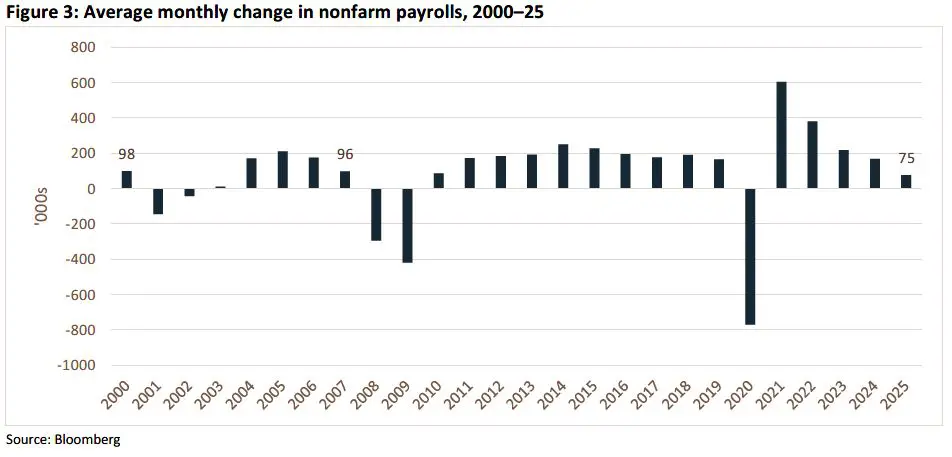

To some extent, Miran’s call for more aggressive cuts may be right. Even the FOMC’s post-meeting statement noted that “job gains have slowed, and the unemployment rate has edged up.” Post-pandemic, the labor market has added jobs every year, but at a progressively slower pace. In 2025, monthly job gains are averaging around 75,000. (In the final years before the dotcom bust and the Global Financial Crisis, monthly employment gains were approximately 98,000 and 96,000, respectively.) Unless Miran—who is on a leave of absence from his position as chair of the White House’s Council of Economic Advisors—has his seat on the FOMC extended beyond January, his chance to influence Fed policy will be limited.

Past Talking Points have noted how Fed policy decisions have given increasing weight to forecasted economic fundamentals, instead of historical data. Over the last two weeks, we have also illustrated the gradual weakening of the labor market; if history rhymes, we could see additional struggles in this market in the near future.

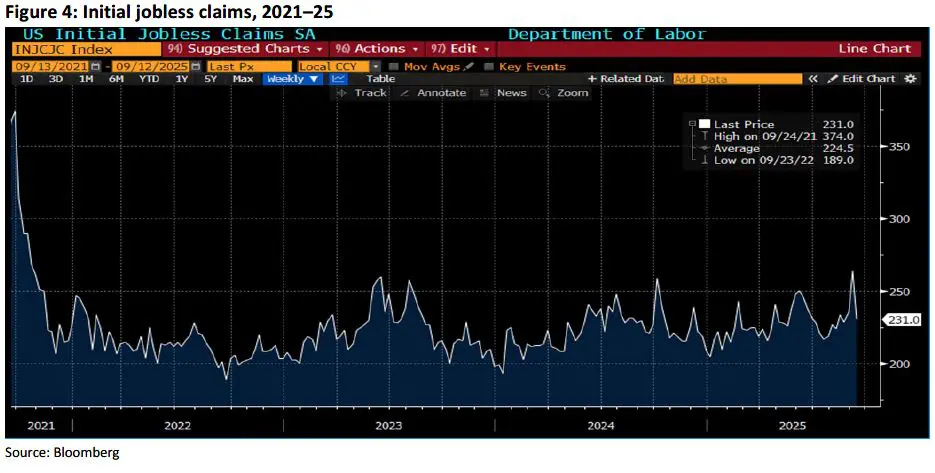

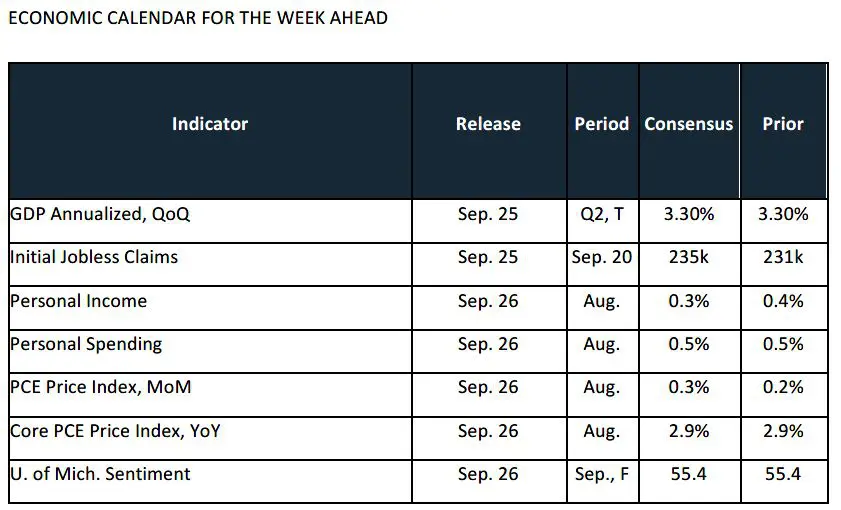

While the macro view of the labor market is one of deterioration, crosscurrents nevertheless provide some cover for monetary hawks in the near term (think next meeting). Jobless claims (Figure 4) improved last week—231,000 from the previous 264,000 (which matched the previous recent high of 2021). Unemployment, too, remains in somewhat healthy territory.

The confusion on inflationary pressures combined with uncertain labor markets is not just a domestic phenomenon at the moment though. President Trump spent much of last week visiting leaders in the U.K., which also had a policy-rate meeting. The Bank of England (BoE), however, held interest rates at 4% and left the prospect of more cuts later this year in doubt after BoE policymakers voiced concerns over a resurgence in U.K. inflation.

The BoE’s Monetary Policy Committee voted seven to two in favor of keeping rates unchanged; longstanding doves Swati Dhingra and Alan Taylor backed a quarter-point cut. The Committee also kept its guidance warning that future cuts will be “gradual and careful” and “depend on the extent to which underlying disinflationary pressures continue to ease.” Upside risks to “medium-term inflationary pressures remained prominent in the Committee’s assessment.” As a result, traders do not expect more easing from the BoE this year and are only fully pricing in one more quarter-point reduction by the end of 2026.

We now find ourselves in yet another period of wait and see. The White House will likely keep pressure on Fed officials for further cuts. And slightly elevated inflationary pressures and labor market crosscurrents will complicate the picture. As a result, we suspect that we will hear a lot of differing opinions from Fed officials in the coming weeks.

As Deryck Whibley from Canadian band Sum41 sang, “You can’t change the state of the nation, we just need some motivation.” When it comes to clues on the direction of future monetary policy, we’re still waiting to observe what the new economic data says, and how it will motivate policymakers.

FROM THE DESK

Agency CMBS — Optimism continues in our market. Another large 232 block traded last week and again, it matched multifamily levels. The dispersion of bids in project loan auctions has tightened up as additional investors are getting slightly more aggressive to acquire new origination. DUS is also well received, with large size, full term interest only (IO) and lower coupon (buydown) trading very well.

Municipals — AAA tax-exempt yields were relatively flat throughout the yield curve, week over week. With the FOMC meeting, last week was relatively quiet from an issuance standpoint. However, a number of cash-collateralized and M-TEB deals did price. While spreads have held relatively steady the past month, spreads on both structures widened toward the end of the week. Municipal bond funds saw a fifth straight week of inflows, with $1 billion entering (YTD inflows of $17 billion), while high-yield funds saw inflows of $425 million. On the short-term side, the market saw $1.35 billion of outflows to tax-exempt, municipal money-market funds.

The information contained herein, including any expression of opinion, has been obtained from, or is based upon, resources believed to be reliable, but is not guaranteed as to accuracy or completeness. This is not intended to be an offer to buy or sell or a solicitation of an offer to buy or sell securities, if any referred to herein. Lument Securities, LLC may from time to time have a position in one or more of any securities mentioned herein. Lument Securities, LLC or one of its affiliates may from time to time perform investment banking or other business for any company mentioned.