Let’s give ‘em something to talk about — Last week was light on meaningful economic data, but heavy on Fedspeak: 22 speeches gave insight into how members of the Federal Open Market Committee (FOMC) sized up the first rate cut in President Trump’s second term, along with the material change to the Fed’s dot plot.

We received further confirmation that there is a sharp division among policymakers at the Federal Reserve regarding the status of the U.S. economy and the appropriate monetary response. Ultimately, consensus estimates seem to lead toward a measured approach—i.e., moves of 25 basis points (bps) per meeting, spread out over time—despite some creeping and persistent political pressure. Below, we summarize the viewpoints of various members of the FOMC.

First, however, we would be remiss to publish this week’s Talking Points while ignoring the looming government shutdown. Congress has until October 1 to reach a spending deal, amid an uptick in posturing by politicians. The most recent escalation in rhetoric arrived in the form of a memo from the White House Office of Management and Budget, which directed federal agencies to plan to permanently lay off workers in programs that do not align with Trump’s priorities if the deadline to pass funding lapses.

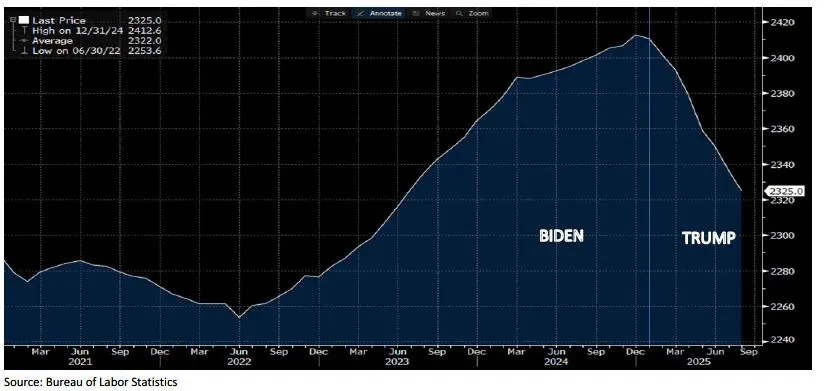

Trimming the government’s workforce has certainly been part of the president’s agenda (Figure 1): He has fired nearly 4% of U.S. government employees since he took office in January. Currently, some 2.3 million civilians are on the government payroll, down from a peak of about 2.4 million before Trump took office.

Nevertheless, we will likely hear more saber rattling over the next few days. And, as in the past, we will also likely end up with some type of spending accord before the deadline strikes.

Now, let’s return to analyzing the outlook of various FOMC members, as articulated in their respective speeches last week.

Stephen Miran, Fed Governor (very dovish)

In his first policy speech since being sworn in as a governor, Miran laid out a case for why the theoretical neutral rate of interest—where the policy rate neither stimulates, nor weighs down, the economy—has fallen and, therefore, requires a lower policy rate to maintain this equilibrium. (If the policy rate is well above the theoretical neutral rate, the economy will slow needlessly.)

That theoretical rate, which was likely overestimated in the past, has also been lowered recently by tariffs, immigration restrictions, and tax policy, Miran argued. “That means interest rates should be much lower to prevent damaging the economy,” he said. He clarified that he wants to cut rates by another 1.25 percentage points at the two remaining FOMC meetings this year. By contrast, the median projection of the FOMC’s 19 officials (of which 12 have voting rights at any given time) has 50 bps of cuts by year end.

“My view is that we can get there in a very short series of 50 basis-point cuts, readjust monetary policy, and then move more gingerly once we’re there,” Miran added. “I don’t think the economy is about to crater. I don’t think the labor market is about to fall off a cliff.” But given the risks, “I [Miran] would rather act proactively and lower rates as a result ahead of time, rather than wait for some giant catastrophe to occur.”

Alberto Musalem, President of the St. Louis Fed (moderately hawkish)

Musalem said that he supported last week’s interest-rate reduction as a way to take out insurance against a weakening labor market. But Musalem also sees limited room for more cuts amid elevated inflation. “I supported the 25-basis-point reduction in the FOMC’s policy rate last week as a precautionary move intended to support the labor market at full employment and against further weakening,” he said.

“However, I believe there is limited room for easing further without policy becoming overly accommodative. … Should further signs of labor market weakness emerge, I would support additional reductions in the policy rate, provided the risk of above-target inflation persistence has not increased and longer-term inflation expectations remain anchored,” added Musalem. Musalem also believes that interest rates are now “between modestly restrictive and neutral.”

Raphael Bostic, President of the Atlanta Fed (hawkish)

Bostic said that inflation concerns would make him hesitant to support cutting rates again in October, even though risks have shifted in recent months toward rising employment. “I am concerned about the inflation that has been too high for a long time,” Bostic said. “And so I today would not be moving or in favor of it [cuts in October], but we’ll see what happens.”

Austan Goolsbee, President of the Chicago Fed (moderately hawkish)

Goolsbee said the Fed should be cautious about additional interest-rate reductions, given that inflation is above its target and on an upward trajectory. “Eventually, at a gradual pace, rates can come down a fair amount if we can get this stagflationary dust out of the air,” Goolsbee said. “But with inflation having been over the target for four-and-a-half years in a row, and rising, I think we need to be a little careful with getting overly, up-front aggressive.”

Michelle Bowman, Fed Vice Chair for Supervision (very dovish)

Bowman said that policymakers are in danger of falling behind the curve and need to act decisively to bring down interest rates as the labor market weakens. “Now that we have seen many months of deteriorating labor market conditions, it is time for the committee to act decisively and proactively to address decreasing labor market dynamism and emerging signs of fragility,” Bowman said. “In my view, the recent data, including the estimated payroll employment benchmark revisions, show that we are at serious risk of already being behind the curve in addressing deteriorating labor market conditions. …Should these conditions continue, I am concerned that we will need to adjust policy at a faster pace and to a larger degree going forward.”

Bowman also argued that policymakers ought to lean more on their forecasts—and less on recent data—to manage interest rates. “A strict interpretation of data dependence is inherently backward looking and would guarantee that we remain behind the curve, requiring us to overcorrect in the future, she said. “I think we should consider reframing our focus from overweighing the latest data to a proactive forward-looking approach and a forecast that reflects how the economy is likely to evolve going forward.”

Regarding inflation, Bowman stated that pricing pressures are “within range” of the Fed’s 2% target, but the labor market is more “fragile” than expected. She added that she has grown more confident that tariffs will have a “small and short-lived” impact on inflation. “The impact of tariffs on rising prices is likely to be a onetime event,” she said. Bowman was appointed to the Fed in 2018 by President Trump and is under consideration to serve as chair of the central bank when the position opens next year.

Jeffrey Schmid, President of the Kansas City Fed (hawkish)

Schmid signaled that the Fed may not need to lower interest rates again soon, citing the need to keep bringing down inflation. “I viewed the 25 basis point cut in the policy rate last week as a reasonable risk-management strategy,” Schmid said. “That said, my view is that inflation remains too high while the labor market, though cooling, still remains largely in balance.”

The current policy stance is only “slightly restrictive, which I think is the right place to be,” he added. “I will continue to take a data-dependent approach to any further adjustments in the policy rate. I will be watching the incoming inflation and labor market data closely, as I continue to assess the balance of risks to the Fed’s dual mandate.”

Jerome Powell, Fed Chair (neutral)

Powell struck a centrist tone in his remarks last week. He said the outlook for both the labor market and inflation faces risks, while reiterating his view that policymakers have a difficult road ahead as they weigh further interest-rate cuts. “Near-term risks to inflation are tilted to the upside and risks to employment to the downside—a challenging situation,” Powell said. “Two-sided risks mean that there is no risk-free path. … There has been a marked slowing in both the supply of and demand for workers—an unusual and challenging development. In this less dynamic and somewhat softer labor market, the downside risks to employment have risen.”

Powell also said that while goods prices are driving a pickup in inflation, tariff increases will likely take time to work through supply chains, resulting in (he hopes) a merely one-time increase in the level of prices that could be spread over several quarters. “Incoming data and surveys suggest that those price increases largely reflect higher tariffs, rather than broader price pressures,” he said.

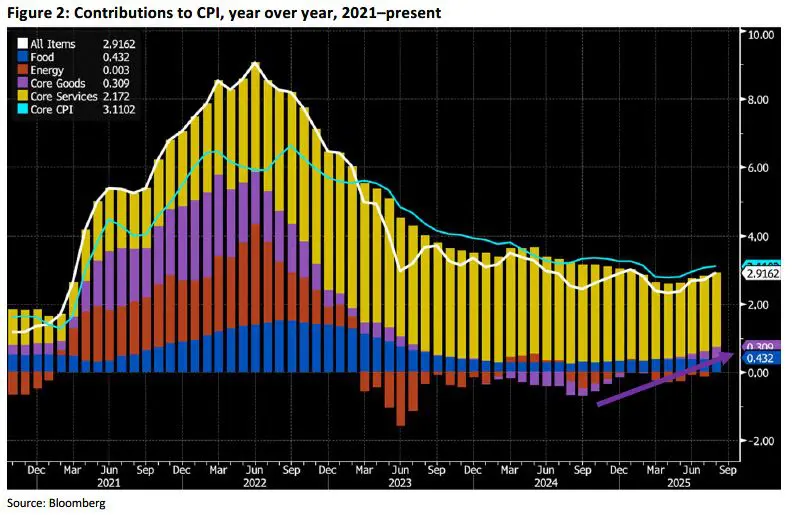

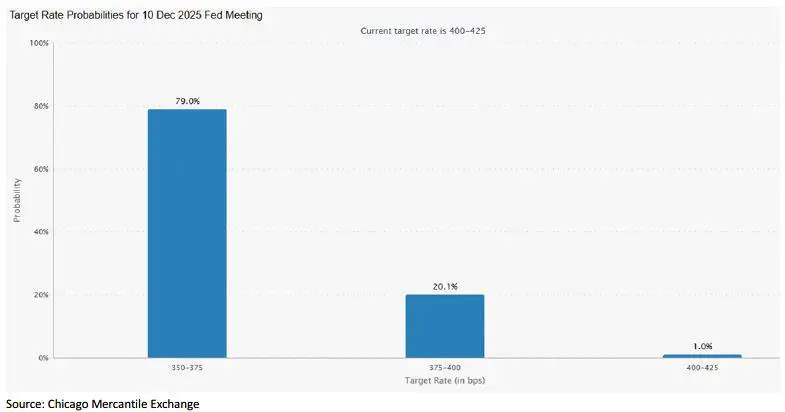

Past Talking Points have also noted that goods inflation has been on an upward trend over the last 12 months (Figure 2) and certainly warrants further monitoring. If this trend continues, it will raise the bar for future rate cuts (Figure 3).

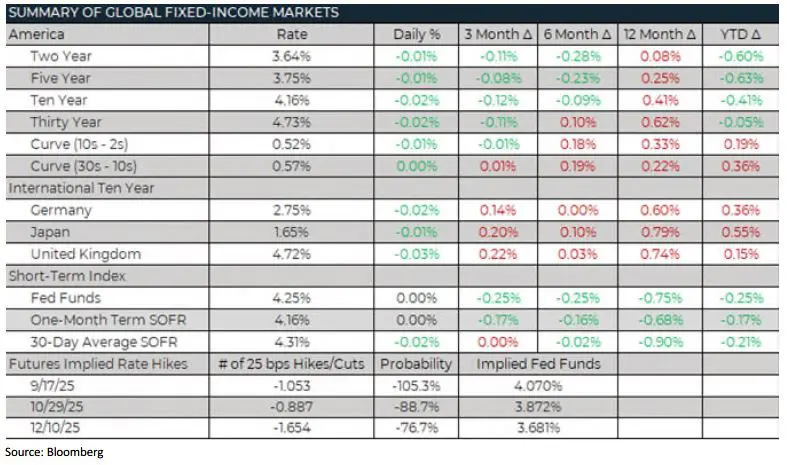

So far, the FOMC’s hawks seem to have the upper hand. The FOMC delivered the well telegraphed 25 bps cut for September—rather than a bigger cut—and has pledged to maintain its “data dependency” for future rate decisions.

History suggests that rate reductions only occur when a strong catalyst warrants it (the dotcom bust, the collapse of Lehman, Covid, etc.). Yet so far, the strings of the economy remain intact. That the Fed is decreasing rates slowly is perhaps a nod to the rare occasion when a soft landing was achieved—in 1994–95, when Alan Greenspan was Fed Chair and inflation was tamed without causing a recession.

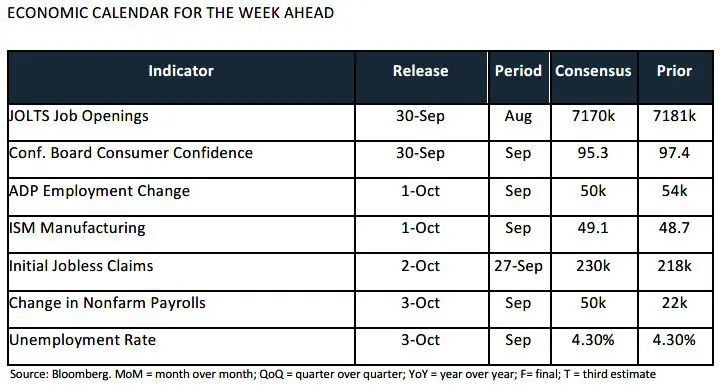

Meanwhile, last week’s data showed that weekly initial filings for unemployment insurance fell to the lowest level since July, while GDP accelerated to its fastest pace in nearly two years. These developments did not help the doves’ argument. But they may have a point. Here, once again, the music business can offer wisdom. Bonnie Raitt’s feel-good hit, “Something to Talk About” not only acknowledges the chance that a soft landing is achievable, but also notes that there will be plenty to talk about (and listen to) from an economic/monetary perspective as the economy continues to further develop.

FROM THE DESK

Agency CMBS — There were no major developments in our market last week. The macro story remains intact, driven by strong demand and continued optimism.

Municipals — AAA tax-exempt yields were higher throughout the yield curve, week-over-week, especially on the short-end of the yield curve where rates increased up to 19 bps in 2026 and 2027. The short end of the yield curve was pressured by elevated primary new issuance as well as expectations around future Fed rate cuts. Investors, while still putting money to work on short term deals like cash collateralized housing bonds, are putting a focus on deals with longer maturities to lock in higher long-term rates while they can. The tax-exempt to taxable ratios on the short end of the yield curve have been rich over the last several months relative to the long end of the yield curve. The two-year ratio was approximately 55% in mid-September while the 10-year and 30-year ratios were 71% and 91%, respectively. Currently, the two-year, 10-year and 30-year ratios are 60%, 70% and 90%, respectively. Municipal bond funds reverted to outflows with $17 million exiting funds (YTD inflows of $16.98 billion), while high yield funds saw inflows of $136 million.

The information contained herein, including any expression of opinion, has been obtained from, or is based upon, resources believed to be reliable, but is not guaranteed as to accuracy or completeness. This is not intended to be an offer to buy or sell or a solicitation of an offer to buy or sell securities, if any referred to herein. Lument Securities, LLC may from time to time have a position in one or more of any securities mentioned herein. Lument Securities, LLC or one of its affiliates may from time to time perform investment banking or other business for any company mentioned.