Last year was marked by a period of continued market and industry volatility, driven in part by the Federal Reserve’s (Fed’s) aggressive rate policy. Notably, the federal funds rate increased by ~525 basis points (bps) between 2022 and 2023. However, the key benchmark 10-year Treasury ended December at 3.88%—over a 100-bps decline in the final weeks of 2023. As 2024 unfolds and a new chapter begins, investors have grown increasingly optimistic that the interest rate environment will further normalize by the second half of the year. As the Fed continues to identify an “appropriate monetary policy,” many in the industry are anticipating at least three rate cuts this calendar year.

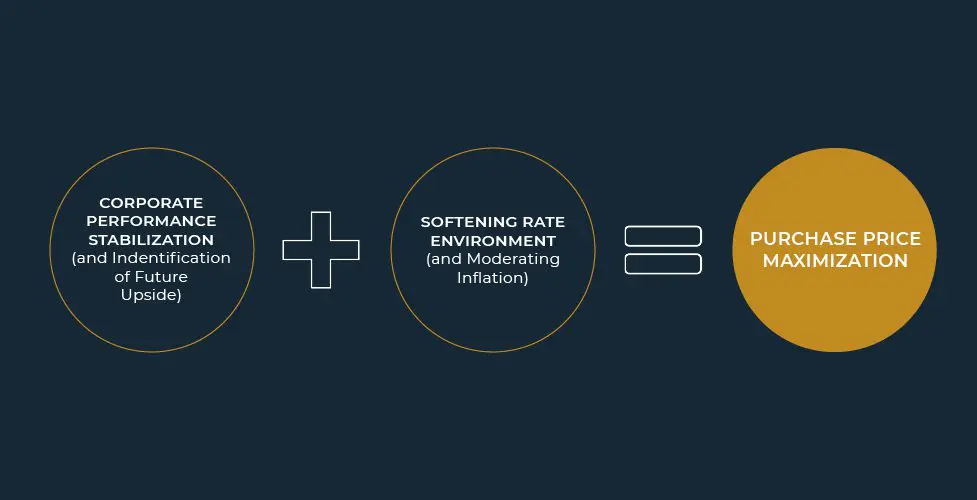

The anticipated softening rate environment, coupled with moderating inflation, is expected to propel acquisition demand, which would create a variety of options for owner-operators interested in divesting. As they seek to lessen business risk and mull strategic alternatives in the new year, playing offense remains critical. Highlighted below are a few key considerations to ensure owner-operators are successfully positioned to optimize transaction goals and objectives.

Have Operations Been Optimized?

Owners and investors are seeking to optimize portfolios as the industry seeks to accelerate transformative solutions to mitigate industry-wide pressures. Optimization strategies include referral and partnership opportunities that enhance scale and services, expansion opportunities that boost the portfolio’s average size or vintage, and the implementation of artificial intelligence to boost operational efficiencies. As exit strategies are contemplated, companies and their owners need to identify key areas of future upside that drive a competitive advantage in the marketplace.

Goal #1 – Craft a strategic plan for the business, recognizing key strengths and challenges. Potential considerations include:

- Does the company have any expansion opportunities that can be pursued to optimize scale?

- Can the company tap into new referral or joint venture (JV) opportunities with regional market healthcare providers?

- Can the company expand service offerings to create a full continuum of care, or should the company divest of any service lines (i.e., divest skilled nursing facilities and retain seniors housing operations?)

- Does the company currently provide any ancillary business services?

When is Stabilization Expected to Occur?

As investors employ an increasingly more disciplined underwriting approach, an in-depth micro- and macro-assessment of the company’s operations will be critical to any transaction process. A granular financial and operational assessment—including identification of target performance benchmarks and a market comparison—further informs the transaction process. Although stabilization does not need to be fully substantiated, investors will not provide a dollar-for-dollar credit for stabilization. However, given the dynamic capital markets, investors are employing creative transaction structures that can provide incremental returns and bridge valuation gaps between parties.

Goal #2 – Craft a detailed, monthly company budget—on both a portfolio and facility-level basis. Key considerations include:

- Does the company anticipate any significant increase in move-ins or turnovers during 2024? If so, what is the expected impact on occupancy and revenue?

- Is the company anticipating any reimbursement rate, or rental rate increases during the year? If so, what is the expected impact on revenue and cash flow?

- Does the company anticipate significant labor pressures to continue in 2024?

- Does the company anticipate significant inflationary pressures to continue in 2024?

Identification of Optimal Transaction Timeline

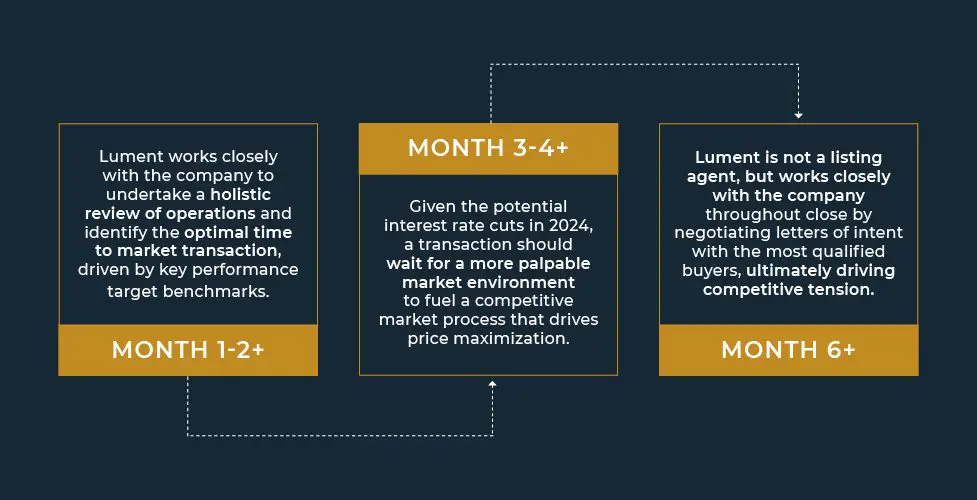

Given that investors are scrutinizing corporate cash flow on a facility-level basis, companies and owners need to closely examine performance to target an optimal transaction timeline. To maximize transaction success amidst turbulent markets, any transaction process is commenced once run-rate momentum approaches stabilization. However, in addition to corporate performance, any transaction process should also consider the forward impact of a softening rate environment. To ensure sellers are positioned strongly in the market, careful consideration as to timing of stabilization—both of the capital markets and the entity-level operations—is required. Working with a firm like Lument can ensure clients are strongly positioned in the marketplace, with access to credible and qualified buyers.

Illustrative Timeline to Optimize Transaction:

Dynamic capital markets require creative transaction structures and careful, thoughtful planning. Sellers mulling strategic alternatives in 2024 need to hire an experienced partner with investment banking services that can drive competitive tension and maximize purchase price. The anticipated softening rate environment, coupled with moderating inflation, is expected to propel M&A activity in 2024. Launching a transaction process, even in an exploratory capacity, early in the year will position sellers to maximize benefits once the anticipated rate cuts occur.

The Lument M&A team has the depth of expertise to effectively and seamlessly help clients accomplish goals and objectives despite turbulent capital markets. With over 110 years of combined experience, Lument’s full suite of services provides unmatched market coverage. Combined with our expertise in underwriting and advisory services, Lument provides clients the benefits of working with a one-stop shop. As such, Lument takes a holistic approach to any transaction process (See “Strategies to Maximize Transaction Success Amidst Turbulent Capital Markets” for additional considerations). The analysis is informed by ongoing conversations with tenured investors and is further supported by an active pipeline of transactions in market. Supported by deep sector expertise—over $13 billion in closed transactions with over $1 billion closed during the pandemic—Lument has demonstrated it can effectively guide owner-operators as they formulate strategic alternatives. As you consider your goals in 2024, we welcome you to give us a call so we can provide you with a customized and confidential analysis to inform your decision.