Although volatility of the political variety continues into 2026, market volatility has largely subsided, and seniors housing providers are planning for the future with a mix of optimism and strategic recalibration, according to the results of the 2026 Senior Living Outlook Report, the latest installment of Lument and Senior Housing News’ annual collaboration.

A few key takeaways—staffing remains the biggest concern and challenge, assisted living represents the top growth target, and occupancy recovery, valuations, and construction starts are all poised for progress. Below, we look at more highlights from the report to glean insights into what C-suite executives, owners, and directors are envisioning for the year ahead and how their strategies are formulated accordingly.

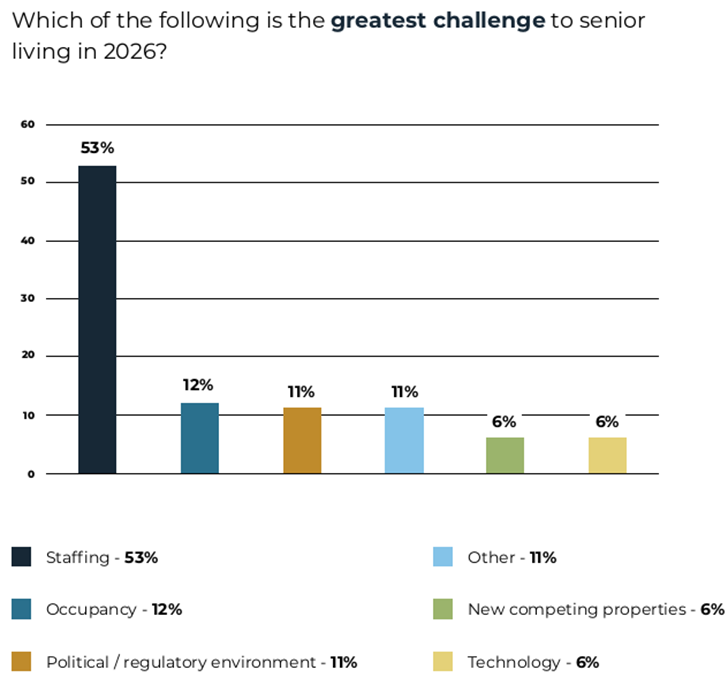

Staffing Still Tops the List

Over half of respondents said staffing is their greatest challenge for the year ahead, strongly outpacing occupancy, regulations, and new competition (Figure 1).

Likewise, staffing was the top response for which area will most impact 2026 budgets at 73%, followed by sales and marketing at only 10% and insurance at 7%. As for when respondents predict staffing pressures may subside, a date that unfortunately keeps getting pushed further into the future, only 37% think things will improve in 2026 while 63% said 2027 or beyond.

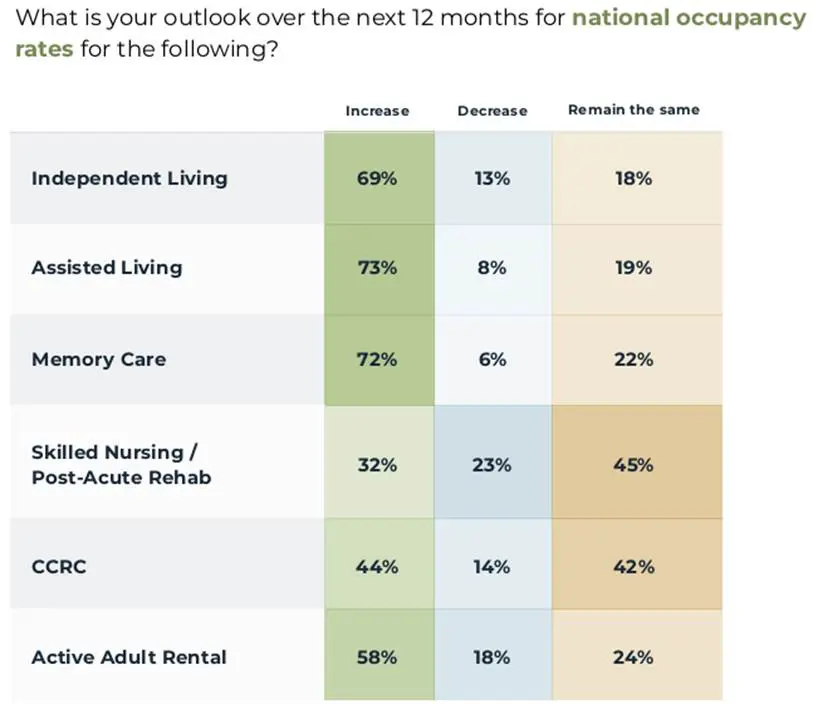

Occupancy Optimism

As the first waves of the silver tsunami reach shore, occupancy levels look strong for the foreseeable future thanks to the favorable demographics. Respondents favored assisted living (73%) and memory care (72%) as the segments that will experience the largest occupancy increase over the next 12 months (Figure 2). Active adult was third at 58%, as the relatively new offering continues to stake its claim in the sector.

Survey respondents see occupancy returning to pre-COVID levels nationally by the end of 2026, with 41% believing it will take until 2027 or later.

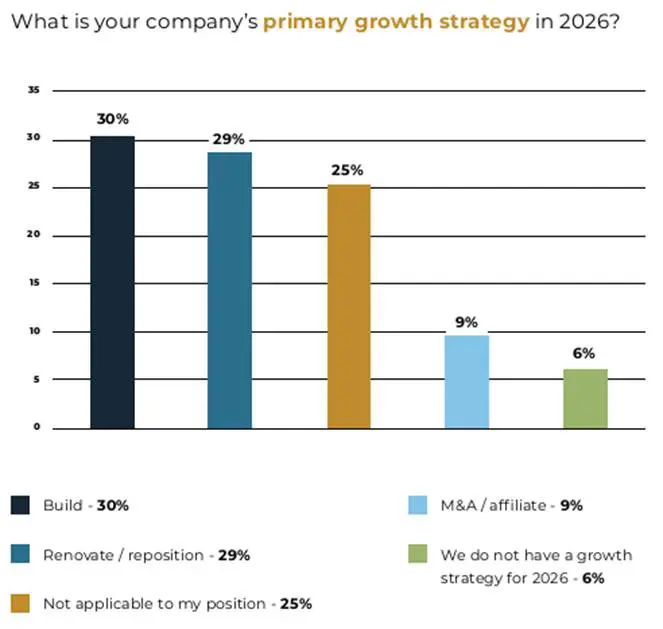

Bullish on Building?

Concerns of undersupply continue to plague the industry, but are we perhaps turning a corner to a more active construction landscape? A clear majority (58%) of respondents think new construction starts will increase in 2026, and 40% of qualified respondents indicated their primary growth strategy is to build (Figure 3).

Other highlights of this year’s survey include the finding that 60% of respondents think valuations will rise in the coming year and the prediction that private equity will be the biggest buyer of seniors housing assets.

To read the complete survey results, download the report at Senior Housing News.