The Federal Housing Finance Agency (FHFA) has announced the 2026 multifamily loan purchase cap structure for both Fannie Mae and Freddie Mac (the GSEs).

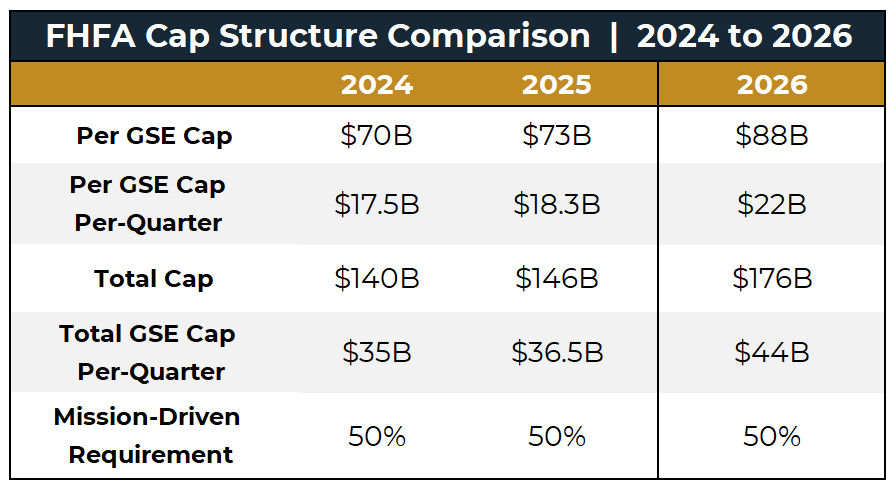

- The loan purchase caps have been set to $88 billion for each GSE, for a combined total of $176 billion.

- The 2026 levels represent a 20.5% increase compared to 2025, when the caps were $73 billion each.

- FHFA continues to require that at least 50% of GSE multifamily business be for mission-driven, affordable housing.

- Loans that finance workforce housing will be excluded from the 2026 limits (the same as in 2025).

- All other mission-driven loans remain subject to the volume caps.

The FHFA indicated that it will continue to monitor the multifamily mortgage market to ensure sufficient liquidity and support. Caps may be updated as needed; however, if the size of the 2026 market trends smaller than anticipated, the cap structure detailed above will remain in place.

The purpose of the caps is to ensure the GSEs support liquidity in the multifamily market, especially affordable housing and underserved segments, without crowding out private capital.

Lument’s commitment to affordable and workforce housing is aligned in the GSE’s caps for the year ahead. Accordingly, we look forward to leveraging our relationships with Fannie Mae and Freddie Mac, as well as our expertise, on our clients’ behalf.