An ADP stumped me this summer. He asked for a book recommendation for those just starting in the business. What should he be reading as a roadmap for success?

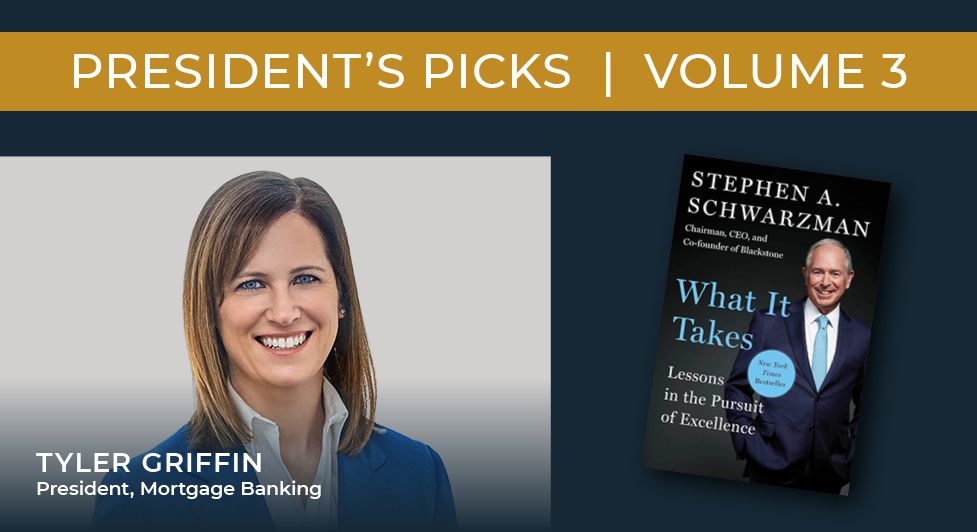

The answer (and I haven’t told him this yet) is something from someone who has succeeded. For our business, there are a few kings and queens of real estate, and many of finance — but combining both and finding someone who’s written about it leads you to Steve Schwarzman, a founder and now CEO of Blackstone, and author of What It Takes: Lessons in the Pursuit of Excellence.

Schwarzman won’t leave you crying into the pillow over personal struggles overcome or lost in plot twists, but he gives honest, practical guidance drawn from a lifetime of experience. Some of his advice is simple — sit up straight for important meetings, or better yet, in all meetings, so you’re never caught off guard — and some only makes sense after you’ve had to make tough calls, like realizing doing the right thing matters more than money.

Schwarzman was never one to sit still, even from a young age. His ambition comes through clearly, matched by a steady pragmatism. Every choice he describes feels deliberate — a way to learn, improve, and move forward. By the time he mentions his sleep habits at the end (I wouldn’t survive), you see how discipline has shaped him from the start. Each setback taught him something useful, and that mindset threads through all the lessons he shares.

He notes that his first year at Lehman toiling away without a mentor or any direction taught him that “prestige didn’t matter nearly as much as the opportunities lost to develop skills.” Schwarzman’s early lessons about effort, discipline, and focus are what shaped the firm he would go on to build. I can relate to this, having started in the industry not long before the 2008 global financial crisis. Companies were lean and mean after that. We learned most of what we knew on the job and worked through problems the long way to find solutions — no one was around to give the answers. That experience gave me the confidence to later join an industry start-up and manage through all avenues of the unknown.

Of course, no book on the history of Blackstone would be complete without a discussion of deals. Schwarzman talks about a lot of his big ones, and I would be remiss to omit his tagline of “time wounds all deals.” Blackstone likely wouldn’t have come to be without the urgency to close their first private equity fund when he did, just a week before October 19, 1987, otherwise known as Black Monday.

Schwarzman thoughtfully lists his main points at the back of the book, so there’s no need to give you all of them here. However, one concept he frequently returns to is worth a final note: hire people who are 10 out of 10.

That’s because at the end of the day, this business always comes back to people — the ones we hire, invest in, and grow with; the clients we serve; and the relationships we build inside and outside the organization. We won’t claim to have it all figured out (Schwarzman wouldn’t either), but we’ve built something rare at Lument: a culture full of people who care deeply, push hard, and make each other better.

(TL; DR: Andrew, you should read the Blackstone book.)

President’s Picks is a book review and leadership advice column written by Tyler Griffin, president of mortgage banking at Lument. Email tyler.griffin@lument.com with any suggestions, comments, or questions.