In 2026, the seniors housing and healthcare market is accelerating its growth rate after several years of gradual recovery following the challenges presented during the global pandemic and subsequent market volatility.

For a deeper dive, we examined the latest market data and found reasons for optimism (i.e., continued occupancy and net operating income (NOI) gains) as well as potential market disruptions and challenges on the horizon. The result is a data-fueled analysis that can inform an adjusted risk return opportunity approach to investing in the seniors housing and healthcare markets.

Occupancy and NOI Growth

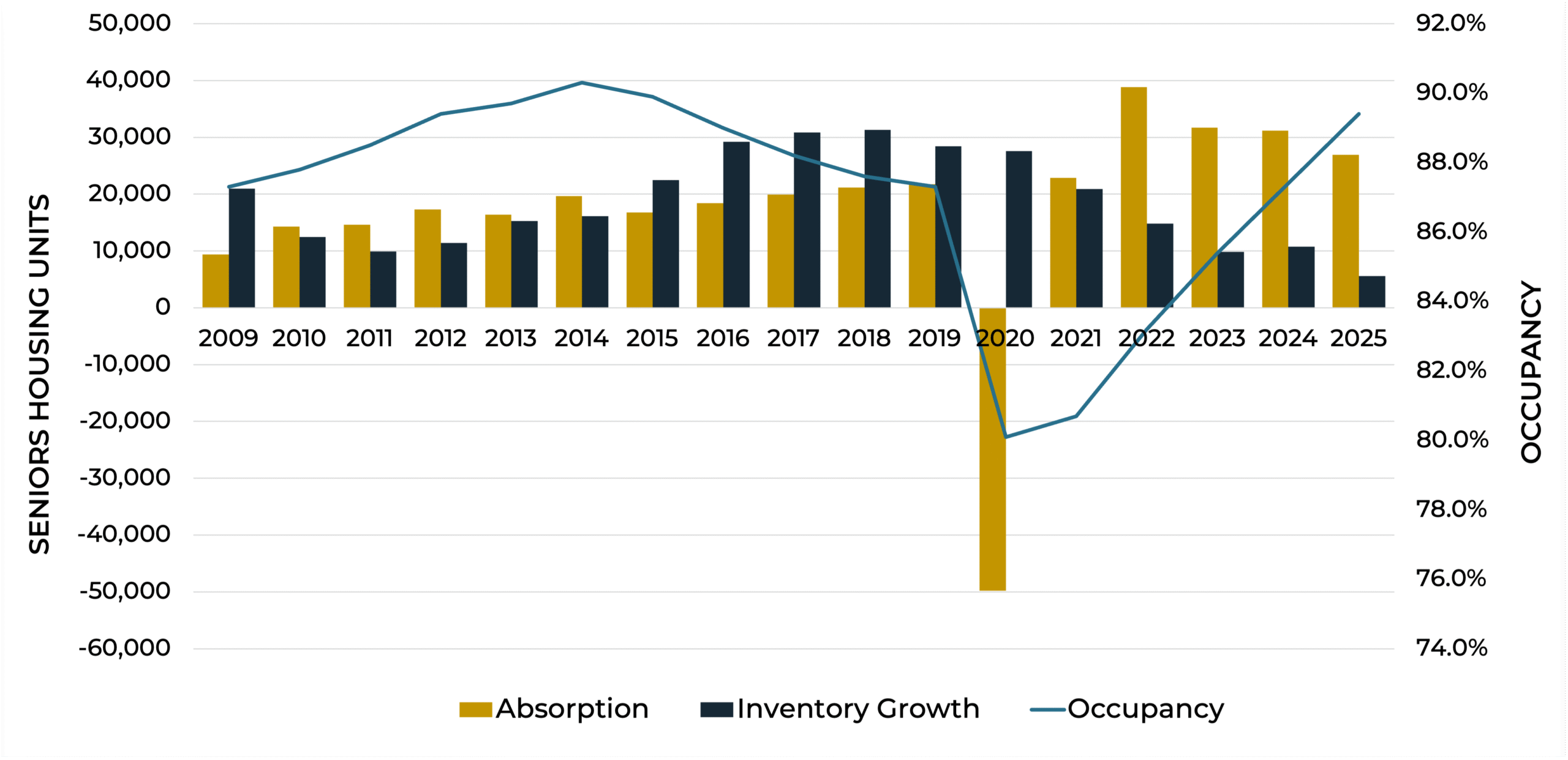

The seniors housing sector occupancy rate continued to climb throughout 2025. According to NIC MAP, the occupancy rate within primary and secondary markets rose from 87.4% at the end of 2024 to 89.4% in Q4 2025 (Figure 1). The occupancy rate is currently at its highest level since 2015 and, given current supply demand fundamentals, should climb through to a new cyclical high in 2026.

The occupancy gains are fueled by a compelling supply demand picture that has emerged in the past few years. Absorption (the change in occupied units) has been averaging over 30,000 units annually during the past four years while the supply of seniors housing units has increased by an average of just over 10,000 units annually. Additionally, the rate of supply growth is slowing within the NIC MAP markets. Seniors housing completion levels have fallen by 73% since 2021. This supply/demand dynamic should bode well for further occupancy gains in 2026.

Publicly listed industry operators also reported gains in 2025. Sonida Senior Living reported its occupancy rate across 55 same-store communities rose from 87.1% in Q3 2024 to 88.0% in Q2 2025. Brookdale Senior Living, the largest seniors housing operator, reported its same community occupancy for December 2025 was 83.3%, which compares to 80.9% observed in December 2024.

Improving seniors housing fundamentals have empowered seniors housing operating portfolios (SHOP) investments, created through the Real Estate Investment Trust (REIT) Investment Diversification and Empowerment (RIDEA) Act. The REITs who operate in the sector have traditionally used SHOP investments when the outlook is for increasing NOI growth. Welltower (the world’s largest publicly listed real estate company by market capitalization), reported Q4 2025 same-store annual NOI growth of 20.4% within its SHOP portfolio. Ventas reported its same-store SHOP portfolio of 518 properties increased NOI by 15.4% from Q4 2024 to Q4 2025. American Healthcare REIT reported its SHOP portfolio NOI increased by 23.5% from Q3 2024 to Q3 2025.

Even traditional (triple net) NNN REITs have made SHOP investments in 2025 and into early 2026. LTC Properties recently announced a $108 million SHOP investment while CareTrust REIT recently acquired three senior living communities for $40 million. Both investments establish initial SHOP portfolios for LTC Properties and CareTrust REIT.

Skilled Nursing Moves Ahead

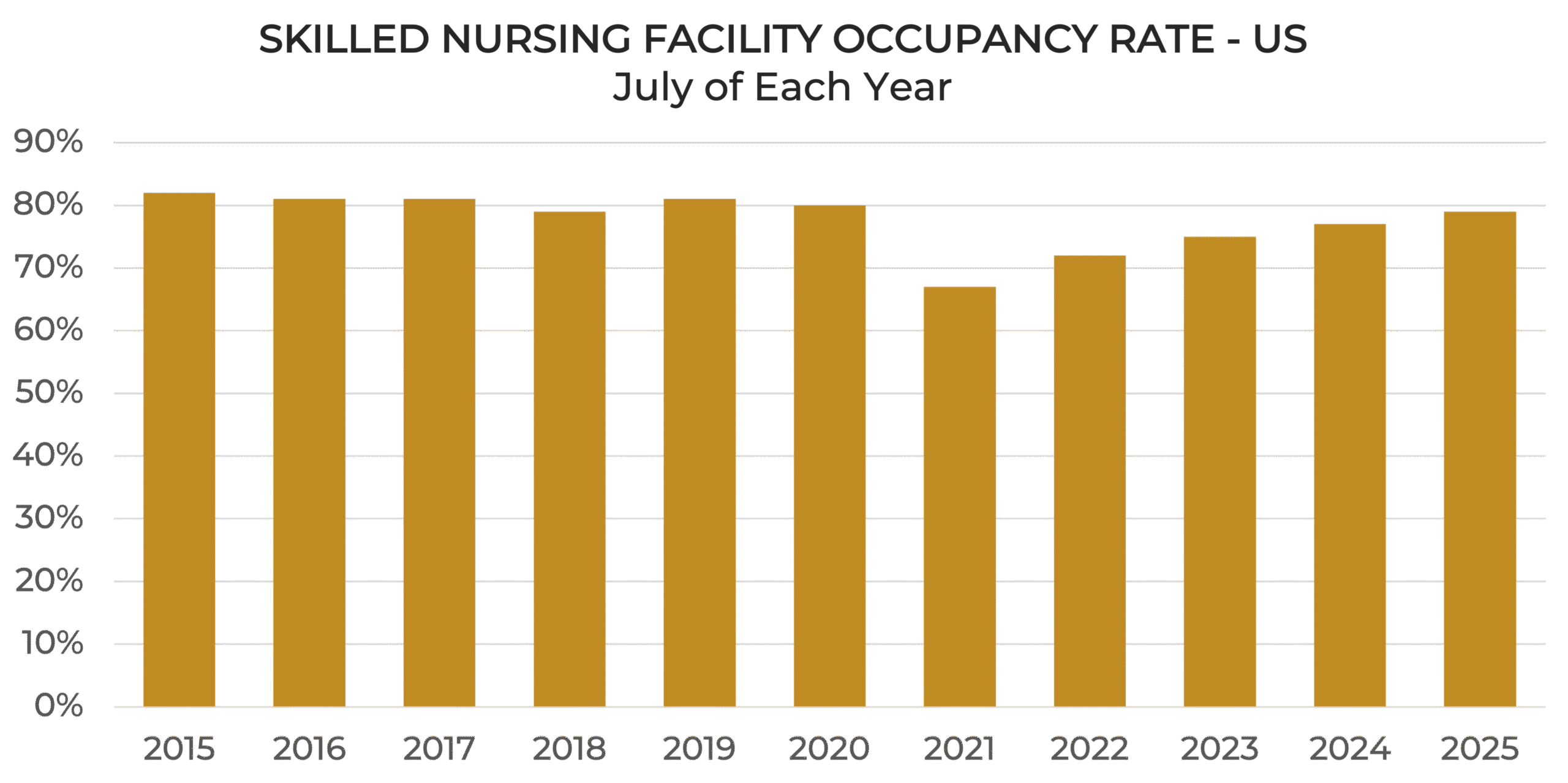

The skilled nursing sector recorded gains in 2025 as well, as the skilled nursing facility (SNF) occupancy rate rose to 79% in July of 2025 from 77% one year ago, according to a Kaiser Foundation analysis (Figure 2) of Centers for Medicare and Medicaid Services (CMS) nursing home compare data. The SNF occupancy rate has trended in a similar fashion to the seniors housing occupancy rate, rising from a low of 67% in 2021 and is now within striking distance of its cyclical high of 82% in 2015.

Publicly listed SNF owners and operators also reported gains in 2025. The Ensign Group reported Q4 2025 same facility skilled services year-over-year (YOY) revenue growth of 7.4% across 210 facilities. The PACS Group also reported significant gains across its 320 post-acute or SNFs across the United States. PACS said its Q3 2025 revenue of $1.34 billion was up 31% from the same period in the previous year. National Healthcare Corporation reported same facility revenue growth of 8.7% in Q3 2025 compared to the same period one year ago.

The reimbursement outlook for the skilled nursing sector in 2026 is steady. CMS issued a final rule which resulted in a 3.2% net increase to SNF prospective payment system (PPS) rates in 2026. Although the increase is lower than the 4.2% net increase in 2025, owners and operators generally viewed the 3.2% increase as positive.

Policy Impact

The One Big Beautiful Bill, signed into law during 2025, promises to reduce taxes on Social Security income and to rain in Medicare and Medicaid spending across the country. The bill targets Medicare cuts of approximately $500 billion over the next 10 years and Medicaid cuts over $900 billion. Further, the bill has other provisions that could reduce Medicaid coverage as well as Medicare benefits.

There is also policy concern that Social Security and Medicare Trust funds will run out of money over the next several years. The Committee for a Responsible Budget (CRFB) estimated that the trust funds will begin running out by 2032. The CRFB also says deficits will exceed $3 trillion by 2036 and warns of eventual higher interest rates and the potential for dislocations caused by rising U.S. debt levels.

Investment Volumes Increase

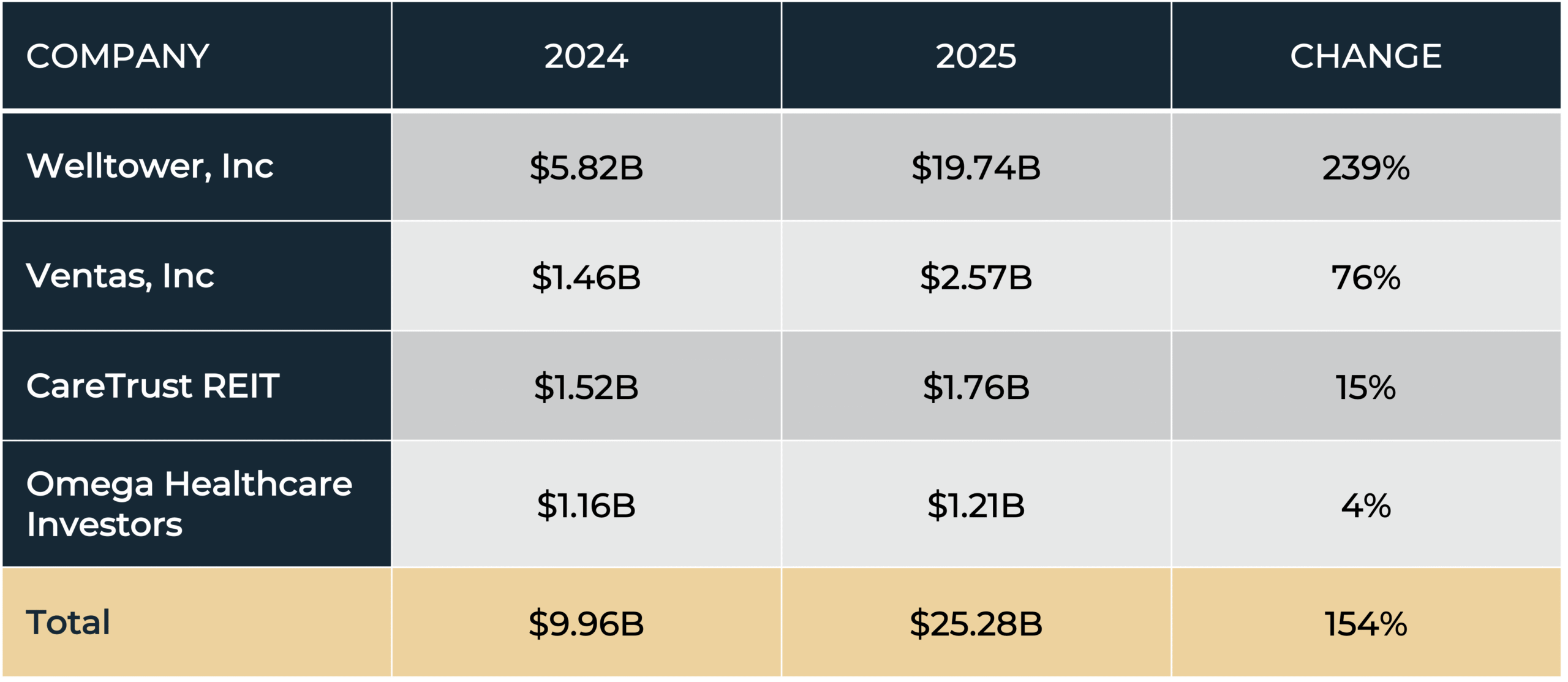

The largest Healthcare REITs reported increasing investment volumes in 2025. Collectively, the group of Welltower, Ventas, CareTrust REIT, and Omega Health Investors reported gross investment activity of $25.28 billion in 2025. That was up significantly from $9.96 billion in 2024. This investment activity reflects gross activity across each REIT including other healthcare property types, acquisitions, mortgage financings, and development funding.

The agency and government lending sources were a mixed bag in 2025. The U.S. Department of Housing and Urban Development (HUD) reported fiscal year loan volume of almost $6 billion through their Section 232 Program. This is up significantly from just over $3 billion generated in fiscal year 2024. Fannie Mae reported its book of business (based on unpaid balance) in seniors housing fell to $11.7 billion in Q4 2025 across 427 loans from $14.6 billion across 513 loans in Q4 2024. Fannie Mae has dealt with credit challenges within its seniors housing portfolio although conditions are improving. Fannie Mae reported its serious delinquency rate for seniors fell from 4.2% in 2024 to 1.8% in 2025.

Overall, the capital markets environment became more stable in 2025. The inverted yield curve, which emerged in 2022 and lasted through 2024, has returned to a more normal yield curve in 2025. The 10-year treasury has stabilized in 2025, albeit at higher levels than were in place prior to 2022. Spreads on commercial real estate loans have also tightened during 2025.

These conditions have set the stage for increasing investment volumes in 2026 and beyond. Those who stay on top of the latest trends and policy developments will surely be well-positioned to reap the benefits of the next cycle.