After a slow start to early 2025, multifamily investment activity reaccelerated meaningfully. By year-end, nearly 1,700 properties were trading quarterly — up from roughly 1,500 in 2024 and 1,400 in 2023. This sales appetite is supported by stabilized interest rates, limited new construction, and favorable demographic demands, as detailed in our Winter 2026 National Multifamily Report.

As investment activity continues to strengthen, the data reveals a clear shift toward higher-quality assets. Specifically, investors are gravitating toward Class A opportunities, where transitional market conditions are creating attractive entry points. One data point reinforcing this shift is the rising average price per unit, which recently reached more than $217,000. That’s a 5.5% jump year over year and the sixth consecutive quarter of growth, a trend that illustrates the preference for newer, high-quality buildings.

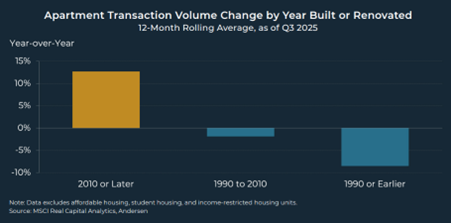

While class definitions can vary, stratifying the investment market by year built or renovated provides a consistent proxy for asset quality and allows for a clearer comparison of investor behavior.

- Among apartment assets that were built or renovated in 2010 or later (a proxy for Class A), the 12-month rolling transaction volume increased by nearly 13% year over year in Q3 2025. Under this framework, Class A buildings accounted for an estimated 56% of total transaction volume in Q3 2025, a 4.6 percentage point increase from a year prior.

- In contrast, sales volume in Class B (built or renovated between 1990 and 2010), and Class C (built or renovated before 1990) declined by 2% and 9%, respectively, during this same period.

So why has investor preference shifted toward higher-quality assets? One driver is the growing pressure on older properties. Increased regulatory exposure (rent control), weaker household economics for lower-income renters, and rising maintenance, repair, and renovation costs are all factors putting pressure on older stock. At the same time, newer assets are benefiting from a few upside mechanisms. In supply-constrained markets, operating fundamentals are accelerating. Markets with massive deliveries in 2024 and 2025 are temporarily experiencing weaker operating conditions while absorption works its way through, presenting an appealing entry price on some properties.

This dynamic is clearly reflected in buyer composition. Private capital investors accounted for the largest share of Class A activity in 2025, with more than 59% of volume (up from 50% in 2024). Institutional investors represented nearly 40% of Class A acquisition volume — a meaningful increase from their five-year annual average of 27%. Together, these trends underscore that smart capital with medium- and long-term investment horizons is increasingly aligning around newer, high-quality assets as the core of today’s multifamily investment strategy.