Summon the heroes

The U.S. government remains shut down, as lawmakers struggle to reach an agreement. But one group in Washington did reach a decision last week (despite some dissention). The Federal Open Market Committee (FOMC) voted to cut the federal funds rate by 25 basis points (bps), as well as end quantitative tightening, starting on December 1.

The 25-bps cut was voted in 10-2, with one dissent coming from Governor Stephen Miran, who favored a 50-bps cut, and one from Governor Jeffrey Schmid, who voted to hold rates steady. In an ever changing political and economic landscape, it is perhaps apropos to cue John Williams’ orchestral composition, “Summon the Heroes”—NBC’s theme song for the 1996 Atlanta Olympics—as we hope today for lasting accord and appropriate monetary policy. Below, we consider monetary policy in Canada and Europe, before returning to the U.S.

The Bank of Canada (BoC) also cut interest rates last week. In doing so, the BoC signaled that monetary policy is now at the right place as long as the central bank’s forecasts materialize. The BoC’s benchmark overnight rate was lowered by 25 bps for a second consecutive meeting, bringing the policy rate to 2.25%, the lowest since July 2022. The central bank also downgraded growth projections for the country. In prepared remarks, Richard Macklem, Governor of the BoC, called the trade conflict with the U.S. a “structural transition” that has “diminished Canada’s economic prospects.” Yet even with a souring economic outlook, BoC officials remained reluctant to add more monetary stimulus for fear of stoking inflationary pressures.

Canadian policymakers also expect pricing pressures to increase supply-chain disruptions inflicted by the trade dispute. “There’s nothing to cheer about here. We’re lowering interest rates because the economy is under immense strain,” Warren Lovely, managing director at National Bank Financial, said on BNN Bloomberg Television. There is “a continued swirl of geopolitical uncertainty and it argues for taking out some interest rate insurance here,” he added. “We’re suffering from a death of a thousand sectoral tariff cuts in our industrial sector. This is an economy that needs support.”

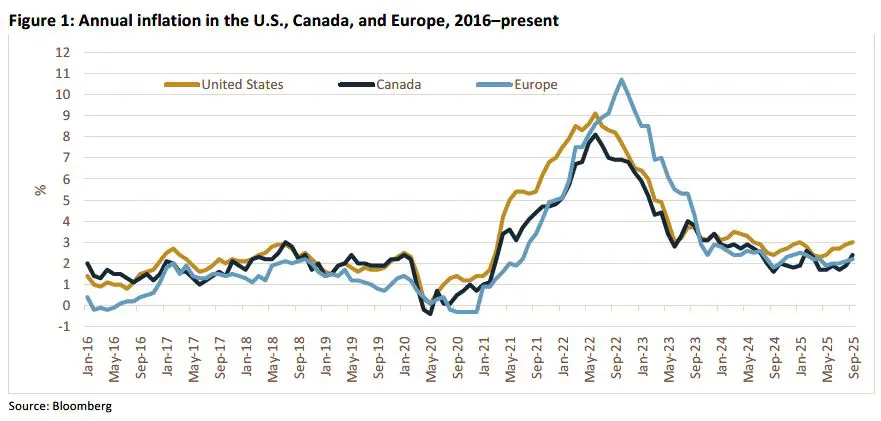

Canadian inflation has been mostly in line with, or less than, inflation in Europe and America (Figure 1). But as a commodity-driven economy, Canada needs to remain especially vigilant about pricing pressures.

The European Central Bank (ECB) left interest rates unchanged for a third consecutive meeting, with inflation in check and the E.U. economy continuing to grow. The deposit rate was kept at 2% on Thursday—as predicted by all analysts in a recent Bloomberg survey.

ECB policymakers continued to offer no guidance on future steps, stressing that they’ll act one meeting at a time, based on incoming data. “The robust labor market, solid private sector balance sheets and the Governing Council’s past interest-rate cuts remain important sources of resilience,” the ECB said in a statement. “However, the outlook is still uncertain, owing particularly to ongoing global trade disputes and geopolitical tensions.”

ECB officials have been vocal of late in signaling that there’s little reason to add to the eight reductions in borrowing costs they’ve already made in 2025. Their confidence stems from inflation that’s been hovering around the 2% goal for months—and indications that the economic damage from Donald Trump’s trade measures has been relatively contained.

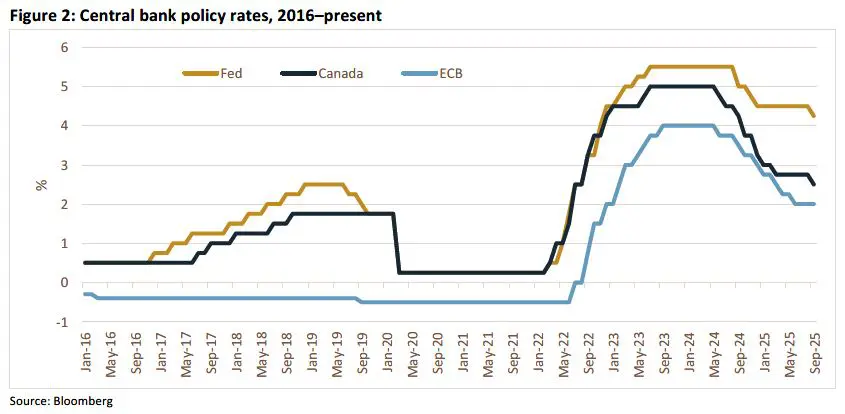

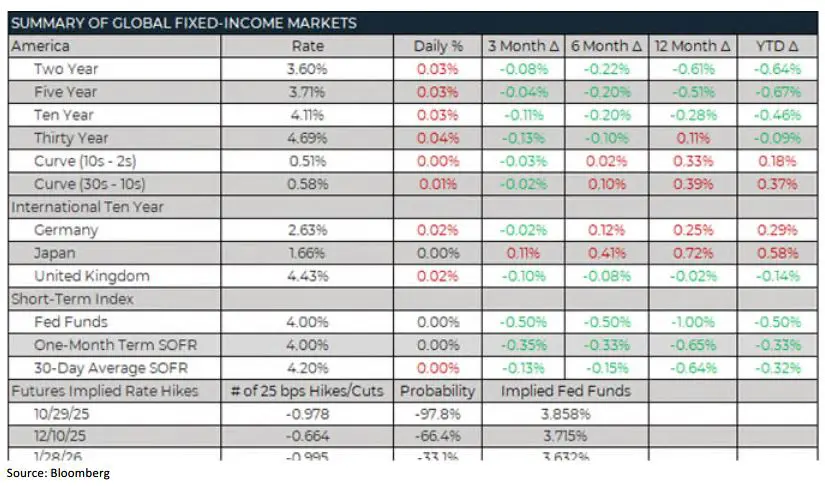

The ECB’s stance contrasts with that of the Federal Reserve, which lowered U.S. rates for a second time in 2025, citing slowing jobs gains (Figure 2). As noted, the FOMC voted 10-2 to lower the target range for the federal funds rate by a quarter percentage point to 3.75%-4.00%. Governor Miran, who joined the central bank last month and is on unpaid leave from his post as chair of the White House Council of Economic Advisers, dissented again in favor of a larger, half-point reduction. Kansas City Fed President Schmid said he preferred not to cut rates at all, after supporting last month’s rate reduction.

Speaking before the press following the cut, Fed Chair Jerome Powell acknowledged the government shutdown. While some economic data has been delayed because of the shutdown, Powell said, “the public and private sector data that have remained available suggest that the outlook for employment and inflation have not changed much since our meeting in September.” This point echoes the theme of last week’s Talking Points, regarding momentum factors for economic indicators.

In his post-meeting address last Wednesday, Powell also warned investors to temper expectations for a December rate cut. “A further reduction in the policy rate at the December meeting is not a foregone conclusion—far from it,” said Powell. He later added that there is “a growing chorus now of feeling like maybe this is where we should at least wait a cycle.”

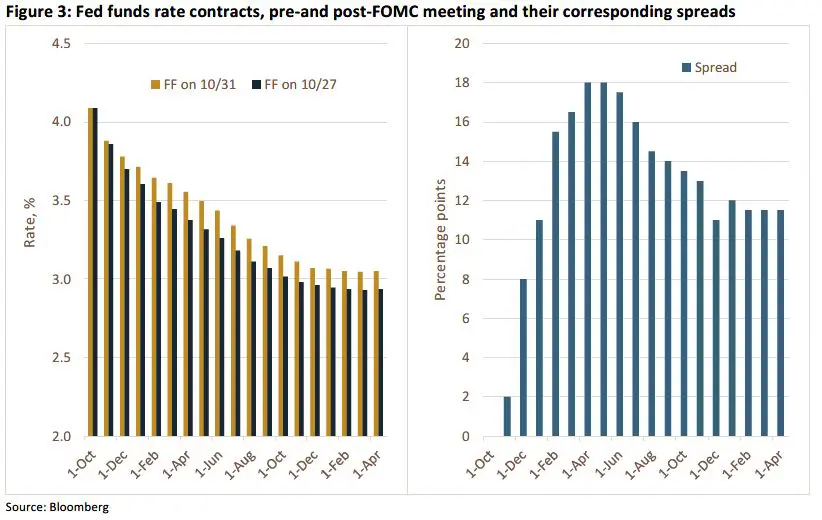

These comments sparked a selloff in Treasuries and caused the investment community to wipe away some anticipated future cuts. Figure 3—which charts implied federal funds rate contracts on October 27 and October 31, as well as the spread between those contracts—shows that the market deleted about half a cut in the first quarter of 2026.

In short, the theme in Washington, Ottawa, and Frankfurt is that global monetary policy is getting closer to neutral after years of high interest rates. Benchmarks are now either shifting from aggressive easing to a potential pause (BoC/ECB), or they’re continuing to ease slowly (Fed). While soft landings have been historically rare, as long as labor markets collectively hold and trade tensions deescalate, the bar to realizing another soft landing is getting lower.

FROM THE DESK

Agency CMBS — Spreads were largely flat in our market week-over-week. The Ginnie Mae market is struggling in REMIC execution, but a lack of supply, not helped by the government shutdown, is keeping a lid on spread widening. DUS loans are still trading well, with large block and full-term interest-only (FTIO) structures maintaining their prime spot for investor preference.

Municipals — AAA tax-exempt yields were higher throughout the yield curve, week over week. After heavy new issuance two weeks ago (topping $18 billion), the municipal bond market saw only about $5 billion come to market last week. When Fed meetings occur, the municipal bond market typically sees a lower than normal new-issuance calendar. We expect the calendar to pick up next week.

Although the market was quiet, the lone short-term, cash-collateralized deal that priced came in at spreads consistent with the prior week. We expected spreads to tighten with the low issuance, paired with the November 1 P&I payments to investors. However, that did not happen. Municipal bond funds had a fifth straight week of inflows, with $720 million entering (YTD inflows of $21.55 billion). High-yield funds received $2 million of those inflows.

The information contained herein, including any expression of opinion, has been obtained from, or is based upon, resources believed to be reliable, but is not guaranteed as to accuracy or completeness. This is not intended to be an offer to buy or sell or a solicitation of an offer to buy or sell securities, if any referred to herein. Lument Securities, LLC may from time to time have a position in one or more of any securities mentioned herein. Lument Securities, LLC or one of its affiliates may from time to time perform investment banking or other business for any company mentioned.