With 2023 and all its challenges behind us, the senior living industry has begun the new year on a decidedly optimistic note, as evident by the results of the 2024 Senior Living Outlook Report, the newest installment of Lument and Senior Housing News’ annual collaboration.

Approximately 165 industry professionals responded to this year’s survey, 86% of whom identified as C-suite leaders, vice presidents, and directors. Eighty-seven percent of all respondents noted they are somewhat or very positive about the months ahead. This optimism has no doubt been fueled by the Federal Reserve’s recent indication that, not only is it likely done raising interest rates, but that it may indeed cut them this year, setting the stage for an increase in deal activity in 2024.

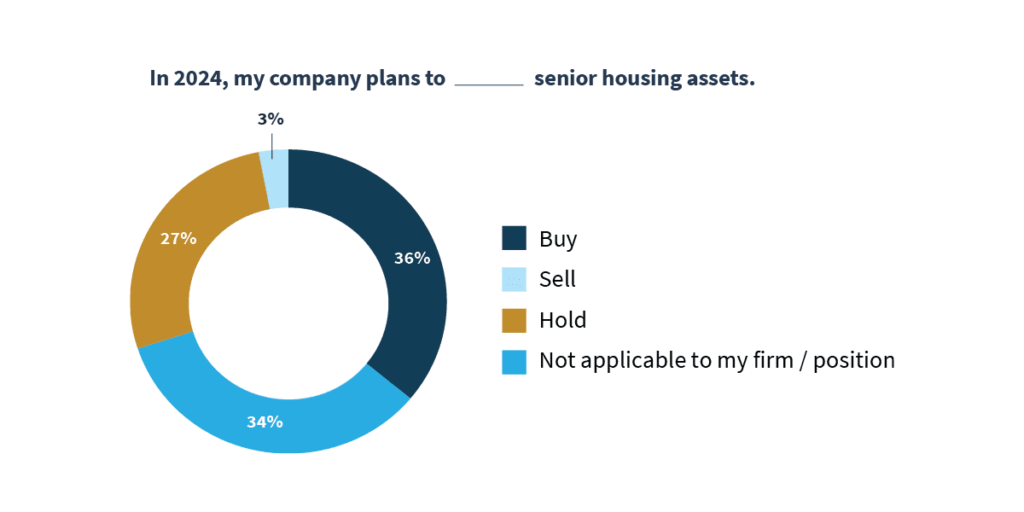

The theme of cautious optimism that permeates this year’s Outlook Report is a familiar one for the senior living industry. Long-term underlying fundamentals remain overwhelmingly positive, and a stable, more favorable market will contribute to a narrowing of the bid-ask spread which should positively impact debt proceeds, cap rates, and valuations. Will that lead to an uptick in deal activity? Our results suggest so, as 55% of applicable respondents said their company plans to buy seniors housing assets in the next year (Figure 1).

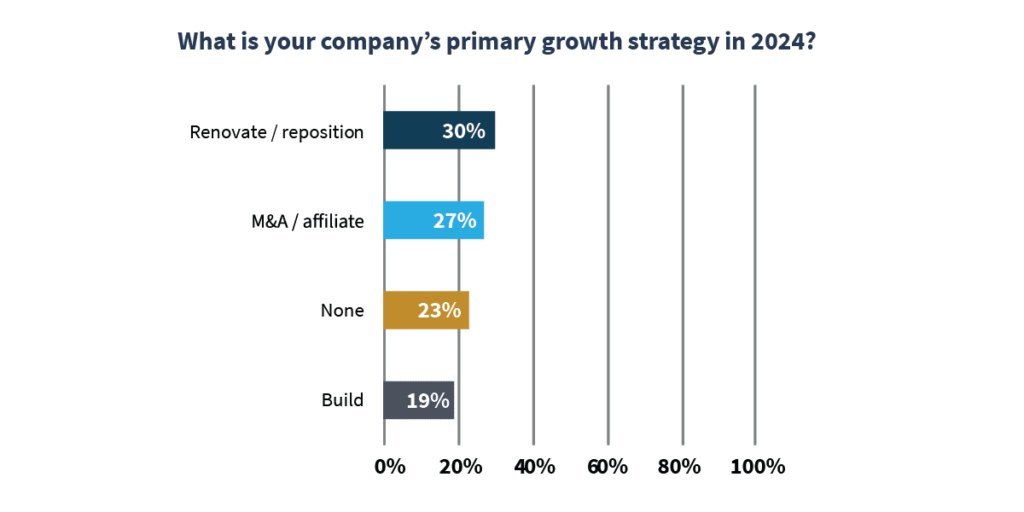

Further, 76% of respondents indicated that their company plans to accelerate growth in the months ahead, with 30% selecting renovate/reposition as the top strategy, 27% selecting M&A/affiliate, and 19% selecting build (Figure 2).

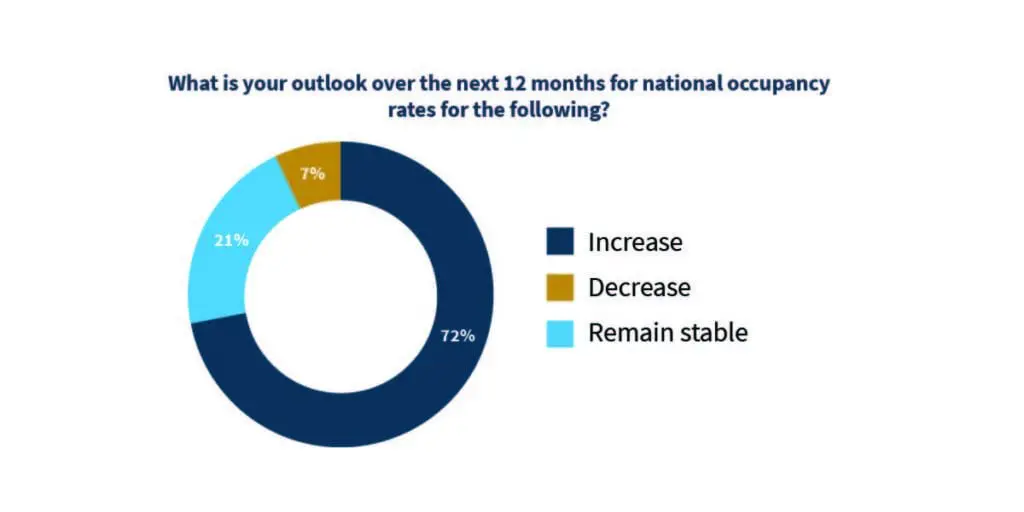

Optimism extends to expectations for operations as well, as most survey respondents anticipate senior living operations margins will be up 1% to 4% relative to 2023. Occupancy levels are also expected to improve, with 72% of respondents predicting occupancy rates will increase in 2024 (Figure 3).

Despite that long-term prognosis for prosperity, the sector still faces substantial challenges in the immediate future, led by staffing woes, which 46% of respondents selected as their greatest challenge. Interest rates ranked as the second greatest challenge for respondents at 23%.

To read the complete survey results, download the report at Senior Housing News.