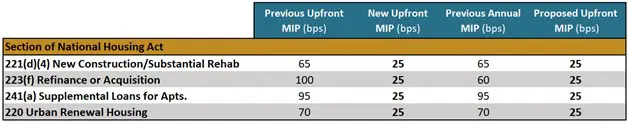

The new 25 basis point MIP rate applies to all FHA multifamily loans closed on or after October 1, 2025.

The U.S. Department of Housing and Urban Development (HUD) has published a notice announcing its new mortgage insurance premium (MIP) rule, which establishes a flat 25 basis point MIP for all Federal Housing Administration (FHA) multifamily loan programs. The reduced MIP of 0.25% applies to all loans closed on or after October 1, 2025.

The revision is expected to streamline the FHA multifamily loan process and reduce borrowing costs for apartment developers and owners. The rule, which was first announced in June of this year, eliminates existing MIP categories, including the Green MIP, in favor of a universal 25 basis point MIP. In addition, the guidance eliminates Green MIP compliance requirements for all existing loans.

Previously, MIPs for FHA-insured multifamily loans varied significantly based on affordability levels and program type. The new flat 25 basis point rate could reduce upfront premiums by as much as 75 basis points for market-rate deals. Although the savings are more modest for affordable housing, the standardization brings clarity and reduces transactional friction.

These adjustments simplify the financing process for market-rate and mixed-income affordable housing, as well as affordable housing that doesn’t meet HUD’s definition of Broadly Affordable — for example, those with limited remaining regulatory term or restricted rents that do not meet HUD thresholds. By eliminating additional green certification costs and requirements, developers now gain direct access to favorable pricing without having to retrofit or recertify to meet green standards.

HUD addressed concerns over the elimination of the Green MIP, noting that when it was introduced in 2016, energy-efficient components were less common and more expensive, making financial incentives a useful catalyst. Today, however, such components are more widely adopted and cost-effective, meaning market forces now support their use without the need for federal incentives. HUD emphasized that a simplified, uniform MIP better advances the broader goal of increasing the supply of rental housing.

“This change eliminates the need for costly and time-consuming reports that were needed for green transactions and reduces borrowing costs at a time when many other costs have been increasing,” said Paul Weissman, senior managing director and head of affordable housing at Lument. “A flat 25 basis point MIP supports the development and preservation of a wide variety of high-quality rental housing with simpler processing, lower costs, and increased proceeds.”

Reach out to Lument’s team of financing experts to learn more.