The Great Divide – Country music star Luke Combs is better known for saying “hold my beer,” instead of relaying opinions on monetary policy. But his 2021 song, “The Great Divide,” seems prescient for today’s economic landscape: Combs posits that “We’re all so far, so far apart now, it’s as deep as it is wide.” He no doubt was foreshadowing the dissention at the Federal Open Market Committee’s (FOMC) December meeting.

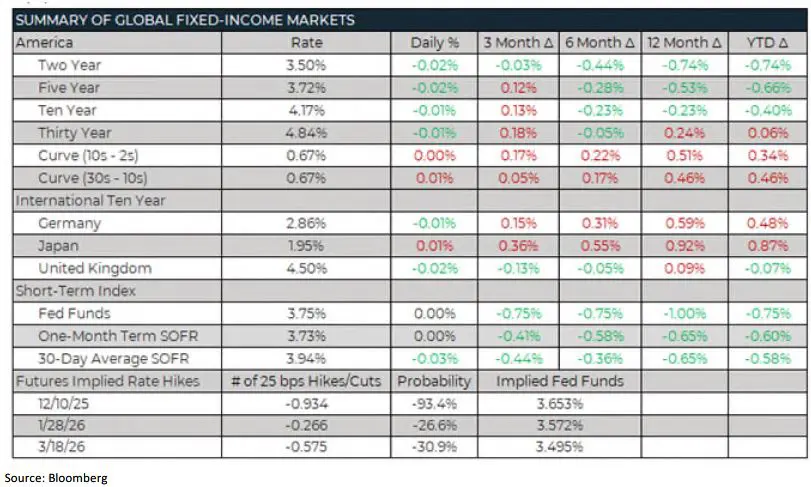

The divide was evident last week, when the Federal Reserve delivered the well telegraphed 25 basis points (bps) rate cut, to a range of 3.50% to 3.75%. Yet with only a nine-to-three tally in favor of the cut, the vote marked the largest number of dissenters since an FOMC meeting in September 2019.

Fed Chair Jerome Powell and company dusted off a familiar playbook when wordsmithing the FOMC’s post-meeting statement, signaling a higher bar for future cuts. For example, the statement tweaked its forward guidance to include the phrase: “The extent and timing of additional adjustments to the target range for the federal funds rate.” Recall that the same language was used in the December 2024 FOMC statement, when “extent and timing” was subsequently followed by a nine-month pause in cuts.

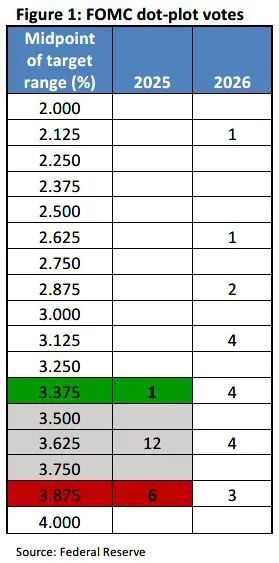

As noted, the hawk-dove divide on the Committee was far more pronounced than usual, with three dissents against the rate decision: Austan Goolsbee of the Chicago Fed and Jeffrey Schmid of the Kansas City Fed voted to keep rates unchanged; Governor Stephen Miran voted in favor of a half-point reduction. There were also seven “soft” dissents, as policymakers signaled their disagreement with December’s rate decision via their respective 2025 year-end “dots” on the Fed’s dot plot (Figure 1). Finally, the FOMC’s new median projection now has one cut in 2026 and one in 2027.

Powell—who started his post-meeting press conference by acknowledging both public and private data sources—noted that the two pillars of the Fed’s mandate are currently in tension. “It’s a complicated, unusual, and difficult situation … where job creation may actually be negative.”

Powell pointed to the 75 bps cuts over the past few months, as well as the aggregate 175 bps cuts since the beginning of the current easing cycle, as evidence that policymakers have addressed concerns about labor market weakness and, as a result, are in better position to wait and react to the latest data. He also argued that the recent cuts were sufficient to achieve the appropriate amount of “insurance” against economic weakness, recycling language used in past statements. (This was a nod to the long, variable lags with which monetary policy works through the economy.)

Regarding the government data, Powell acknowledged that survey data for October and half of November, along with the Consumer Price Index (CPI) numbers, will likely be distorted and not very useful. But by the FOMC’s January 2026 meeting, however, he expects the data to be cleaner and more useful.

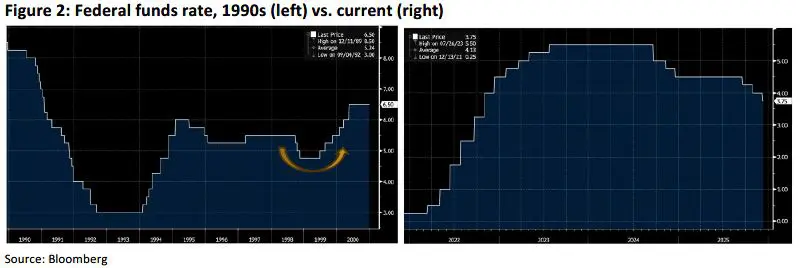

During the press conference, reporters asked Powell whether the current environment might soon mirror the experience of the 1990s, when Fed cuts were quickly followed by hikes (Figure 2). Powell dismissed the comparison, responding that his expectation is that the Fed will choose between 1) a pause in cuts, with an eye for a future cut, or 2) a cut in the near term. This was the sole dovish piece of news from the day.

The reason for Powell’s consternation with the job market was on full display too, which once again showed signs of both strength and weakness. Job openings rose slightly in October, according to the JOLTS report, with 7.67 million vacancies up for grabs. The growth was driven by a handful of industries like retail and wholesale trade industries, as well as health care.

Meanwhile, the number of layoffs in October rose to 1.85 million, the highest since early 2023. Dismissals picked up in leisure and hospitality, as well as manufacturing. Hiring declined by 218,000 from the month prior, to 5.15 million. The quits rate, which measures the percentage of people voluntarily leaving their jobs each month, fell to the lowest level since May 2020; this suggests that people are less confident in their ability to find a new position.

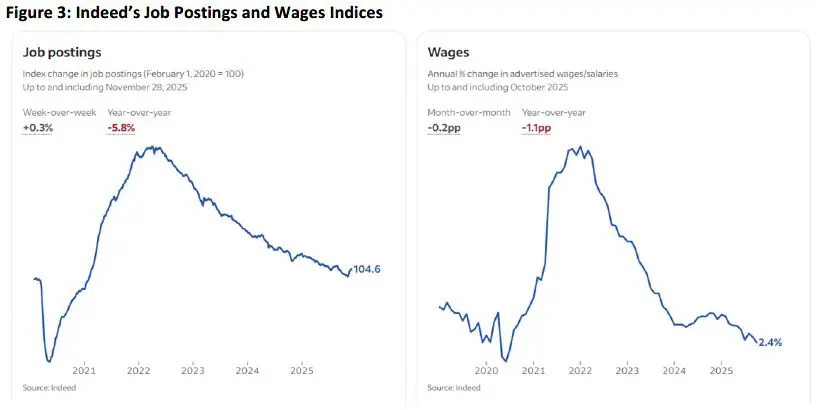

At the same time, the JOLTS report noted: “BLS temporarily suspended use of the monthly alignment methodology for October 2025 preliminary estimates”—a reminder that we are in a period of questionable data. For instance, a separate, daily index from Indeed, a job-posting site for private-sector positions, showed that openings declined in October from the month prior, but rebounded strongly in November. (The Indeed Job Postings Index wasn’t impacted by the government shutdown.) Wages, on the other hand, continued their decline, according to Indeed (Figure 3)—reducing inflationary pressures, but also highlighting labor-market fragility.

Separately, initial jobless claims increased by 44,000 to 236,000 in the week ending December 6, according to the Department of Labor. That was the biggest jump since March 2020, and it followed the lowest level of applications in more than three years during the previous week, which included Thanksgiving. (These numbers also highlight how collecting data around holidays can produce volatile results.)

Either way, last week’s data furthers the already confusing story of a labor market that is showing

crosscurrents of labor market strength and weakness. Further openings/opportunities, followed by increased firings, albeit from a low level, spotlight the current, and rare, “low hire, low fire” environment that the Fed faces.

So far, Fed officials are holding the line in their commitment to data dependency, along with a no-preset-course mantra. For his part, Kevin Hassett—director of the White House’s National Economic Council and a front-runner to replace Powell as Fed Chair—recently applauded this approach. “The Fed chair’s job is to watch the data and to adjust and to explain why they’re doing what they’re doing,” Hassett said. “And so to say, ‘I’m going to do this over the next six months’ would be irresponsible.”

Hassett seems to be mastering the art of the “two-handed” economist. When asked at the Wall Street Journal’s CEO Council Summit in early December if he would push for substantially lower rates if he gets the top Fed job, Hassett said: “If the data suggests that we could do it, then—like right now—I think there’s plenty of room to do it,” he said. Asked whether that meant more than 25 basis points, he said, “correct.”

When asked whether he would adhere to Trump’s preferences or his independent economic judgment if appointed Fed Chair, Hassett said he would adhere “to my judgment, which I think the president trusts … I think the most important job that the Fed Chair has is to be looking at the economic data and to avoid being part of politics.”

A final thought as we head into the Christmas and New Year holidays: At the start of 2026, some of the voting members on the FOMC will change, with a likely tilt to the hawks. So—while the data still points to confusion and, therefore, dissention among the ranks—2026 has the potential to be more straightforward, with less change in policy.

Of course, if new, cleaner data showed a marked deterioration in the economic landscape, we could expect a more aggressive easing cycle in 2026. Until then, as Luke Combs also sang, “I like to think too much damage ain’t been done.”

FROM THE DESK

Agency CMBS — Ginnie Mae spreads tightened by about three bps from Monday to Friday, marking an approximate 10 bps spread-tightening, month to date. We expect some slowdown in HUD issuance as we approach the holiday season, along with PTO hurdles. This leaves coupons only marginally higher after accounting for the rise in Treasury yields. It seems that a trading range of 4.00% to 4.20% is well established; given the lack of confidence in economic data, this range is also likely to persist. We saw a long 18/15 trade in the market last week, a duration that has been a rarity. We brought the spreads on long bonds in to “20 bps over the 10/9.5 from what was previously thought to be “45 bps. Investor appetite for long bonds seems strong.

Municipals — AAA tax-exempt yields were relatively flat throughout the yield curve, week over week. Last week again saw price a large new issuance calendar, with issuers looking to come to market before year end. With the heavy supply, we saw the municipal bond market lag the Treasury rally during the middle of the week. With one full week left in 2025 to price deals, we expect one last heavy new issuance calendar before the market takes a breather. Municipal bond funds saw a third straight week of inflows, with $16 million entering (YTD inflows of $23.52 billion), while high-yield funds saw outflows of $64 million.

Looking for more economic insights? Check out all of our previous Trading Desk Talk posts.

The information contained herein, including any expression of opinion, has been obtained from, or is based upon, resources believed to be reliable, but is not guaranteed as to accuracy or completeness. This is not intended to be an offer to buy or sell or a solicitation of an offer to buy or sell securities, if any referred to herein. Lument Securities, LLC may from time to time have a position in one or more of any securities mentioned herein. Lument Securities, LLC or one of its affiliates may from time to time perform investment banking or other business for any company mentioned.