House of the Rising Sun and Interest Rates

In 1964, band members of The Animals sang a tale of woe in “House of the Rising Sun.” In the middle of the downtrodden song, they posit that “The only thing a gambler needs, is a suitcase and a trunk.” Last week, Sanae Takaichi, Japan’s Prime Minister, made a calculated gamble to hold a snap election on February 8 with promises of expansionary policies. Like the gambler in the song, Takaichi may end up packing her bags if the voting public doesn’t maintain their current support. “If the Liberal Democratic Party and the Japan Innovation Party can’t win a majority, I will immediately have to resign,” she said.

Japanese government bond yields spiked following Takaichi’s decision on fears of fiscal responsibility. She included tax relief on food and increased defense spending in her expansionary policy—if she wins. Call it Japan’s “Liz Truss” moment.

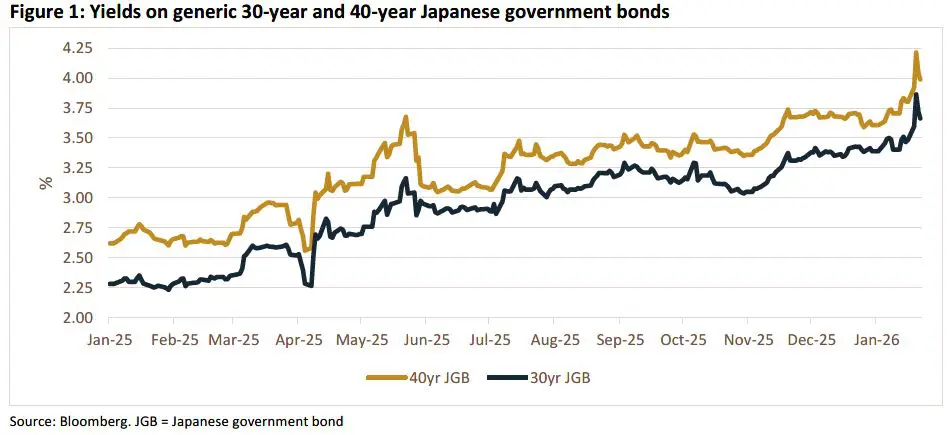

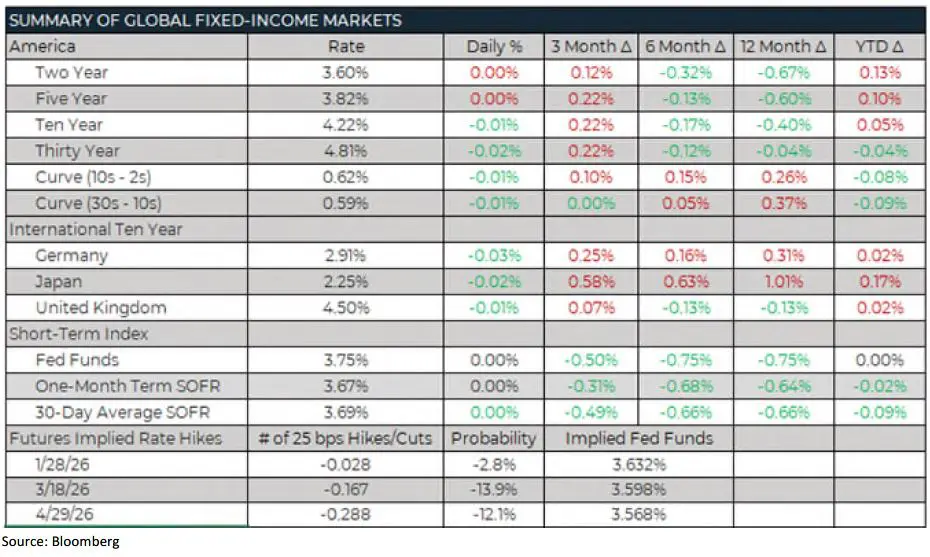

Concerns about the premier’s fiscal policy took long bond yields in the Land of the Rising Sun to fresh highs: 30-year yields rose from 3.48% on January 9 to a closing peak of 3.87% on January 20; 40-year yields rose from 3.80% to 4.21% (Figure 1). Nevertheless, the reasons for the volatility may be more nuanced than first meets the eye—and much less draconian from a broader fixed-income perspective.

One of the major reasons for the volatility is the bond market mechanics for Japanese government bonds (JGBs). Foreign investors now account for roughly 65% of monthly cash JGB transactions, up from just 12% in 2009, according to data from the Japan Securities Dealers Association. JGB purchases were once dominated by domestic life insurers and pension funds but now take a back seat to investors with much shorter holding periods.

The market’s fragility was on display after the selloff forced some hedge funds to unwind losing positions, pushing life insurers to dump bonds. The selloff also caused at least one corporate bond investor to pull out of a multimillion-dollar deal, Bloomberg News reported.

The turmoil in JGBs reflects “dysfunction in a thin and fragile segment of the ultra-long end of the curve,” wrote Taro Kimura, Bloomberg’s Japan economist. For example, it took just $280 million of trading to push Japan’s $7.2 trillion government bond market into meltdown. The concern is no longer simply that yields are high, but that when they rise, there may be no natural buyer left to absorb selling pressure.

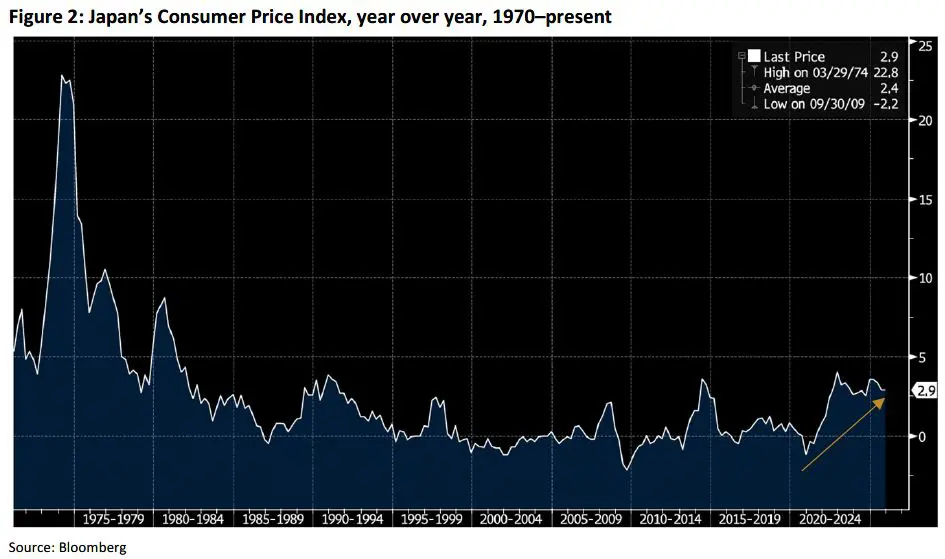

Meantime, the country’s inflationary landscape is not conducive to Bank of Japan (BOJ) easing in the near term, which may result in upward pressures on rates. Japanese inflationary pressures have been on the rise after going negative in late 2020. Soaring food costs are a key component driving broader inflation higher. Japanese consumer price growth has also stayed above the central bank’s 2% target for four straight calendar years (Figure 2).

Pertinent to both the BOJ and to Takaichi’s voter base, the proportion of food spending within overall household consumption came to almost 29% in November, the highest for that month since comparable data became available in 2000. Therefore, if Takaichi can tackle this portion of the economy, she can help ease pressure on the BOJ and strengthen her support (despite already enjoying majority approval).

That political calculus will also shape how far the BOJ can go in responding through monetary channels. “Many market participants expect the BOJ to make extraordinary purchases of government bonds,” observed Ryutaro Kimura, a senior fixed-income strategist at AXA Investment Managers. “But this will depend on whether the government tolerates the resulting yen depreciation.”

The BOJ met last Friday and voted to hold interest rates steady at 0.75%, after having hiked the rate in December from 0.50%. Though the BOJ elected to hold rates steady this time, most investors, perceiving hawkish momentum at the bank, anticipate further hikes in the near future.

Following the rate decision, BOJ Governor Kazuo Ueda said: “As prices and wages rise gradually, we are at a phase where we need to scrutinize whether this will continue and if so, at what pace.” The yen fell as Ueda gave his address, before suddenly spiking back up.

Both U.S. investors and Treasury officials should pay attention to the volatility of the yen and JGBs because Japan is the largest foreign holder of Treasuries. According to data from the Treasury Department, Japan held a $1.203 trillion principal balance of Treasuries in November 2025—over 35% more than second place United Kingdom ($0.888 trillion), as well as over 75% more than third place China ($0.683 trillion).

In fact, some investors have for years conducted a carry trade that includes borrowing cheaply in yen and investing in higher-yielding U.S. assets, including Treasuries. That trade is now beginning to unwind, as yields on JGBs rise and volatility of the yen increases. Some market strategists now even speculate that reversal of the carry trade was the cause of some, maybe most, of last week’s selloff in U.S. rates.

Separately, the conversations in Davos, Switzerland made headlines last week but were not particularly relevant from a market-moving perspective. Whether or not a deal, or even the makings of a deal, have been reached about Greenland, investors largely yawned off President Trump’s threats of new 10% tariffs and military saber rattling.

Instead, the main concern is whether NATO is on the verge of collapse and what such a breakup would do to future capital flows. That is clearly a longer-term issue—but it’s a very important one for an industry like ours, which thrives on cheap, plentiful sources of capital.

FROM THE DESK

Agency CMBS — Our market continued to benefit from the recent presidential directive that the government-sponsored enterprises invest up to $200 billion in mortgage-backed securities. As discussed previously, spreads contracted immediately thereafter; for the most part, spreads in our markets have held in since. Lower than normal new issue volume also helped in this regard. Fannie Mae spreads were 10 to 15 basis points (bps) tighter the week following the directive and were basically flat last week. Ginnie Mae spreads, meanwhile, were six to eight bps tighter the week after the directive and tightened another four to five bps last week.

Municipals — AAA tax-exempt yields increased modestly at the front end of the curve and rose by as much as eight bps on the long end, week over week. New issuance activity remained limited last week; no cash-collateralized, Fannie Mae MTEB or senior-living transactions priced. Municipal bond funds have started 2026 on a strong note, posting four consecutive weeks of inflows. Funds collected $994 million last week, bringing the year-to-date total to $4.47 billion. Of last week’s collections, $351 million was directed toward high-yield funds. As money market rates continue to grind lower and investors reassess portfolio allocations, we expect strong demand further out on the yield curve, as investors look to lock in medium- and longer-term yields.

Looking for more economic insights? Check out all of our previous Trading Desk Talk posts.

The information contained herein, including any expression of opinion, has been obtained from, or is based upon, resources believed to be reliable, but is not guaranteed as to accuracy or completeness. This is not intended to be an offer to buy or sell or a solicitation of an offer to buy or sell securities, if any referred to herein. Lument Securities, LLC may from time to time have a position in one or more of any securities mentioned herein. Lument Securities, LLC or one of its affiliates may from time to time perform investment banking or other business for any company mentioned.